Most Americans think it could never happen here, but no one is immune to this economic disaster...

Hyperinflation.

People often think of "hyperinflation" as just an extension of higher levels of inflation. But it's not.

It's an outright collapse of the trust and faith in a currency.

When a country crumbles under the weight of its debt obligations, the rules of commerce break down. History is rife with stories about societies that collapsed under the weight of their debts.

When Alexander the Great died, Babylon's market economy was crippled.

In the wake of Alexander's death, commodity prices surged. Wool prices doubled, and barley prices rose more than 10 times over. Alexander's riches of conquest didn't bring wealth to his kingdom. Instead, an influx of silver led to an increase in the money supply. More silver meant silver was cheaper. And the cost of everyday items rose in concert. This spiraling inflation lasted for at least a decade –cutting the value of Babylon's currency in half.

This wasn't the world's first inflation disaster... and it definitely wasn't the last.

The most famous case of inflation and national currency collapse in history is that of Germany's Weimar Republic in the early 1900's.

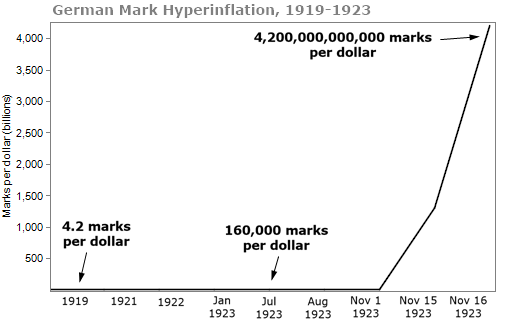

Over a period of about 10 years, the German mark eventually became worth one-million-millionth of its former self, surging from an exchange rate of 4.2 marks per U.S. dollar in 1919 to 4.2 trillion marks per U.S. dollar just four years later.

To outsiders, it was obvious Germany was destroying its currency. But locals simply held on, in a state of confusion and denial... even as inflation exploded exponentially.

As a German woman told Nobel and Pulitzer prize-winning writer Pearl Buck:

We used to say, "The dollar is going up again," while in reality the dollar remained stable but our mark was falling. But... we could hardly say our mark was falling since in figures it was constantly going up – and so were the prices – and this was much more visible than the realization that the value of our money was going down... It all seemed just madness, and it made the people mad.

Economic historian Adam Fergusson explained why in his book When Money Dies:

It was the natural reaction of most Germans, or Austrians, or Hungarians – indeed, as for any victims of inflation – to assume not so much that their money was falling in value as that the goods which it bought were becoming more expensive in absolute terms.

And this is exactly what's happening in America right now.

Unfortunately, the sad truth is most Americans will do the exact same thing Germans, Hungarians, and Austrians did with their soon-to-be-worthless currencies, even after the dollar has been devalued for the umpteenth time...

They will cling to their increasingly worthless money, rather than preparing for what's to come.

Inflation has plagued savers and wage earners since the invention of currency and the market economy. Any income investor, retiree, or business owner should know the fear of rising prices. The higher prices go, the less you can buy with your nest egg.

The Federal Reserve spends a lot of time trying to either tamp down or boost inflation. The unfortunate truth is... almost no one fully understands inflation. (Not even so-called "experts.")

Three years ago, I warned readers we'd see higher inflation within the next three to five years. And now, it's here.

This past March, I wrote:

Today, I think all the conditions are in place for inflation to rise...

To be clear, I'm not predicting hyperinflation – the phenomenon by which runaway prices render a currency worthless. But I do see inflation heading from today's 1.4% level toward 3.5% or 4%.

That may not seem like much, but it adds up...

The difference between 1% inflation and 4% inflation is significant. Due to the power of compounding, a $100 weekly grocery bill turns into $110 over 10 years at 1% inflation... or $148 at 4%. If you spread that across all your daily costs, retirement gets a lot more expensive.

What's more, the expectations for inflation will drive investment returns. When you expect inflation, you position yourself differently than you would if you expect deflation.

I've spent the last few years educating readers on inflation because I know that with an understanding of inflation, you can protect yourself and your family.

Right now, you need to do three things: Ditch inflation-exposed assets. Find inflation-protected assets. And prepare for uncertainty... Rising prices can lead to panic, distrust, and disruption in our society and government.

I've put together a plan to help you protect your wealth and purchasing power from inflation. I talk about ways to do that as an investor in my just-released report for Retirement Millionaire subscribers, The Perfect Inflation-Era Portfolio.

I also just released The 'New Era' Playbook where, I share some offbeat ways you can protect yourself. First, we'll identify some stocks you shouldn't own – so check your portfolio for them today.

And I reveal a special, limited investment that will protect you against inflation with no risk.

I also share ways to turn a worthless piece of paper into hundreds of thousands of dollars, how to cover your (rising) medical costs in retirement, and how to keep your assets safe from the government.

We are living in a dangerous financial time. The biggest risk right now is doing nothing. You can't rely on anyone else or the government to save you.

Click here to learn how to protect yourself today.

What We're Reading...

- Food and beverage producers warn even higher food prices are on the way.

- Something different: Antibiotic overuse could increase your risk of colon cancer.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

July 14, 2021