I see this mistake from investors far too often...

You hear about a brilliant trade recommendation... The story makes sense and the potential profits are huge. In fact, you like it so much that you put a lot of money into it. With dollar signs in your eyes, you forget all about investing basics 101.

You make an all-or-nothing bet... with money you need for your future.

This mistake is a sure-fire way to go broke.

I'll give you a recent example...

In my newest trading service, Advanced Options, we design trades that can achieve triple-digit gains in a short period of time using option-market techniques that most investors have never even heard about. These techniques let us customize our trading to do exactly what we want... increase profits, reduce risk, and often still even profit if a stock doesn't go anywhere.

Back in March, we recommended an extremely bullish trade on China.

If you've been following Stansberry Research for long, you'll know that my colleague Steve Sjuggerud has been outspoken about China for a while. He thinks Chinese stocks are poised for a massive boom. And I agree... So in Advanced Options, we wanted to make a cheap bet on his conviction.

We laid out a trade that could turn a $1,000 investment into $5,000 in about seven months. That's a massive 400% return on your money.

Of course, there is risk involved. After all, China might not boom as soon as we think. Maybe we have a real trade war. Or perhaps the situation in North Korea heats up again. So the risk that we have to consider is that if the trade doesn't work out, we'll lose the money we put up.

But we only need to make 400% once for every four losing trades to break even. So if the likelihood of the trade paying off is higher than that – and we think it is – then the upside outweighs the downside.

This is a great speculation... as long as you keep one simple trick in mind.

With this kind of aggressive trade, you must keep your position size small.

After all, if we think this trade has, say, a one-in-four chance of working out – then we'd make 400% once for every three losing trades. That's a great return... and we only need to win a quarter of the time.

The problem, of course, is if you load up on the first speculative trade that offers this kind of risk and reward... If you go "all in" and your first speculative trade isn't a winner – and remember, three-fourths of the time, that'll be the case – then you're out of the game.

It doesn't matter what the second trade can return – 400%, 4,000%, 40,000% – if you don't have the capital to take a stake.

And even if you're not going "all in," position sizing is still incredibly important.

Taking even slightly unbalanced stakes is also dangerous.

For example, imagine a trader who has an account of $10,000 that he dedicates towards speculations.

If he makes a big bet of $3,000 on one speculation like our Advanced Options China trade and it works out, he could turn that $3,000 into $15,000 by January 2020. His total account would increase by 120% just from that one trade.

But he could lose 30% of his account if the trade goes against him.

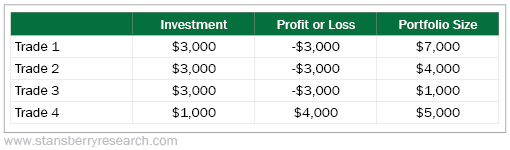

If this speculation has a one-in-four chance of winning, he could possibly make three trades in a row and lose on all three. If he put $3,000 into each trade, he's now down $9,000.

And even if he puts what's left in his account into a fourth trade that pays off, that's still a big loss...

At first glance, it seems like this trader was close to using position sizing correctly.

But even a small imbalance can lead to a big mistake. In this case, he only had $1,000 left to make that final winning speculation that made him $4,000 – putting his final portfolio size at only $5,000.

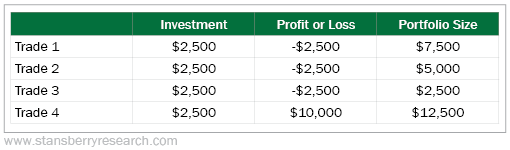

He could have easily avoided losing 50% of his portfolio with just a small shift in his initial position size. For example, a $2,500 initial position size would have led to him making 25% over this series of trades.

But that's still more aggressive than I would suggest.

After all, this trader was down to his final $2,500 on the fourth trade. Eventually, he's going to go bust.

Here's the smarter way to stay in the speculation game...

Keep your position size small. I usually recommend less than 10% of the money you've dedicated to speculating.

As you can see, it leads to much steadier results... and it allows you to speculate on many more trades.

This trader could speculate on dozens of trades and still sleep well at night. And if you speculate on well-researched ideas (like Steve’s China thesis), you’re likely to hit on more than one-fourth of your speculations.

Always have a plan before you enter a trade and think about what can happen if things don't go your way. Using the right position sizes will keep you in the speculation game for a long time.

What We're Reading...

- Something different: Game of Thrones' Battle of Winterfell was less deadly than expected.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

May 1, 2019