Doc's note: For years, investors were given the same advice. And for a long time, the advice worked. But in our current market environment, there's a better way to grow and protect your money.

So we're rounding out our week of wealth-myth busting with an issue on why the traditional way you learned to invest doesn't work anymore…

***

The old way of investing is dying...

As an investor, you have to evolve. The advice you received from your grandparents and parents just isn't true anymore.

The world is much different today.

You've probably heard about the "60/40" portfolio-allocation model for your entire adult life... Put 60% of your investment portfolio in stocks and the other 40% in bonds. This is what professors teach in Finance 101.

And in normal market conditions, that traditional allocation works great. The stocks provide growth but greater risk, and they're balanced against the safety of modest, predictable bond yields.

But sometimes, this rigid model is a disaster for your retirement... You could spend a lifetime squirreling away your savings in a 60/40 allocation, only to come up short if the markets turn against you just before you retire.

Today, the 40% allocation to bonds is especially troubling. They are not paying anything. Even worse, they have much more risk than ever before.

Back in the day, folks would lean into corporate bonds as a safe way to generate some income and protect their capital.

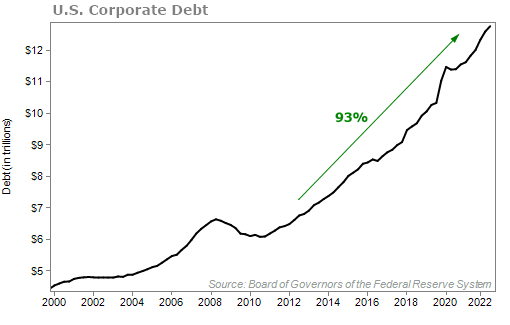

Over the past decade, U.S. corporate debt has nearly doubled and is about half the size of the U.S. economy. Take a look...

Mike DiBiase, editor of Stansberry's Credit Opportunities, wrote about this last December. Specifically, he warned that the quality of this growing debt is at an all-time low. Here's Mike from the issue...

Let's look under the covers...

Investment-grade debt makes up around 80% of total corporate debt. This is the highest-rated debt, with credit ratings ranging from AAA to BBB.

The lowest tier, BBB, accounts for more than half (57%) of all investment-grade debt. That's the highest percentage ever. This is important because this debt is one level away from being considered junk. And when debt gets downgraded to junk, prices generally fall hard.

Now, let's look at junk-rated debt...

Junk bonds total around $1.5 trillion today. This includes debt with credit ratings ranging from BB+ to C. The midpoint junk rating is B-. Debt rated B- and below makes up 35% of all junk debt. A few months ago, that level topped 40% – the highest percentage ever.

That's scary stuff for fixed-income investors. And we agree. Now is not the right time to be invested in bonds. They're not as safe as they used to be.

So, if you were a 60/40 investor and had 60% of your money in an S&P 500 Index fund and the other 40% in a bond fund like the iShares iBoxx Investment Grade Corporate Bond Fund (LQD)... then you're in trouble.

Fortunately, there is a better way to invest than the 60/40 approach...

We call it the "Intelligent Retirement model."

This proprietary tool from my Income Intelligence newsletter identifies the ideal asset allocation for every market condition. Sometimes, market conditions call for a high percentage of gold (like they have been recently, which has paid off for us). Other times, the model calls for a higher percentage of your portfolio in real estate investment trusts... It all depends on outside market conditions. And those change all the time.

In our extensive backtesting, this Intelligent Retirement model dramatically outperformed the standard 60/40 allocation. For example, if you would've put $100,000 into a 60/40 portfolio in 1973, it would've grown to more than $7.5 million over the next 49 years. That's pretty good, but you also would've experienced drawdowns as high as 35%.

With this new approach, $100,000 in 1973 would've turned into $18 million today... And get this, you never would've experienced a drawdown of more than 12%. It's more reward and less risk at the same time.

Today, the Intelligent Retirement model is still outperforming by nearly 7 percentage points since its inception in June 2021.

That might not sound like massive numbers, but in investing, it is. This adds up over time, and even a few percentage points can mean tens of thousands of more dollars.

One reason for this outperformance is that the model has been leaning heavily into inflation protection. As I've written many times before, inflation needs to be the No. 1 worry for investors today.

In the Intelligent Retirement model, we have positioned investors to actually make money during inflation...

You can get access to the current iteration of the Intelligent Retirement model by signing up for a subscription to Income Intelligence.

You can click here to get started.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

December 22, 2022

Editor's note: Our offices are closed this coming Friday and Monday for the Christmas holiday. Your next issue of the Health & Wealth Bulletin will be in your e-mail inbox on Tuesday, December 27. From all of us here on the Health & Wealth Bulletin team, we wish you and your loved ones a safe and happy holiday.