Every recession in the past 70 years followed the same signal...

It flashed warnings before the downturns in the early 1980s, the savings and loan crisis, the burst of the dot-com bubble, the 2008 housing bust, and even the brief COVID-19 recession in 2020.

We're talking about the yield curve: the difference between long-term and short-term interest rates.

Health & Wealth Bulletin readers may be familiar with the yield curve, but the general public is not. It's a bit arcane.

Since it has been all over financial news recently, let's dive into it for a moment...

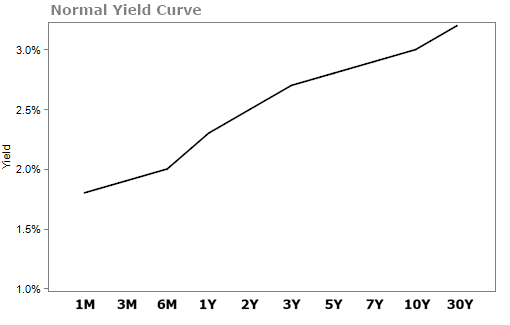

Really, the yield curve is simple. It's just a measure of interest rates at different time periods. You plot the prevailing interest rates for three months, six months, one year, two years, and so on.

Typically, longer periods have higher interest rates. Lenders charge more because the distant future is less predictable than the near term. The lender wants to be compensated for that risk. When that's the case, the plot line curves up. Here's an example...

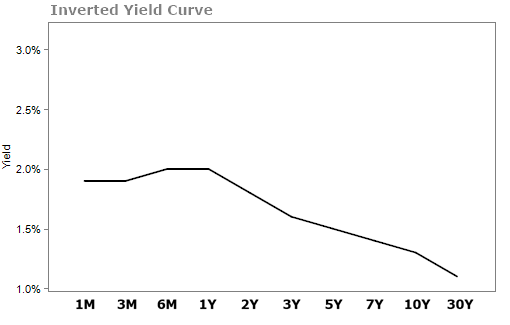

But this can change. If investors think future growth (and therefore inflation) will be poor, they won't require high interest rates for long-term bonds. In that case, short-term rates might have higher interest rates than long-term rates, and the yield curve will invert...

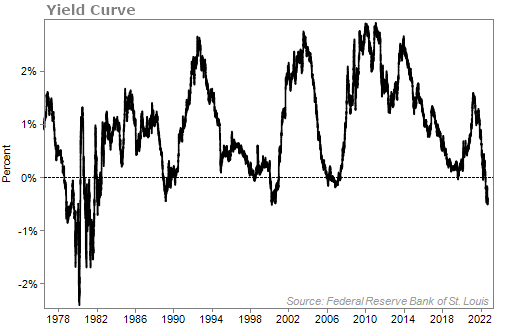

To know where we are right now, we can look at the daily change by simplifying things. We'll just take the difference between the two-year rate and the 10-year rate. That distills the difference in the yield curve into a single number that we can show over time...

As you can see, the curve has inverted. Short-term rates are higher than long-term rates. Specifically, the two-year is yielding 4.3% and the 10-year is yielding 4%.

This inversion is a reason why investors have been panicking lately.

Again, every recession in the past 70 years followed a yield-curve inversion.

Now, how long after this will a recession hit? It can vary... It can happen in as little as six months or up to two years (though, we're in a "technical" recession already).

Still, this should give you pause that the economy can get much worse from here. While the labor market is still strong, there are other areas of the economy that have been hurt by record inflation rates.

With rates continuing to climb – and the market almost certain that we will get another 75-basis-point rate hike from the Federal Reserve in November and in December – it could cause even more trouble.

Folks are tapping into their credit cards more and mortgages are rising, so it's possible defaults could tick up. This yield-curve inversion is not to be taken lightly.

My colleague Joel Litman has another warning for readers...

Joel says a new financial crisis has taken hold of America – but it's not the one you'd likely expect. This crisis isn't arriving next week, or even next month. According to him, it's already here...

And it has the potential to devastate millions of Americans' retirement savings.

But the fact is, you can always make money during a crisis...

That's why Joel teamed up with Chaikin Analytics founder Marc Chaikin to share their investment "playbook" for how to protect and grow your wealth today. Thousands of people have already tuned in to hear from Joel and Marc about how to navigate today's rocky market.

You can hear directly from them by clicking here to watch their brief presentation.

What We're Reading...

- 10-year Treasury yield tops 3.9%, rises to highest level since 2010.

- S&P 500 hits lowest level of 2022 as the global sell-off continues.

- Something different: Hurricane Ian lashes Cuba as Florida braces for 'major disaster.'

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

September 28, 2022