Doc's note: Longtime readers know I usually feature essays from guest contributors on Mondays.

Instead, I'm sharing an excerpt from the most recent issue of my trading newsletter, Retirement Trader.

Last Friday, I told my subscribers why I'm not panicking over the market's correction...

***

Well... that didn't take long.

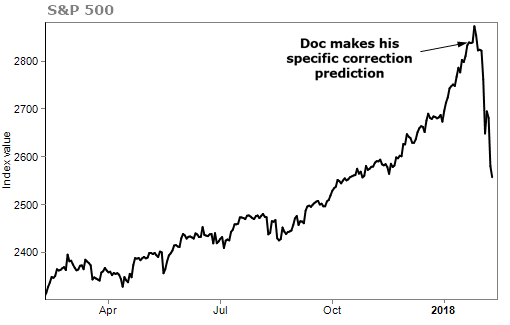

A few weeks ago, my publisher, Stansberry Research, asked its top editors – Porter Stansberry (our founder), Steve Sjuggerud, and me – for our No. 1 predictions for 2018. Mine was straightforward: "[In] the first half of the year... stocks will fall between 12% and 15% and remind investors stocks can indeed take a breather."

As of last Friday's close, the S&P 500 Index was off more than 8% from its recent high. So we're not quite there yet. But with volatility still higher than it's been in a long time, it won't be hard for the market to skip down a few more percentage points.

For weeks now, I've shared how nervous friends and colleagues have called me worrying about the historically high stock markets. The current correction has accelerated the calling, and the fear factor is high.

Folks look at their trading accounts or 401(k)s and see thousands – or even tens of thousands – of dollars evaporated. They get upset about their returns over the last week. Many of them call me to ask what to do...

They don't usually like my answer: It's time to celebrate.

Most people don't like to hear that when the market is in the midst of selling off. But it's true. Let me give you two reasons...

For one, this is what stock markets do. My prediction didn't rely on some magic indicator. It's just what you should expect the market to do. Consider that we see a 15% correction about every other year. That means one happening within any given six months, like I predicted, is about a three-to-one shot.

Add in the fact that we hadn't see a correction of that size in six years, and that pushed odds to greater than 50%, in my view.

If you can't handle the occasional pullback like this, you shouldn't be as invested as you are in stocks. That's just the truth. I'd suggest checking with Goldman Sachs (GS) or Capital One Financial (COF) where you can earn 2.5% in a five-year certificate of deposit ("CD").

Second, as a trader or investor, you shouldn't cheerlead the market ever higher. You should root for corrections to happen more often. That's your chance to buy in.

[optin_form id="73"]

It's a time to snatch up more ownership of quality businesses at cheaper prices.

Coca-Cola (KO) or Walmart (WMT) are the same businesses they were a month ago. But you can own a stake in those businesses for less today. You can get bonds or funds at a better price. Even entire countries and regions are on sale.

How is that a bad thing? Or something to worry about?

You can't have it both ways. For the past year or two, folks were concerned that valuations were too high and it was hard to find businesses that traded at valuations that they felt comfortable with.

Now, the market has fallen and stocks have repriced cheaper... and people are too worried that things are falling to buy in.

More often than not, those are all the same people.

I understand that it's human nature to worry, but you'll never be happy if you can't figure out what you want. (Otherwise... CDs.)

Unless you need the money today, you should cheer down moves in the market like this.

In my upcoming issue of Retirement Millionaire, I'll tell readers about one of the cheapest companies on the market today... it's like paying $0.50 on the dollar.

Retirement Millionaire subscribers will get all of the details in this Wednesday's issue. If you're not already a subscriber, make sure to sign up so you don't miss out.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

February 12, 2018