This indicator was wrong just one time in three decades...

It flubbed the 2008 financial crisis. But otherwise, megabank JPMorgan Chase says its tool has been a bulletproof predictor of market rallies.

You're probably skeptical. And you should be. We've warned over and over that anyone who claims to predict the market is probably wrong or a liar.

In this case, though, we actually agree with JPMorgan... This indicator is as close to bulletproof as you can get. Except when the entire financial market imploded in 2008, its "buy" signals have been 100% accurate going back to 1990. That's an outstanding track record.

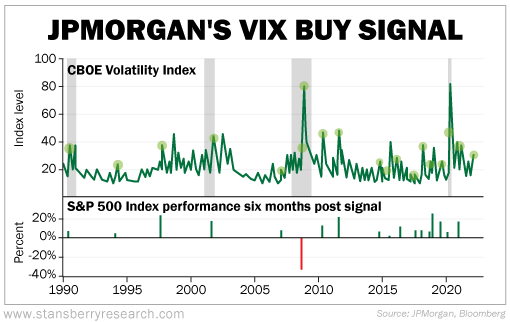

The logic behind the indicator makes sense, too. It tracks the CBOE Volatility Index ("VIX"), which we also call the market's "fear gauge." When investors panic and send the VIX soaring more than 50% higher than its one-month moving average, the indicator predicts a market rally.

That's in line with our understanding of investor sentiment. We've shown you before that markets tend to do the opposite of what everyone is positioned for. So we're not surprised that JPMorgan's indicator is so successful. It's perfect.

Right now, fear is elevated... and that indicator is once again calling for a market rally. We're sure the smart guys over at JPMorgan are eager to take advantage of this signal.

But here's the thing...

They're using it wrong.

We're Seeing a Green Light

The VIX is our North Star for options trading...

The higher the VIX, the more investors are afraid of the markets falling. And the more they're scared, the more they're willing to pay for options protection. So as option sellers, we prefer to trade when the VIX is high.

There's a problem, though...

Sometimes there's a spike in the VIX because investors are spooked and markets are falling... Then the market continues to fall even more.

When this happens, we can still end up with profits if we collect a big enough premium payment. But other times, we may have to dig ourselves out of a hole by rolling our trades.

The JPMorgan indicator pairs a spike in volatility (higher premium payments for us) with extreme lows in investor sentiment (meaning markets should rally).

JPMorgan's VIX indicator has signaled 21 rallies since 1990. In the six months after each time the indicator was triggered, the S&P 500 Index gained an average of 9%. Take a look...

As we mentioned earlier, there was a false signal during the 2008 global financial crisis. In that case, the extreme market fear truly was justified, and the S&P 500 was still down 33% six months later.

So outside of our financial system being on the brink of collapse, this indicator is useful at pegging likely market rallies.

The folks at JPMorgan use that signal to buy stocks. And sure, that can work. Like we said, stocks go up an average of 9% in the six months following this signal. That's hardly a bad return.

But we can do better. And that's because instead of betting on stocks, we sell options.

In our Retirement Trader advisory, our strategy gives us maximum profits when folks are scared of stocks falling when they actually go up... or at least hold steady.

So when we look at the JPMorgan indicator, it's screaming that it's time to sell options...

This VIX signal was last triggered on January 25. That means markets should finish higher over the next six months. It also means there's a large amount of fear in the market.

As option sellers, we're salivating.

Just last week, we booked two more winners for Retirement Trader subscribers with trades we made on timberland company Rayonier (RYN) and trash giant Waste Management (WM).

But this strategy is one of the most criminally misunderstood investing approaches out there today.

That's why for the first time in two years, I'm laying out, in plain English, exactly how it works... and how you could use it to start adding tens of thousands of dollars to your retirement account every year, no matter what's happening in the markets.

For a limited time, I've placed all the details for you, right here.

What We're Reading...

- In case you missed it... Earning $455 today.

- Something different: It took a month, but the Ever Forward is finally free.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

April 18, 2022