The average American household spends more than $800 a month on health insurance.

That number doesn't include additional expenses like copays and deductibles. One study from the Commonwealth Fund found that the average family spends 10% of its wealth on health insurance. That's up from 6.5% 10 years ago.

The rising costs of coverage has pushed people to choose health care plans with even higher deductibles to save on the monthly cost.

According to the Centers for Disease Control and Prevention, nearly 40% of Americans have a high-deductible health plan (HDHP). But if you have a medical emergency, you could be on the line for $1,000 or more in costs before you meet your deductible.

So today, we'll explain how to put aside money for emergencies and take advantage of a loophole that allows you to profit from your health care plan.

HDHPs are one of three main health insurance plans. The other two are health maintenance organizations (HMOs) and preferred provider organizations (PPOs).

Health maintenance organizations (HMOs) offer local plans that focus on in-network providers. That means they have specific doctors, specialists, and hospitals they work with. They've worked with the insurance plan to offer reduced rates in exchange for getting more patients through the insurance company.

Preferred provider organizations (PPOs) have a wider net for providers and allow out-of-network doctors, though in-network doctors have better rates and lower payments.

Generally, HMOs and PPOs offer low deductibles. That's the amount you're responsible for paying before your insurance kicks in.

Then there are HDHPs. These work by offering low baseline coverage. They're ideal for folks who don't need a lot of tests and procedures every year.

HDHPs are often the cheapest choice when it comes to health care plans, saving you on monthly costs for coverage. So it's no wonder that nearly 40% of Americans choose HDHPs to save money on health insurance.

But these plans come with high deductibles and greater out-of-pocket expenses... The deductible minimum for individuals this year is $1,350. And for a family plan, it's $2,700. Similarly, the maximum out-of-pocket expense for an individual is $6,650. For a family, it's $13,300.

There are two ways to help cover these costs – a flexible spending account (FSA) or a health savings account (HSA).

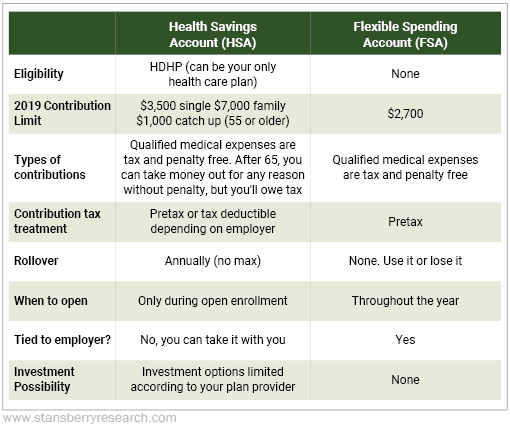

FSAs and HSAs are both types of accounts that allow you to put away money, often pre-tax, to later pay for medical expenses. Qualified expenses include things like eye exams, prescription medications, and dental treatment.

Here's a rundown of the main characteristics of HSAs and FSAs...

Some employers offer you a choice between the two when you have a HDHP. So which one should you choose?

The hands-down choice is an HSA.

The biggest downside with an FSA is that if you don't use all your money by the end of the year, you lose it. With an HSA, you can roll over an unlimited amount of money each year.

And best of all, it serves as a great tax shelter...

The IRS allows you to use your HSA like a garden-variety IRA. You can just keep putting money in it until age 65. Once you hit 65, you can withdraw the money without penalty for any expense... you'll just have to pay taxes if it's non-medical.

Another benefit is investing through your HSA. The money in your HSA grows tax-free. That means the capital gains, interest, and dividends in your account are nontaxable. Remember, your contributions are either pre-tax or tax-deductible. And you can make tax-free withdrawals for qualified medical expenses.

That means you're saving on taxes three times over.

As long as you have a HDHP, you're under the age of 65 and you're not on Medicare, a dependent on someone else's tax return, or covered by a non-HDHP plan, you can sign up for an HSA.

Setting up an HSA is simple. Some employers or health insurance companies might have a recommended bank to open your account. But you can also check with the bank of your choosing, credit unions, or brokers.

If you have a high-deductible health plan and you're not using an HSA to your advantage, get started today.

What We're Reading...

- Something different: More than 1 million species are threatened with extinction.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

May 9, 2019