The markets today are gripped by "negative panic."

The combination of low interest rates, market volatility, and an uncertain global economy have even skilled investors a little uncertain about what may happen next.

One global strategist at Credit Suisse recently polled his clients in the U.S., Europe, and Asia and came away with a clear consensus. "Never before have we seen so many clients who do not know what is happening and have cashed up," said Andrew Garthwaite in a client survey released by Credit Suisse.

In other words, the guy's very high-net-worth individuals have stopped investing and are keeping their capital as cash.

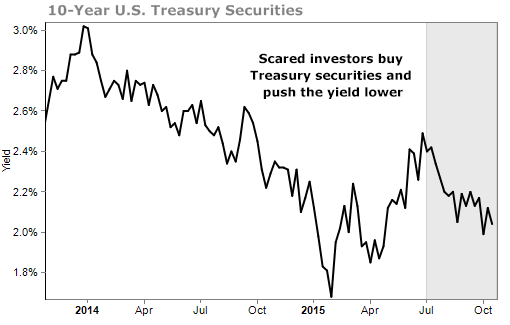

When investors go to cash, it mostly ends up in risk-free bonds. Over the last four months investors have bought up U.S. Treasury bonds and bid up their price. That makes the yield on these investments go down, which you can see in this chart of the yield on 10-year Treasury notes.

Think about it: Everyone is so scared of rising interest rates that they are driving rates even lower with their behavior.

This is a classic form of "negative panic."

Negative panic is an involuntary and dangerous response. It's a tendency that people have to freeze and/or do nothing to escape a life-threatening situation.

It's well-documented in emergency situations in which people's physical safety is at stake – like plane crashes or natural disasters.

But negative panic also comes into play in financial markets. At market bottoms, it drives investors into cash. They sit on the sidelines and watch as the new bull market begins and runs up and away from them. No matter how much higher the market goes, people remain frozen and unable to act.

In real-world disasters, you overcome negative panic by planning ahead. The same is true with investing.

So how can we plan in our investment funds to avoid negative panic when markets get chaotic?

To start, remember one thing: Everyone's investments go down sometimes. One of the most successful hedge-fund managers of all time, Ray Dalio of Bridgewater Associates, has seen his "All-Weather Fund" fall 3.76% this year. Other investing legends like David Einhorn and Daniel Loeb are having down years, too.

[optin_form id="73"]

A few red numbers in your brokerage statement should not make your palms sweat. Those who invest only when they are sure it's safe have retirement funds earning 0.5% in a savings account their entire lives.

Take your pick of any crisis in market history and the correct move has been to stay invested. Many investors grew scared of markets in the 2008 financial crisis and pulled their money out of all their investments. They sold for big losses, and then missed the seven-year bull market that would've earned back all their money and then some.

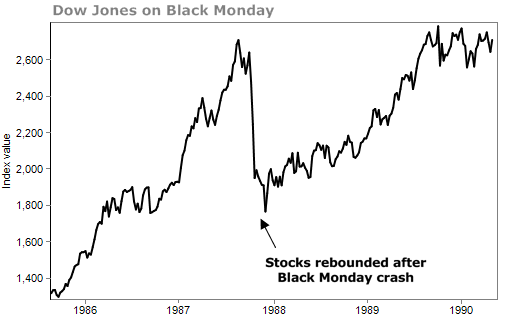

I was on the trading desk 28 years ago, on October 19, 1987, otherwise known as Black Monday. In a single day, the Dow Jones Industrial Average lost 22.6%. The worst percentage loss on record.

At the time, it felt like the world was ending. By the end of the year, the market posted a positive gain. Those who were smart enough to stay invested were able to look at their portfolios and imagine nothing happened.

Those who panicked and sold ended up with big regrets.

If you've got a long-term view toward saving and investing for retirement, you should be looking past any scares or confusion in the market today.

If you're closer to retirement and need to protect against losses, that should be reflected in your asset allocation, and not in reactive moves that push you in and out of investments as the market gyrates.

To learn more about negative panic and preparing for disaster situations, you can get a copy of The Doctor's Protocol Field Manual right here.

We also cover asset allocation and investing every month in my Retirement Millionaire newsletter. You can click here to get more information. And subscribers get access to The Doctor's Protocol Field Manual for free as well.