What's the best predictor of a recession?

Economists and PhDs could debate this for days. Some claim consumer spending is the most accurate predictor. Some claim it's the labor market. And others use a bunch of indicators weighted together, like the Conference Board's Leading Economic Index.

The truth is, there's no one indicator that is universally accepted as the early warning sign of an economic downturn.

A couple weeks ago, I told you that you only needed to focus on one indicator – unemployment. I said we won't see the economy or market get rough until the employment picture changes. I wholeheartedly believe that to be true.

But what if I told you there is one indicator that has flashed a warning sign before every recession over the past 60 years? Well, the San Francisco Federal Reserve tells us that's true.

The indicator is the yield curve.

You may have heard the term "yield curve" being thrown around on the news without a clear explanation. It's simple to understand... The yield curve is the difference between long-term interest rates and short-term interest rates.

Typically, long-term rates are greater than short-term rates because investors demand to be paid more for locking their money away for a decade or more. There's also more risk with the longer duration.

Lately, there's been a bit of panic because of the "flattening" of the yield curve. This means that the gap between long-term yields and short-term yields is shrinking.

This is happening because the Federal Reserve is trying to slow down the economy by raising short-term interest rates. And when long-term rates are slow to rise, that suggests that traders are concerned over long-term growth.

Right now the 10-year U.S. Treasury yield is 2.87%. The yield on the two-year Treasury is 2.59%. The difference between the two is a mere 0.28%...

The spread is currently at its flattest level in about 11 years. Back in 2011, the spread was near 3%.

According to investment bank Piper Jaffray, the probability of a recession increases substantially as the spread falls below 0.2%.

But the flattening of the yield curve is nothing to panic over. It's the inversion of the yield curve that should worry you. When the yield curve inverts, short-term rates are greater than long-term rates... And that's when we should expect a recession.

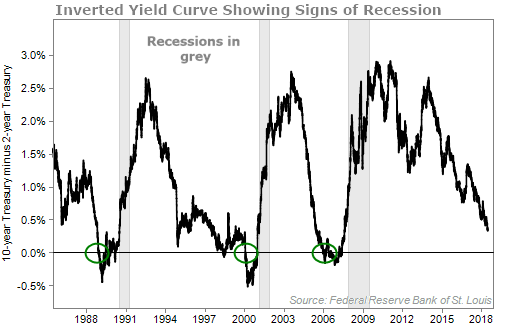

In fact, every recession in the past 60 years was preceded by an inverted yield curve.

Over the past six decades, there was only one exception... In the mid-1960s, the curve inverted, which was followed by an economic slowdown but not an official recession.

You can see the accuracy of the yield curve by looking at the past three recessions...

To be clear, once the yield curve inverts, the economy doesn't automatically enter a recession. It can happen in as little as six months or up to two years.

For the last three recessions it took about a year and a half for a recession to begin, on average.

So what does this all mean?

It means we're not on the cusp of a recession yet. We're getting closer, but we're still probably a couple years away. As the Fed continues to jack up short-term rates, eventually the yield curve will invert... and then we know it's only a matter of time before there's a recession.

For investors, there are two major takeaways...

First, re-evaluate the bank stocks you own. Banks become less profitable as the yield curve flattens because they essentially borrow money at short-term rates and lend it at long term-rates. When the spread tightens, there goes the profits. And as the curve inverts, lending money is a losing proposition.

Second, and this is important: Don't expect the same type of stock returns over the next five years as the previous five. The landscape is changing. As I've been pointing out the past few weeks, the warning signs for a market downturn are flashing.

Be selective. Be defensive.

But when you have an opportunity to make money, take it. The bull market is not over yet, and my colleague Steve Sjuggerud believes that the final innings of a bull market produce the largest gains – known as the "Melt Up."

Folks who read my newsletters know that I haven't stopped recommending stocks, despite my changed outlook. Now, I have to find a favorable risk-to-reward setup before I feel confident recommending anything. If you are buying your highest-conviction ideas, don't be scared to still be in the market.

That leads me to what my team and I have discovered...

We believe billions of dollars will flow into a particular stock very soon. It's a blue-chip stock (it pays a 6% plus yield – so yes, it is safe) that's about to go through two very specific changes that should boost its stock price by 100% or more.

These kinds of opportunities rarely ever come around. That's why I'm ecstatic to share this with my readers.

And I'm extremely confident this particular stock will outperform, even if the yield curve does invert.

I don't want you to miss out. I almost never make bold predictions that stocks will double or triple – but I'm so confident that we've found a stock that will, I'm willing to make those claims. That's why I put together a special presentation about this opportunity. Click here to learn more.

What We're Reading...

- Something different: The Top State for Business in America this year.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

July 11, 2018