Doc's note: Recently, my friend and colleague Steve Sjuggerud explained that stocks are actually in the middle of a "Melt Up" and this could lead investors to enormous gains.

Today, I'm sharing an update on the Melt Up from Steve where he explains why it's nowhere near over.

The stock market is up more than 300% from its lows in March of 2009. That's one of the best eight-year runs in the history of stocks.

But it's got to come to an end – and soon – right?

During our conference in Las Vegas back in September, Stansberry Research founder Porter Stansberry explained the fundamental problems in today's market and showed our subscribers why he's worried.

I (Steve) get it. I even agree with his analysis. But I disagree on the timeline...

In short: don't be in too much of a hurry to write this market's death certificate. Not only are we not there yet, but I believe the timeline has just been extended.

My friend, you know what the end of a great bull market looks and feels like...

The real estate boom that peaked a decade ago – that's what the end of a great bull market feels like. People thought house prices could never go down, and folks quit their day jobs to flip houses.

The dot-com boom that ended in 2000 – that's what the end of a great bull market feels like. Cocktail-party chatter shifted from sports to stocks, and my friends quit their "real jobs" and took stock options to join dot-com companies.

Today doesn't feel like those times – yet. You have to agree.

When this stock market boom ends, I expect it will end like previous stock market booms... with individual investors speculating in the most exciting, highest-volatility companies – especially tech stocks.

This is what happened in the last great "Melt Up" in 2000. And that's what will happen today, I expect.

To get some clues for what will happen this time around, let's briefly look at what happened last time and compare it with today's environment.

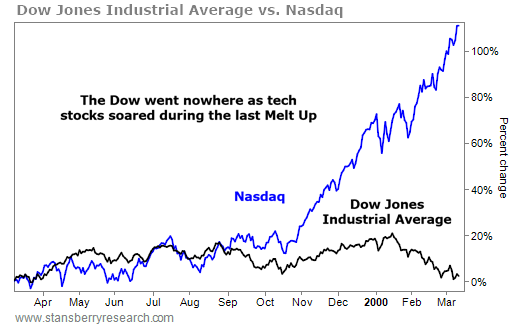

I love this first chart...

It shows what happened in the last Melt Up... the tech-heavy Nasdaq Composite Index versus the "old school" Dow Jones Industrial Average stock index.

The Nasdaq today includes Alphabet (GOOGL), Amazon (AMZN), and Facebook (FB). The Dow doesn't – it has names like General Electric (GE), Coca-Cola (KO), and McDonald's (MCD).

[optin_form id="73"]

It's amazing to me... During the final 12 months of the last great Melt Up in stocks, the Dow did nothing. Literally. It returned zero percent.

Nobody wanted the old fuddy-duddy companies when they could invest in the Internet.

Meanwhile, the tech-heavy Nasdaq returned more than 100%! Take a look:

The massive return difference is what's extraordinary to me. Even more extraordinary is the fact that nearly all those gains happened in the final six months.

The divergence is crystal clear: In the first six months of the chart, the Dow and the Nasdaq tracked each other – up 10% or 15%. The last six months are where the "old" and the "new" diverged.

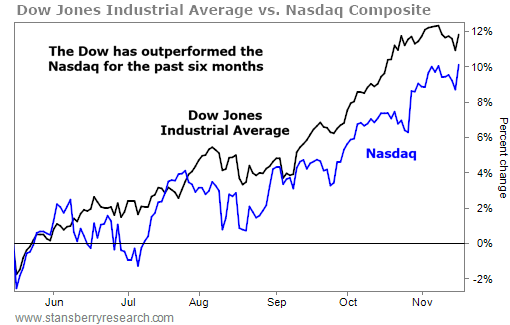

Most people think that all the gains in stocks lately are from the Facebooks and Googles of the world. Let's see if that's true...

Let's look at the Dow and the Nasdaq over the past six months... The "boring" Dow has delivered a total return of 13%. Meanwhile, the tech-heavy Nasdaq has delivered a 10% return.

So over the last six months, it's the fuddy-duddy companies that have beaten the big tech stocks! Take a look:

So what conclusion can we draw from this?

It's pretty simple: Yes, stocks have performed fantastically since March of 2009. But no, we are not really in a classic Melt Up yet – where the exciting tech stocks start to run away from the old-school businesses.

We are not experiencing the final run up yet – the time when the extraordinary gains should be made.

The big, fast gains are in front of us, not behind us.

What's even more amazing is that today's stock market boom could last until 2019 – or even 2020.

Good investing,

Steve

P.S. My True Wealth Systems readers know exactly what to look for – all the signs that show when the Melt Up will end. While it wouldn't be fair for me to share all five indicators here, you can sign up to read all about them in my most recent issue... Plus, you'll receive all my exclusive True Wealth Systemsresearch to help you profit safely in today's market. Click here to learn more.