We're coming to you live today from Boston, Massachusetts at the annual Stansberry Conference & Alliance Meeting.

This year's lineup of speakers has been incredible, to say the least.

We've already heard from serial entrepreneur Scott Galloway, professor of marketing at NYU's Stern School of Business... Jaime Rogozinski, the founder of WallStreetBets... and, of course, many of the Stansberry Research editors.

One presentation really stood out to me (Jeff Havenstein)...

Gareth Soloway is the co-founder of InTheMoneyStocks and a technical trader. He gave a presentation about simple technical trading patterns and also made some predictions on the market. (He even shared one asset class he loves, which others hate right now.)

Now, I don't consider myself a technical trader. Far from it. I'm a fundamentalist, just like many of the Stansberry editors.

But when Gareth took the stage Monday afternoon, he warned that stocks may be flat for the next decade. The charts he showed made a compelling case.

In fairness to paying attendees of the conference, I won't share all the details of his presentation. But his prediction reminded me of something we wrote here in the Health & Wealth Bulletin.

On March 3, 2021, I wrote an essay called "Beware of the Market for the Next 10 Years."

Scary title, I know. But I wanted subscribers to reset their expectations of the market going forward. The next decade wasn't going to be like the last decade.

You see, back in March 2021, the market could do no wrong. It had just rallied 75% from the COVID-19 lows and was already 16% above the pre-pandemic high.

Stocks were on a one-way ticket higher. And as we all know, stocks kept surging higher over the next few months...

So giving a warning about the market during a ripping bull market is probably not what subscribers wanted to hear. But it was a warning I had to make.

You see, stocks were historically expensive in early 2021. You can measure that by the cyclically adjusted price-to-earnings ("CAPE") ratio.

The CAPE ratio takes the regular price-to-earnings ratio and smooths out earnings over the business cycle. The idea is that earnings are too low when things are bad, and too high when things are good. Smoothing out earnings – then comparing them with current prices – gives a better indication of whether stocks are cheap or expensive today.

Here's what I wrote back in March 2021...

The CAPE ratio is currently at 34. And that tells me that the next 10 years of investment returns are not going to be good...

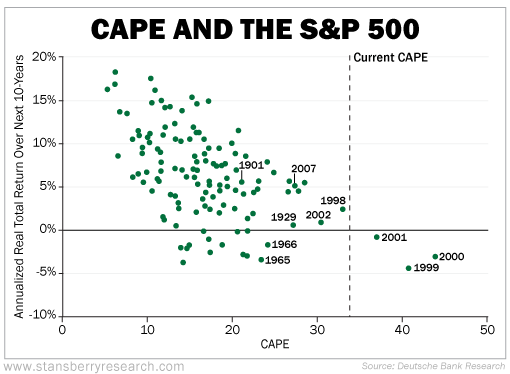

The chart below looks at the CAPE ratio in various years and the return of the market over the following decade.

If you can imagine an average line, it would be downward sloping. That means when the CAPE ratio is small, market returns over the following decade tend to be higher. The more expensive stocks get, the less they return over the next 10 years...

This chart should make you nervous. Based on history, we should expect to see low to even negative annualized real total returns over the next 10 years.

A year and a half later, stocks have been flat. And if you consider real returns, returns accounting for inflation, it's definitely negative.

Of course, this could be just the beginning...

Based on the data above, we might be in this sideways market for many years to come. Think about the financial crisis and how it took stocks many years to regain losses.

My colleague Dan Ferris took the stage in Boston last night. He also issued a warning, one that's more severe than flat or negative annualized returns for the next decade...

Specifically, Dan said we’re in the biggest financial mega-bubble in all financial history. And bubbles this like this, something that has only happened about four times before, doesn’t just end with stocks down 25%.

Dan thinks stocks can definitely move much lower from here.

If you've been following Dan over the past year or so, you know that he has been dead right about this bear market. He's been warning his readers well before the market tanked earlier this year.

Dan thinks that what happens in the coming weeks could make or absolutely break your retirement. That's what history has shown when stocks are falling, inflation is rising, the Fed is raising rates, and economic activity is slowing.

It's a scary time to be an investor, for sure. Fortunately, Dan has a simple solution to protect your wealth.

If you haven't already, I suggest you watch Dan's warning and presentation by clicking here.

What We're Reading...

- Something different: Fed to hike rates by 75 basis points again on November 2.

Here's to our health, wealth, and a great retirement,

Jeff Havenstein with Dr. David Eifrig

October 26, 2022