You've likely heard this a lot lately. When you're on an airplane, you need to know where the exit doors are and what to do in an emergency. If you're in a movie theater or other public place, you need to pay attention to where the exits are in case of a fire or active shooter.

You need to have an escape plan.

We want you to be prepared for the worst no matter what life throws at you.

And your portfolio is no different. You want to make sure you have a solid "escape plan" in place should stocks take a dive. Ideally, you want to keep your losses small and let your winners ride.

For stocks, the best way to escape is something called "stop losses."

Stop losses are prices or percentages you set as "exits" on your stock. When your stock falls to that price or by that percentage, you sell. No questions asked, no second guessing. That way you limit exactly how much you lose. Stop losses take the guesswork out of knowing when to act.

There are two types of stop losses...

Hard stops are based on a set price or percentage below the purchase price. If the stock falls to that amount at any time, you sell.

Let's say you purchase Stock X at $10 and set a 20% hard stop at $8. No matter how high its price goes, you would sell once Stock X fell back to $8.

Hard stops are usually recommended for more volatile stocks... sectors or companies that regularly see wild swings in price. But it also means you're locked in and could lose a substantial amount if you've held a stock for a long time. That's why it's sometimes better to use a stop that follows price movement...

Trailing stops are based on a percentage below the purchase price, but they don't stay the same. As the stock price hits new highs, the trailing stop follows it.

Let's say you set a trailing stop at 20% below your purchase price. For Stock X, you'd start out at $8, the same as a hard stop.

But here's the difference... As Stock X's price rises, the trailing stop follows. So, if the stock rises to $11, the stop would rise to $8.80 (20% below the $11 high). And if Stock X went up to $15, the stop would be $12... if it hit $20, the stop would be $16... and so on.

Trailing stops only adjust upward based on the highest price the stock hits. So, in this example, if the stock hits $15 and then goes down, you would sell at your trailing stop of $12.

Choosing which stop to use takes time and experience. We wrote about it in an issue of our sister publication, Health & Wealth Bulletin and we encourage you to read it (access it right here).

Once you've picked the type of stop you want to follow, it's just a matter of tracking it. Most brokers give you the option to enter your stops "into the market" using stop-loss orders or trailing-stop orders...Don't do it.

Other investors or brokers can see those orders and might manipulate the stock price to push you out of it. That's why we urge you to track your own stop losses.

Now, we all live full, busy lives. We don't have time to watch our stops or stocks constantly. In a few surveys, people said one reason they didn't invest was a lack of time. Most of us worry we won't be able to pay attention to our stocks on a regular basis and as such, miss the boat on buying or selling. But here's where a time-saving solution comes in...

A few years ago, our colleague Dr. Richard Smith put together a new service, TradeStops, to help people track their portfolio positions automatically. It lets you put in the stocks you want to track and sends alerts whenever a position hits a stop loss.

Take a look at how simple it is...

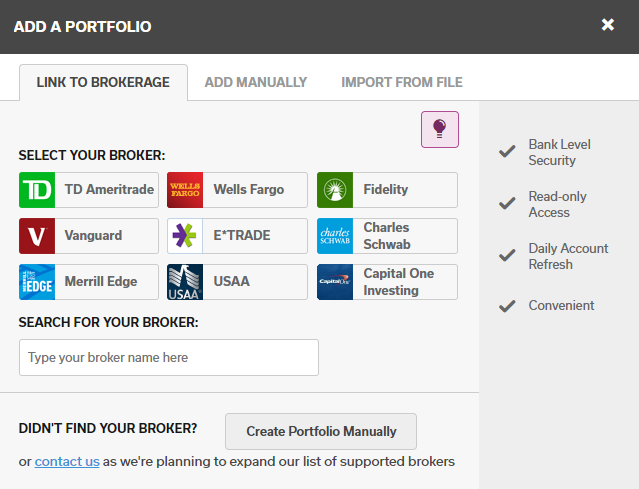

You can import a portfolio from your broker easily:

There are also options to enter positions manually, including multiple portfolios, and set your own alerts for the type of stop you want to use.

Last week, Richard joined Stansberry Research founder Porter Stansberry and analyst Steve Sjuggerud for a webinar about what's going on in the markets, when a bear market could hit, and how to keep your investments safe. If you think you don't have time to track your own stops, you need to watch this webinar to find out how you can save not only time, but also profits. Make sure to watch a replay of the webinar and learn more about TradeStops right here.

TradeStops is a great way to take the guesswork out of following your stocks and protecting your portfolio. It's a must-have for any investor.

One last note: Our publisher, Stansberry Research, owns TradeStops. So as a company, we do receive some compensation for this product. But we only recommend what we believe will help our readers live a richer, happier life.

Here's to a fresh start,

Amanda Cuocci & Laura Bente

May 13, 2018

P.S. No, we didn't forget... We'd also like to wish everyone a happy Mother's Day today. (Hi, Mom!) Does your mother read The Sunday Refresh? If not, invite her to sign up today by sending her this link.