Today, we're getting back to the basics...

We've talked before about the importance of paying off debt, investing in your retirement, and cultivating your financial literacy.

But before you do any of that, you need to make sure you've saved for emergencies.

If you look at your financial life as a house, an emergency fund should be the foundation. You want to make sure, in the event of an accident or job loss, you have the funds available to pay your expenses.

Typically, financial planners recommend having about three to six months' worth of take-home pay in your emergency fund. We've even seen some recommendations for as much as nine months' worth of pay saved.

How much you need to keep depends on factors like your marital status, if you have kids, your health, and your job stability.

You've probably heard this stuff already.

But recently, a friend asked me a question I haven't gotten before...

Where should I keep my emergency fund?

He explained he was finally working on saving up his emergency fund and wondered if he should just keep it in a checking account...

That's about one of the worst things you can do with it.

Most checking accounts don't pay interest. And those that do often require balances of $10,000 or more just to earn 0.01%, annually.

You don't want to risk your emergency fund, but why not make it work for you?

Savings accounts are one of the easiest and safest places to keep emergency money. Savings accounts are FDIC-insured, which means that the Federal Deposit Insurance Corporation will make depositors whole – up to $250,000 – should the bank make bad loans or experience financial disaster.

Most savings accounts require a small minimum deposit to open, anywhere from $1 to $100. Banks have various types of savings accounts, including accounts specifically created for kids. And some banks offer higher interest rates the more money you keep in the account. But you don't earn much... Right now, the national average interest rate is 0.09%.

A money market account (MMA), sometimes called a money market deposit account, will usually have higher minimum deposit requirements. This can be as low as $500 or as high as $1,000, and they often pay a higher interest rate. With a current national average of 0.18%, an MMA can potentially double the interest you'd make in a savings account.

Something to be aware of... Both savings accounts and MMAs limit your monthly transfers to six.

Certificates of deposit, or CDs, have many of the benefits of savings and money market accounts... They pay interest and they're FDIC-insured. But when you put your cash in a CD, you agree to leave it there for a particular amount of time – usually between three months to five years – and you'll pay a penalty for early withdrawal.

Since the money is locked up, the bank will give you a higher interest rate. Right now, the national average is 2.10% on a one-year CD. That rises slightly to 2.22% on a two-year CD.

Although the interest rate is higher, CDs aren't a great emergency fund because of the withdrawal penalties.

Once you know the type of account you want, you'll need to find the best rate.

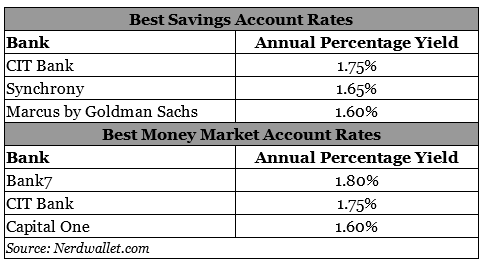

Big national banks, like Bank of America and Wells Fargo, offer savings accounts that yield 0.03% and 0.01%, respectively. But you can do much better with a little searching. Websites like Bankrate and Nerdwallet can help you find the best rates. Here are some of the best rates right now:

If you want to look for even better rates on any of these accounts, join a credit union. Credit unions are nonprofit companies that act as local community banks. Credit unions often pay the best rates, but many have membership requirements. Sometimes it's as easy as living in the community that the credit union serves, but it can vary. You can find a credit union near you with A Smarter Choice, and for a list of credit unions that anyone can join click here.

(Note: We do not endorse nor are we affiliated with any credit union or financial institution mentioned in this letter or in the links above.)

So, you've got money in your emergency fund... what should you do with the rest?

The editor of our sister publication, Health & Wealth Bulletin, Dr. David Eifrig writes a monthly advisory where he shares his best health and wealth tips.

Doc (as we like to call him) has a report that details the downside of holding too much cash, the safest places to keep cash, and what the "shadow banking" system could mean for your money.

Click here to start your subscription to Retirement Millionaire and get access to this special report, "How to Hold Your Cash Balances for Maximum Safety and Yield."

Have a great week,

Laura Bente & Amanda Cuocci

May 6, 2018