It was supposed to be the collapse of the modern world as we know it...

In the years and months leading up to the turn of the millennium, lots of folks thought computer systems across the globe would crash, leaving much of the world in shambles. Banking systems would collapse... Government systems would malfunction... there would be large-scale blackouts... infrastructure damage... you name it.

Folks were scared. This widespread panic became known as Y2K, short for "the year 2000."

You see, many computer programs only allowed a two-digit year format to minimize the use of computer memory (they would use "99" instead of "1999"). As a result, there was a lot of concern that computers would be unable to operate when the date changed from "99" to "00".

As it turns out, as soon as the calendar flipped to 2000, there were minimal issues.

Some think the panic was overdone. They think the change to 2000 wouldn't have caused many problems anyway... Others think it was the behind the scenes efforts of the government and other businesses that corrected the bug in advance.

Either way, there was a lot of panic across the country. Folks were so scared about a collapse in the banking system – and any other doomsday scenario they could imagine – that they started to hoard cash. And given the possible outcomes, cash was a safe place for most people.

We're in a slightly similar position today...

Folks are scared. They don't know what's going to happen with the COVID-19 virus. They don't know how long the economy will be shut down. And they don't know the lasting effects from the shutdown.

As a result, they've felt safer hoarding cash.

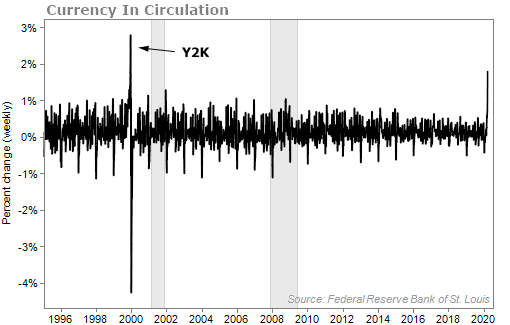

The chart below shows the weekly changes in "currency in circulation," which measures paper currency and coin held both by the public and in banks. There has only been one time over the past three decades when the need for cash has been greater than today... Y2K.

As you likely know, I've been an advocate of holding cash for many months now. I'm glad to see that people are finding safety in cash. Because the truth is, the worst is probably yet to come.

We've seen the market rally recently, but don't be fooled by it... This is likely what's known as a "bear market rally."

Huge up days for the market don't usually happen in good times. They happen in bad times... and that's what we've seen so far.

So what should you do now?

Many of you probably have a good chunk of your portfolios sitting in cash. And it's safe in cash. But it's just sitting there... earning nothing.

Many investors want to know when the time to put that money back to work and buy back into the market will be.

Stocks that you love – blue-chip stocks like Apple (AAPL), Coca-Cola (KO), Home Depot (HD), or Microsoft (MSFT) – are trading for 15% to 25% less than they were a month ago. They look like bargains.

But you need to understand that they can still fall from here, along with the rest of the market.

While you could buy today and hold them through the drawdowns the market may have, (at the very least, through a very choppy market – and who knows how long that will last) I have a better way to make the most of your cash today.

I'll describe the trade to you. And I'll use a company that I love and that can be a cornerstone for any portfolio... Apple (AAPL).

As I write, Apple trades for about $245 a share. It's down about 25% from its February high.

A 25% discount on Apple sounds like a great deal... but it's possible it could easily fall 10%, 15%, even 20% more from here if we see this economic shutdown extended. So you're hesitant to buy...

Here's what I think you should do... Tell your broker that you are willing to buy 100 shares of Apple for $210 a share anytime over the next month and a half. (And $210 is 14% lower than where Apple is trading for now, which is a great deal.) All you have to do is set aside the cash to show your broker you can afford to buy shares.

And here's the best part... Because you agreed to potentially buy shares of Apple for 14% less than they are trading for now, you'll get paid $875 today.

And no matter what happens to the price of Apple, you'll get to keep that $875.

Seriously. There's no fine print.

So the deal is that you'll get paid $875 today all because you agreed to potentially buy someone else's shares of Apple from them... and for 14% lower than what they are worth now.

Let's go over all the outcomes in this trade so there's no confusion...

Let's say Apple gets crushed because of slow consumer spending. Shares fall to $205 – a drop of 16%. In this case, you'd have to make good on your promise and buy shares for $210 a share. That's a loss of $5 ($205 – $210). On 100 shares that's a $500 loss.

But remember, you earned $875 at the beginning of the trade. So even though the stock crashed 20%, you still made $375. And you now own Apple, a blue-chip stock, at a very cheap price. Over the next few years, I'm sure you'll be a happy and wealthy shareholder.

Meanwhile, regular shareholders who simply bought Apple and held would have lost $4,000 on 100 shares.

Now let's talk about what will happen if shares fall just a little, stay flat, or even rise.

It's simple... You'll keep the $875 that you received at the beginning of the trade and walk away. That's the end of the trade. You're not on the hook for anything.

You just earned $875 and the worst-case scenario of the trade was that you had to buy shares of Apple for 14% less than what it is trading for now.

This type of strategy is a great way to not only collect big cash payments, adding some much-needed income to your portfolio, but also provides a way to potentially buy shares of your favorite businesses at a huge discount.

You won't find this kind of downside protection anywhere else.

Why Now?

There are very few times in history when this special trading strategy will work, but today is one of them...

And that's because of the record amounts of fear happening today.

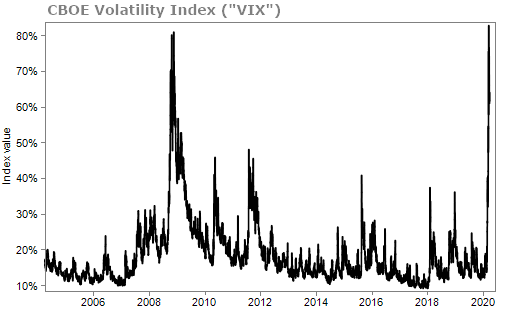

My team and I track fear by looking at the CBOE Volatility Index ("VIX"). The VIX measures the expected volatility in the S&P 500 Index. As you can see, this "fear index" has hit peaks even greater than the 2008 to 2009 financial crisis...

This is important because when investors are fearful, they are willing to pay for portfolio protection. Specifically, they pay up for option protection.

Right now, options are extremely expensive... And that makes it the perfect time to sell them.

By selling options, we get to collect massive payments upfront and the only risk we take is the potential obligation to buy stocks that we want to own anyway – for much less than they are worth today.

We can basically take advantage of the extreme amounts of fear in the market.

The excessive level of fear won't last forever... That's why I think it's important you take advantage of these trading opportunities today.

Last Friday in my Retirement Trader service, I showed readers how to earn $650 and $385 by agreeing to buy two stalwarts with 22% and 20% downside protection, respectively. The strategy is simple to learn and anyone can use it.

Because of the rare opportunity in the markets, we are offering a reduced price to join Retirement Trader for a limited time only. Even though it's scary to put your money back into the market, you won't lose a night's sleep with this strategy...

What We're Reading...

- 20 years later, the Y2K bug seems like a joke because those behind the scenes took it seriously.

- World's busiest border falls quiet with millions of Mexicans barred from U.S.

- Something different: How the gender pay gap affects women's mental health.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

April 1, 2020