"This will just show how strange things are right now."

My senior analyst Matt Weinschenk dove into his usual economic charts during last week's COVID Conversation.

And one thing stood out this time...

In other developed nations, the GDP declined along with disposable income. That makes sense – massive unemployment due to the pandemic shutdowns means less money to spend. And a halt in the economy means a drop in GDP.

But in the U.S., that picture is very different from the rest of the world. GDP declined, and disposable income increased... due to the government's interventions and stimulus checks. Folks on unemployment suddenly found themselves $600 richer with every check.

I've heard some anecdotal stories about unemployed folks spending that $600 willy-nilly on things like extravagant restaurant meals. But that seems to be the occasional story, not the big picture.

As a whole, American spending is down. And savings is much, much higher...

A recent survey by research firm Statista looked at how much folks spend today on different aspects of consumer products. Compared with pre-pandemic times, here's what they reported:

- Spent 77% less on going out (including eating out, movies, shows, etc.)

- Spent 70% less on travel

- Spent 69% less on services (including hair salons)

All that extra cash has to go somewhere. And it's going right into savings accounts.

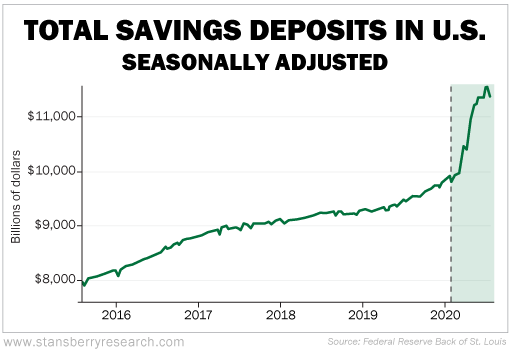

The Federal Reserve of St. Louis tracks economic data and trends in the U.S. It tracks the billions of dollars in savings accounts in the country, calculated weekly.

In 2018, the total amount of deposits in savings accounts grew just 1.9%. In 2019, that amount grew by 5.5%.

But from January 2020 through July, we've already seen a growth of 16.2%. We're now at an all-time high for savings deposits, passing the $10 trillion mark for the first time since tracking began in the mid-1970s.

So that led us to the big question: What are folks doing with all that savings?

We've written before about the importance of setting up an emergency fund. That's typically enough money to cover three to six months' worth of expenses like mortgage payments, food, and utilities.

But once you have that covered, you should put your money where it can benefit you the most.

A few months ago, we recommended holding cash. When we say cash, we simply mean all the money you have in savings, checking accounts, certificates of deposits, or U.S. Treasury bills. We consider any investment with one year to maturity or less as cash.

Now, with interest rates practically at 0%, you're not going to become rich sitting in cash. (In fact, the national average for August 2020 is 0.06%.) But cash is safe and will still pay you a small yield... a yield you'll be thankful for when stocks fall (as we suspect they will again in the coming weeks and months). And once markets stabilize, you'll be in a better position to go bargain-hunting if you have plenty of "dry powder."

One of our favorite ways to hold cash right now is through a money-market account. These accounts pay a higher interest rate compared with traditional savings accounts, and your money is insured by the Federal Deposit Insurance Corporation ("FDIC").

Specifically, you can use a cash-like vehicle such as the Fidelity Government Cash Reserves Fund (FDRXX) to park your money. The current yield isn't much, but it's safe. And over the past 12 months, FDRXX paid a yield around 0.94%... which again, is more than most savings accounts.

Of course, stocks offer higher returns... and the market keeps plowing higher. The key is that some businesses keep powering ahead, even in a pandemic. That's what we look for in my special advisory, Retirement Millionaire. In fact, we just recommended a company with a 160-year track record that earns more than 30% a year on its invested capital. The average company in the S&P 500 Index earns just 7.6%. Putting a bit of your wealth into owning part of a business like that can earn big returns.

You won't want to miss this opportunity. If you're a Retirement Millionaire subscriber, click here to read the full issue. If you aren't, click here to start your subscription today.

What We're Reading...

- How the pandemic changed our spending habits.

- Something different: We found another Milky Way. Maybe their 2020 is going better.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

August 18, 2020