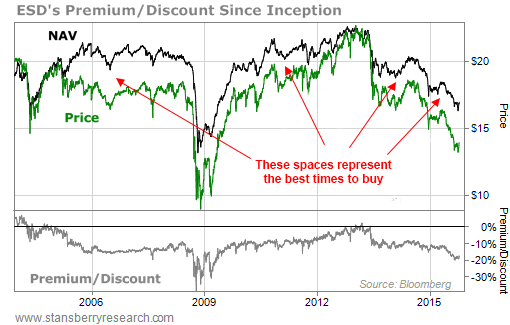

Imagine your spouse sent you to the grocery store to pick up a few regular items you use day in and day out – items with a far-off expiration date, like cans of tuna. At the store, you discover the tuna you've been buying for $4 a can is now on sale for $2. What would you do? I know what I'd do... I'd buy more cans. If I usually bought 10 cans, I could now buy 20 for the same price... I might even double my "usual" purchase... and stock up on 40 cans or more. And yet... it seems like a lot of investors would rather shout at the store manager. It's especially galling with fixed-income investments... When folks see the price of interest-generating bonds and notes drop... they complain about "losing money." That's like griping that the tuna is on sale... When fixed-income securities are cheap – when the tuna is on sale – that is the time to buy more of them. Here's the thing – we love sales. And for our income portfolios, we like to buy fixed-income securities to generate income. Generally, these can include funds stuffed with bonds, preferred shares, or a mix of different kinds of investments. Let's look at bond funds as an example. These are a selection of bonds that are sold in a bundle as a fund. You buy shares of the fund to get a piece of the bonds and the interest they pay. But, when a bond drops in price, its yield goes up... That's because the interest it pays divided by its now lower price goes up. So it makes sense that when bond prices dive, the yield will increase... So as an income hunter, you'll want to use the opportunity to buy more. Plus, reinvesting your higher interest payments in the fund grows your income stream even faster. And the money that the fund gets from maturing securities can now be put to work at even higher interest rates than a month or two ago. Take advantage of the lower prices and stock up on them like you would on cans of tuna. As regular paid-up subscribers know, another measure we use to see if the fund is "on sale" is something called the net asset value, or NAV. Buying funds when they're trading at a discount to NAV is a fantastic strategy. We love doing this with closed-end funds. Closed-end funds issue a limited number of shares. So the share price can fluctuate based on investor demand... and not necessarily match what the securities in the fund are worth. This means that closed-end funds can trade above ("at a premium") or below ("at a discount") the value of the fund's assets. I prefer to invest in funds that are trading at a discount to NAV because it's like buying a dollar's worth of stuff for $0.80 or $0.85. If you don't remember, we discussed why buying at a discount to NAV is a solid idea in this issue. Here's a look at how the discount to NAV changes over time. This is a chart of the Western Asset Emerging Markets Debt Fund (ESD) that we recommended last fall.  In short, the premium or discount is a measure of sentiment – how much investors love or hate the sector. Closed-end fund prices tend to move back to their NAV in time, so buying at a deep discount is a great opportunity for increasing returns. In my newsletter, Income Intelligence, we love looking for funds that are on sale. Whether it's a market selloff or a discount to NAV, we scour the best investment opportunities for our readers. Right now, several of these funds are rallying, but eventually a drop will come. And when it does, we'll be there to cover the absolute best funds for your income portfolio. Remember, the lower the prices, the better the opportunity to secure a bigger income stream. It's hard for me to imagine a sale that would be "too big" not to want to stock up. Use selloffs as an opportunity to add to your fixed-income allocations at lower prices and higher yields. Lock in the income while everyone else misses out. Of course, if you really do get to the grocery store and tuna is on sale... make sure you buy "light" tuna. It has the lowest amount of mercury among tunas.

In short, the premium or discount is a measure of sentiment – how much investors love or hate the sector. Closed-end fund prices tend to move back to their NAV in time, so buying at a deep discount is a great opportunity for increasing returns. In my newsletter, Income Intelligence, we love looking for funds that are on sale. Whether it's a market selloff or a discount to NAV, we scour the best investment opportunities for our readers. Right now, several of these funds are rallying, but eventually a drop will come. And when it does, we'll be there to cover the absolute best funds for your income portfolio. Remember, the lower the prices, the better the opportunity to secure a bigger income stream. It's hard for me to imagine a sale that would be "too big" not to want to stock up. Use selloffs as an opportunity to add to your fixed-income allocations at lower prices and higher yields. Lock in the income while everyone else misses out. Of course, if you really do get to the grocery store and tuna is on sale... make sure you buy "light" tuna. It has the lowest amount of mercury among tunas.

- Epicurious taste-tests 13 different types of canned tuna. (Its best overall pick is also the cheapest.)

- Buying stocks at a discount... "The Closest Thing to 'Free Money' in the Stock Market."

- Something different: Florida: The Punchline State.

P.S. If you'd like to catch your own tuna, write us at [email protected] for charter information on Porter's fishing boat, Two Suns. There's nothing like eating sashimi or a grilled salmon steak that you caught that day... Last year, Porter's crew and the folks at GoPro put together a short highlight film of their boat at the White Marlin Open in Ocean City, Maryland, that gives you an idea of what to expect. Click here to see the short film.