Last week, I (Amanda) wrote about the mistakes people make with their rollover IRA accounts.

Let's say you've opened a new rollover IRA. Or maybe you opened a traditional or Roth IRA... or you just started a 401(k).

If you're like most Americans, you're likely nervous about how to choose your investments. Don't worry. There are two secrets you need to know to make a solid portfolio.

First, figure out your allocation and risk tolerance.

As we discussed in our issue "Overcoming Your Biggest Character Flaw," stocks hold the highest risk, but also offer the biggest reward. The least risky are certificates of deposit (CDs) and U.S. Treasury bills.

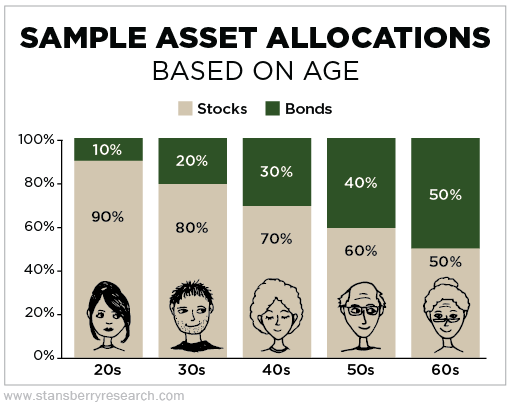

Depending on your age, you'll want to pick your investments accordingly. If you're in your 20s or 30s, you have more time to recover from potential losses, so take advantage of more stocks (and their growth). Think of a split around 90% stocks and 10% bonds or 80% and 20%. Remember, this mix changes depending on your comfort level and personal circumstances. If you're very risk-averse, fewer stocks are a better option.

If you're in your 40s or 50s, move more toward fixed income like bonds. By the time you're 50, you'll want to be at about 60% stocks and 40% bonds.

When deciding on what to buy, remember to keep your stocks spread across sectors. This basically means keeping yourself safe should any one sector tank.

A few popular sectors include...

|

Sector

|

Well-Known Companies

|

|

Energy

|

ExxonMobil, Chevron

|

|

Health Care

|

Johnson & Johnson, Pfizer

|

|

Information Technology

|

Apple, Microsoft

|

Diversification is important. If you buy nothing but tech stocks, you'll lose everything should that sector experience a major downturn. (Our boss Dr. David "Doc" Eifrig covered sector risk in an essay from our sister publication, Health & Wealth Bulletin. It's free to subscribe – you can find the issue right here.)

Now, it's intimidating to choose a bunch of stocks and bonds and hope you're covering different sectors. That's why we recommend starting with funds. Mutual funds and certain index funds are a great way to get exposure to a lot of stocks without taking on as much risk.

Mutual funds pool money from investors and use it to purchase stocks and/or bonds. So each investor gets a portion of the gains or losses. There are hundreds of funds out there, but you can find good ones that match the sectors you want to track. Be sure to look at fees for these too... since most are actively managed, the manager will charge a fee, usually annually.

Similarly, index funds give you plenty of exposure with low risk. They're mutual funds that managers structured to follow a certain index. An index is a set of stocks like the S&P 500 Index, which tracks the top 500 largest stocks in the U.S. Index funds have low fees and little, if any management, so you won't be paying a trader to work on it. It's a good way to keep your fees low.

It's easy to think your fees are low. For example, a mutual fund can easily charge 2% or 3% of assets without looking too expensive.

But that 2% adds up over time. That's why whenever you choose a fund for an investment, aim for something with an annual fee of just 1% each year.

These fees come from annual maintenance. So, if it's a fund that's actively managed over the course of the year, you'll pay more. If it's a "set and forget" fund (like an index fund), less work translates to lower fees.

Let's take a look at an example. Say you save $5,000 a year and earn 8% on your investments. But you're paying 2% on an annual fee.

After 40 years, that investment would grow to around $786,000.

But if you could find funds that only charge 1% in fees, that amount swells to almost $1,045,000. And the lower, the better over time...

|

Returns with $5,000 per year, for 40 years, and an 8% return

|

|

|

Fee

|

Estimated Ending Value

|

|

2%

|

$786,000

|

|

1%

|

$1,045,000

|

|

0.39%

|

$1,247,000

|

|

0.05%

|

$1,378,000

|

If you can take your fees down to just 0.05%, you'll make an extra $592,000. That will make your retirement that much more secure.

When you're researching which funds to buy, make sure you look at the sectors they cover along with the fees. Proper allocation will save you from disaster. And lower fees put more money in your pocket.

Here's to a fresh start,

Amanda Cuocci & Laura Bente

March 18, 2018