The markets are wild...

In the month of June alone, the S&P 500 Index fell 2.9% in one day, fell 3.8% the day after, dropped another 3.3% one day in the following week, then gained 3.2% in one day the following week.

These wild price changes don't happen often in a big, broad index like the S&P 500.

But the days of the market barely moving from day to day are gone...

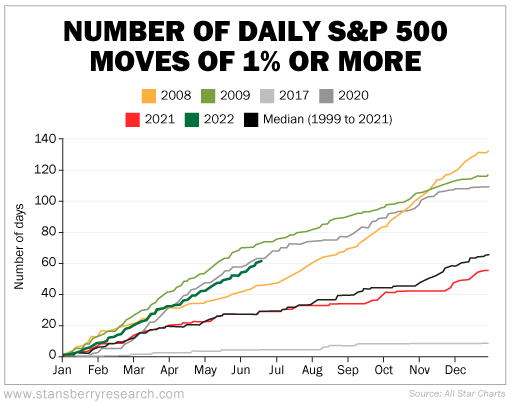

The chart below tracks market moves of 1% or more across different periods. We're halfway through 2022, and the S&P 500 has already moved up or down 1% or more nearly 60 times.

That's just below the paces of 2020 – when the COVID-19 pandemic crashed the markets into an abrupt recession before a quick recovery – and 2009, amid one of the worst economic collapses of all time.

Also take a look at the black line, which is the median since 1999. Markets are on track to have one of their wildest years in decades.

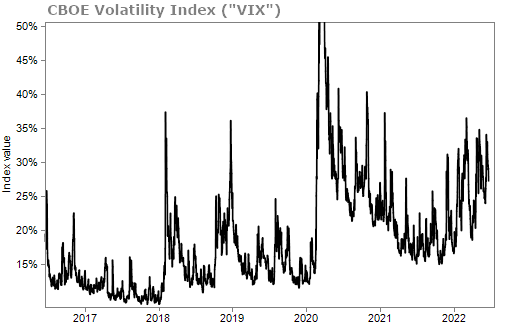

What's more, the CBOE Volatility Index ("VIX"), described as the S&P 500's "fear index," currently stands at around 29%. Anything above 20% is considered elevated volatility. And except for temporary spikes – most notably during the COVID-19 panic, where the VIX shot to 80% – volatility has stayed unusually high in recent months.

Take a look...

There are many reasons why investors are jumpy... record inflation, rising interest rates, the threat of recession, and geopolitical unrest.

As we've written about before, investors are the most bearish they have been in years. And we don't see these fears going away anytime soon...

There are a few things you could do with this fear...

First, you could do nothing and wait for market conditions to get better. You could hide in cash until there's a reversal in the markets.

But as we know from experience, most folks will stay on the sidelines too long. They'll miss the buying opportunity.

Put simply, most folks will let fear cripple them. And if you're close to retirement, this is not an option.

The better option is to profit from market fear.

Let me explain...

Today, fearful investors are buying portfolio protection. They buy some "insurance" in case stocks fall another 10% or 20%. And they pay a hefty premium for it.

The smart traders are the ones taking the other side of their bet.

Today, you should be the one selling folks portfolio protection... That is, if you want to make a lot of money.

Since there are so many people buying portfolio protection, the surge in demand has caused prices on that protection to skyrocket. And investors are happy to pay these hefty prices.

Some investors are even buying protection or insurance on stocks that they'll likely never have to actually use. But it brings them peace of mind.

It's a wildly profitable strategy if you're the one selling them that insurance policy. The prices that investors are willing to pay today are much more than they were anytime over the past few years. And that leads to a once-in-a-decade income opportunity...

In fact, fear levels haven't been this high since the financial crisis over a decade ago.

I've recently put together a presentation that goes into detail about the strategy of selling portfolio protection to nervous investors. Trust me, if there was ever a time to learn this strategy, it's today.

The insurance premiums you can collect can add up to hundreds or even thousands of dollars in your pocket every single month.

What We're Reading...

- 74% of consumers are concerned about a recession.

- These major economies are headed into recession in the next 12 months.

- Something different: WNBA star pens handwritten letter to Biden from Russian prison: "I'm terrified I might be here forever".

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

July 6, 2022