If you're like most folks, your retirement nest egg is probably smaller today than it was a few months ago...

The stock market is down about 9% from its November 2015 high.

But if you look at your statement this month and kick yourself for losing that money... or think, "If only I had sold"... you're making a huge mistake.

In fact, you likely couldn't even do better if you were a perfect investor.

Let me explain...

Market corrections like this are normal.

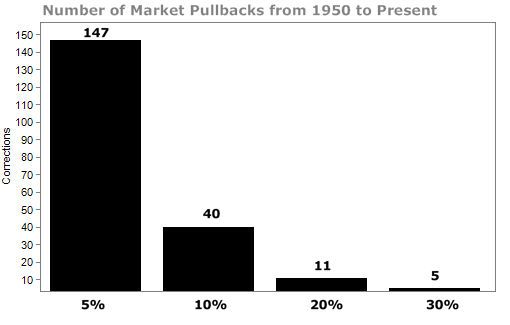

By our count, since 1950, the market has undergone 147 pullbacks of 5% or more, 40 "corrections" of 10% or more, and 11 "bear markets" of a 20% drawdown.

(In the unofficial vocabulary of Wall Street, a "correction" is a 10% fall and a "bear market" is a 20% fall.)

The following chart tells the story:

The correction that we're experiencing right now is normal. It happens about every 1.6 years, though not on a set schedule, of course.

History shows that riding out the market is the best thing to do… because you don't know what the market's going to do next.

Let's say you decided to sell your whole portfolio if the market falls 10%... This would mean that you're trying to avoid a bear market drop of 20%. But you'd be wrong 72.5% of the time – only 11 out of 40 pullbacks of 10% or more turn into a bear market.

And then, while you're deciding when it's "safe" to buy back in, the market will rise without you...

Selling in a panic rarely pays off. Don't do it.

Even if you had perfect knowledge of what stocks are best to own, you'd have to ride out even bigger losses than this...

In an analysis by research firm Alpha Architect, Dr. Wesley Gray investigated what would happen to an investor with impeccable foresight.

He imagined a "perfect investor" who knew exactly which stocks would post the best performance for the next five years... This investor would only buy, say, the best 10% of the stocks in the market.

In other words, this guy can't lose. He knows the best stocks. He buys only them.

If this perfect investor adjusts his portfolio every five years starting in 1926, he'll earn a whopping 28.9% per year on his investment. The S&P 500 returned 9.6% a year over the same period. So far, so good.

When you analyze an investment strategy, you also compute the maximum "drawdown." The drawdown is a measure of the worst decline in your investment funds from the highest point (in investor parlance, the "peak") to the lowest point (the "trough").

Drawdowns are what keep investors up at night. Drawdowns get professional money managers fired.

Well, the "perfect" investor saw a maximum drawdown of -76.0% versus -84.6% for the S&P 500. That's a little better, but still terrifying.

In fact, there were 10 different five-year periods in which the perfect investor – though he always picked the best stocks – had a point where he was down more than 19%.

In other words, no matter how good of an investor you are, and no matter how certain it is that you're going to earn good returns over the long-term, you'll still end up going through some very rocky times.

That's simply the nature of investing.

So if you've got your retirement savings invested for the long-term view, you shouldn't be panicking when your account takes a dip.

And if you still have that nagging feeling that you could be doing a little bit better, just let it go. Even the perfect investor can't avoid hitting an occasional down market.

[optin_form id="286"]

What We're Reading...

- Here's the synopsis from Alpha Architect.

- A classic read on "black swans" and "blowing up" investment funds.

- Free deal alert: Have a Chipotle close to you? Today until 6:00 p.m. Eastern time, you can receive a free burrito, burrito bowl, salad, or order of tacos by following these instructions.