When is it time to get out of the market?

We're getting this question a lot. And it's a valid question. After all, we're in one of the longest bull markets in history...

Stocks have been on fire in recent years, with the S&P 500 Index more than doubling since June 2012.

Yet it was a small 10% correction earlier this month that spooked a lot of investors. At the time, we sent out a note telling readers not to panic and that the drop in stocks might be short-lived. History showed us that stocks, after a correction without a recession attached to it, tended to bounce right back in a few months.

And that's exactly what happened. Since the bottom of the correction, the market is already up just about 7%. I hope you took our advice and didn't succumb to fear earlier this month. Now is not the time to get out.

Corrections are healthy to market cycles... And yes, even to bull markets. During the last major bull market, from 1998 to 2000, the Nasdaq Composite Index soared more than 200%. What you might not know is that there were five separate times that the index fell by about 10% during that same period. After each correction, the market kept churning higher.

So this is correction is nothing new. We welcome it. It reminds investors that stocks can indeed go down from time to time. The "Melt Up" – as our colleague Steve Sjuggerud calls it – appears to be back in full swing.

Some of you might remember the Melt Up during the late '90s, but this current bull market feels a bit different. For starters, it's less "mania-y". Back then, investors piled into any dot-com stock without any substantial fundamental data backing up valuations.

The dot-com companies thought they couldn't lose either. During the 2000 Super Bowl, 17 different dot-com companies bought ad spots during the game for a combined $44 million. As we all know now, most dot-coms didn't last the year... By 2001, there were only three dot-com companies that bought ads during that Super Bowl.

Investors in those companies lost a lot of money. Folks initially thought that Internet stocks were a ticket to get rich quick... And you didn't want to be the fool sitting on the sidelines missing out on free money.

That's not the mindset today.

Sure, stock valuations are stretched. But investor optimism drives valuations more than euphoria.

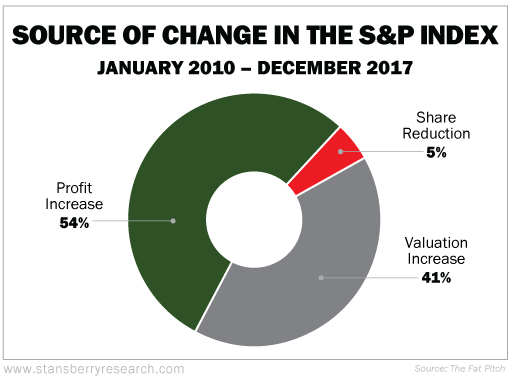

From 2010 to the end of 2017, more than 50% of the gains in the S&P 500 came from something tangible – higher profits...

The valuation increase of 41% may seem high, but that's normal for a bull market. By comparison, Bloomberg View columnist Barry Ritholtz reported that in 1982 to 2000 valuation increase accounted for 75% of the total market gain.

Now that's a mania... And that's not what we're seeing today.

The S&P's sales grew 9% in 2017. That is the best growth in six years. Also, earnings shot up 23% compared to 2016, the best in seven years.

Think about the giants that are pushing the market higher... The red-hot "FAANG stocks." Facebook (FB) reported year-over-year revenue growth of 47% for the fourth quarter. Amazon (AMZN) touted 38% revenue growth year-over-year, Apple (AAPL) was just less than 13%, Netflix (NFLX) boasted 32%, and Google's parent company Alphabet (GOOGL) announced a 24% increase.

Apple was the worst performer in the group... only growing its revenues 13%. That's incredible. The company also reported a 12% increase in net income, so profits are still very healthy.

The troubling part is that the average price-to-earnings (P/E) ratio among these five companies is 125x. That's downright expensive... But again, a lot of it comes from earnings.

So while yes, we are getting cautious, we're not in mania territory yet.

[optin_form id="73"]

- Something different: American consumer confidence is the highest it's been since 2000.

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

February 28, 2018