Don't let them fool you... they're not really concerned about beating the market.

Sure, most Wall Street fund managers want to crush the S&P 500 Index every year. But that's not what really drives all these top business-school alumni (usually Ivy Leaguers).

Nope. Their true No. 1 goal is to not underperform the market.

If they underperform, they lose their jobs. And being a fund manager is a job you don't want to lose...

These Ivy Leaguers have spent years working their way up the corporate totem pole... And when they finally make it to the top, they get to enjoy some of the finer things in life – vacation homes, fancy cars, and five-star restaurants.

Once you live a lavish lifestyle, it's hard to go back. So fund managers will do whatever it takes to keep their lifestyle.

Managers can explain a year where their fund had the same return as the broader market to their clients... But they can't explain a year of underperformance. When that happens, clients start to think they'd be better off buying an index fund with much lower costs. They'll pull their money out of the actively managed fund without a second's hesitation.

So managers aren't necessarily trying to earn the highest return possible. They're simply trying to tell their clients that they did just as well or slightly better than the market.

After that, they can always say, "There's always next year, right?"

That means when it comes time to make investment decisions, they are faced with this question: What's the easiest way to not underperform?

The answer: Do what everyone else is doing.

Most of the time, it means owning the same stocks as the S&P 500. That way, if the index soars by 20% or falls by 10%, their funds will have similar results.

They get to keep their jobs and collect their management fees.

Fund managers are notorious for following the herd. If they see other professionals doing the same thing, they can't help themselves but to do it as well. Again, it's easy to explain a loss if every other hedge fund got burned too.

Of course, as we talk about all the time in Health & Wealth Bulletin, if everyone is doing the same thing, usually the opposite occurs.

True contrarians are the ones who often make the most money in the end.

With that in mind, let's look at how the professional fund managers are doing today...

Each month, Bank of America (BAC) puts out its Global Fund Manager Survey. It polls some of the top fund managers in the investing world. And it tells us what parts of the market they're bullish on, what they hate, and what scares them today.

In August, the survey revealed that fund managers are downright bearish.

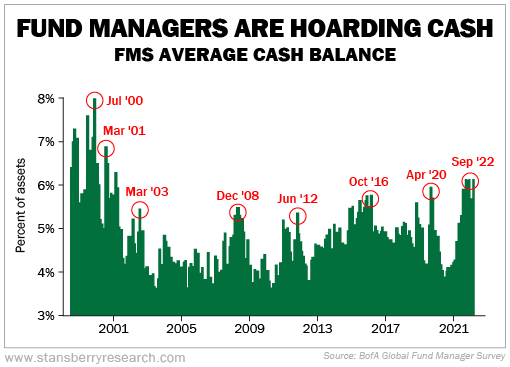

They're hiding in cash. Take a look...

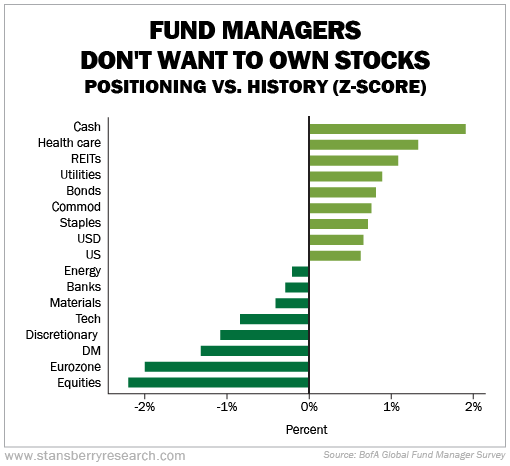

The chart below shows how their portfolios are positioned relative to the past ten years. As you can see, fund managers are long cash and defensive assets like health care, utilities, and bonds... And they are underweight equites.

Also, institutional investors are hedging their portfolios at record amounts. Doc showed you this last week, as institutional investors are buying put options in droves.

The fact is that the professionals are ultra-bearish today. They are hanging onto every word from the Federal Reserve and playing it safe because of high inflation numbers.

Their portfolios are not positioned to profit if stocks turn higher.

While there will likely be more volatility in the weeks ahead, the time to be contrarian is coming.

Instead of following the professionals into cash and safe bonds, I urge you to listen to two investing gurus – Marc Chaikin and Joel Litman.

Marc and Joel have teamed up to let you know exactly what you should do in the coming months to potentially erase the losses you have sustained over the past year.

The event, which takes place tomorrow at 8 p.m. Eastern time, is free to attend, but you'll need to reserve your spot.

You can click here to learn more.

What We're Reading...

- "Super bearish" fund managers' allocation to global stocks at all-time low, Bank of America survey shows.

- Something different: Amazon memo says 'Thursday Night Football' drew record number of Prime signups for a three-hour period.

Here's to our health, wealth, and a great retirement,

Jeff Havenstein with Dr. David Eifrig

September 21, 2022