Most of you probably ignored my advice...

Last Wednesday, I told you it was never really a bad time to move some of your portfolio to cash.

For years, I've said that stocks are the greatest wealth-building tool in all of history. You need to have your money in stocks.

That means holding stocks through the good times and the bad. If you just buy and hold, riding all the bumps along the way, you'll eventually make money in the end. Trust me.

But our brains don't work that way. We typically either go all in or all out.

If you want to be all-in and 100% invested, today's essay is for you. I'm going to tell you exactly which groups of stocks you should buy as you prepare for the upcoming bear market... And which ones to avoid.

I'm also going to show you the importance of owning another asset class... and how it will offer you protection while still growing your wealth.

First, let's talk about owning stocks. Like I said earlier, if you own stocks over a long period of time, there will be some bumps along the way.

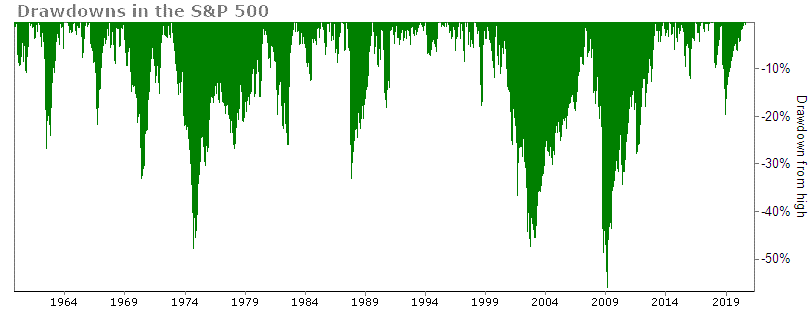

The chart below shows how far the market drops from its peak in each drawdown.

You can see here that when the market falls, it falls hard. But you can also see that – though fresh in investors' minds – the global financial crisis of 2008 was an outsized event. Yes, markets can get bad, but that was a truly historic crash that doesn't happen often.

Unless you have nerves of steel, you're probably not going to hold steady through most of the big drops. So instead of buying an index that tracks the broader market movements, like the S&P 500, you should want to own a select group of stocks that doesn't fall as much and is less volatile.

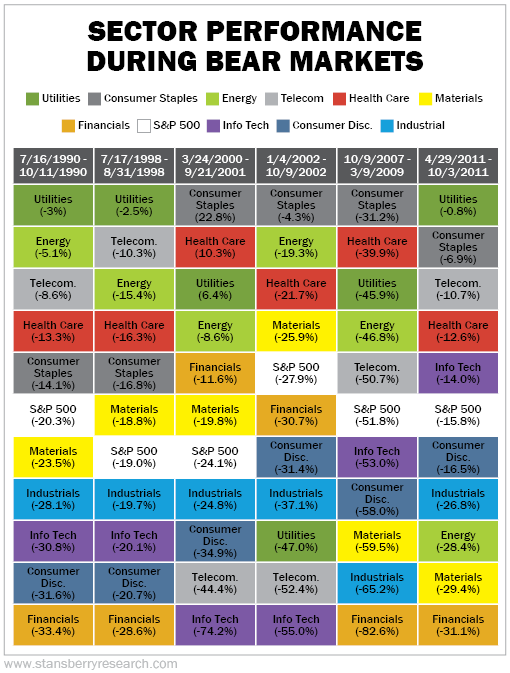

My team and I ran the numbers and looked at which sectors move the most during bear markets. The table below shows the 10 broad sectors of the market and their performances over the last six bear markets (the bear market dates are based on the definition of a bear market by Ned Davis Research).

This table offers some clear lessons. Utilities, consumer staples, and health care stocks offer opportunities to safeguard your wealth. Aside from the global financial crisis, every other bear market has had some sectors that stayed near even, and some that posted gains. You should own these groups of stocks if you're worried about volatility.

You may say, "Well, why even hold utilities if they are going to lose money in a bear market?" But the fact is that you don't know for sure when the bear market is coming or how soon it will end. If you hold defensive sectors, you can still earn equity gains when the market rises without taking on the full risk of other sectors.

On the flip side, if the bear market is coming, then you want to avoid financials, tech stocks, and the consumer-discretionary sector.

Moving into the next bear market, the table will look a little different. Since the 2011 bear market, real estate has broken out of financials to become its own sector. And the telecom sector was renamed "communication services" and includes some stocks that used to be considered part of tech and consumer discretionary.

Even so, the names may be new, but the conclusions are the same... Holding safe sectors can pay off.

If you want to diversify away from stocks but still make more money than you would in cash-like securities (such as a certificate of deposit (CD) or money market funds), you should consider owning bonds.

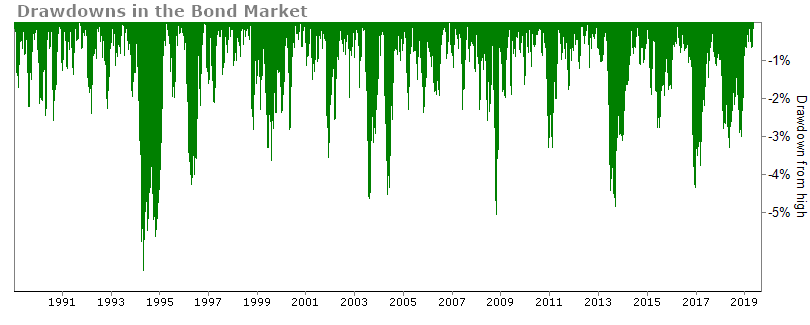

Gyrations in the bond market seem like nothing compared with the stock market. As you saw from our previous stock market drawdown chart, stocks can fall 20%, 30%, and even 50% from highs with regularity.

Bonds, too, have their drawdowns. But the most drastic declines on this chart finish up at around 6%...

In other words, bonds also fall... But if you are used to stocks, you'll never lose a moment's sleep over your bond portfolio.

Bonds give you the opportunity to earn returns and have capital ready to deploy. All you need is a high-quality mutual fund or exchange-traded fund like iShares iBoxx Investment Grade Corporate Bond Fund (LQD)... or something that may be available in your retirement account, like the Vanguard Total Bond Market Index Fund or the Fidelity Total Bond Fund.

Being prepared for a bear market is important. That's why you need to join tonight's Bear Market Survival Event.

Stansberry Research founder Porter Stansberry and legendary investor Jim Rogers are coming forward to detail the critical steps you can take right now to ensure you're ready for the coming crisis.

They'll show you exactly how to safely profit from the final phase of this epic bull market... and how to protect yourself from its inevitable collapse.

They'll also discuss six powerful strategies that can help you grow your retirement war chest before, during, and after the crash.

It all happens TONIGHT. Don't miss it.

Click here to claim your spot now.

What We're Reading...

- Something different: Democrats and Trump do battle in court over his financial records.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

May 15, 2019