Doc's note: If you've been following Health & Wealth Bulletin, you're familiar with my colleague Dr. Steve Sjuggerud's Melt Up theory. But now, he's making a major shift... According to Steve, the Melt Up will end this year.

And in today's issue, Steve explains why he thinks that's the case...

The Melt Up will end sometime this year.

That's the big prediction I shared with you last month. It's a major shift in opinion for me.

I've made a name for myself calling the Melt Up in recent years. I've been bullish and right. But I can't ignore what I see brewing in the markets right now.

Today, I'll share why I believe this major prediction is a near certainty.

What's happening today is simple... It's the Greater Fool Theory.

Folks are hoping that by buying today, there will be a greater fool than them to pay a higher price tomorrow. But think about this for a second...

Right now, we've got multiple rock stars (and Elon Musk!) pushing Dogecoin – which the founder admitted was formed as a joke and should never be worth much.

Once Musk, Snoop Dogg, Gene Simmons, and all the kids in the local high school have put their money to work... where can the next greater fool possibly come from to drive prices higher?

"The single most dependable feature of the late stages of the great bubbles of history has been really crazy investor behavior, especially on the part of individuals," legendary investor Jeremy Grantham wrote earlier this year. "For the first 10 years of this bull market, which is the longest in history, we lacked such wild speculation. But now we have it. In record amounts."

That gets to the heart of it...

To me, what we're seeing now is "really crazy investor behavior, especially on the part of individuals."

The thing is, to make the most money, you want to buy when everyone is fearful and sell when everyone is greedy (to quote billionaire investor Warren Buffett). And right now, individual investors – many of whom are buying for the first time – are darn excited...

An astounding 28% of all Americans bought GameStop (GME) or other viral stocks in January, according to a Yahoo Finance-Harris poll. The median investment, according to the poll, was just $150. The largest group of buyers was men aged 18 to 44. And 43% of these folks said they had just signed up for a brokerage account in the last month.

So in new individual investors, we have seen a dramatic shift in investor attitudes and behaviors. In short, basically since GameStop, we moved from a stock market boom to an investing bubble.

We may not know the exact date... But the Melt Down is coming. And if I haven't convinced you yet, consider this...

The main index of tech stocks – the Nasdaq – hit another scary record in February. From its bottom, it was up 105% in 47 weeks. To give you some frame of reference, that was the best 47-week performance in the 50-year history of the index.

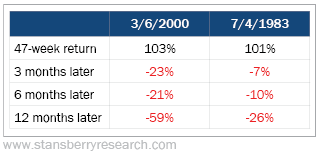

The Nasdaq has only been up over 100% after 47 weeks twice in history... The last two 100% moves ended in March 2000 and in July 1983. The stock market performed terribly immediately after those huge moves higher. Take a look...

The last two times in history that we saw a market up over 100% in the same short period of time, the Melt Down was knocking at our door. It's as simple as that.

There are several points here. But the takeaway is an easy one...

Market sentiment and performance are both hitting bubble levels. And that tells me the top is near.

I expect the Melt Down to begin sometime this year. And that means the time to prepare is now.

Good investing,

Steve

Editor's note: While Steve says the Melt Down in stocks is inevitable, there's still a chance to profit. Next Thursday, at 8 p.m. Eastern time, Steve will make a major announcement about what to do with your money today and how to navigate the inevitable Melt Down in stocks. It's free to attend. Just click here to register so you don't miss this critical presentation.