Doc's note: What's the secret to finding the best-performing stocks?

In today's issue (adapted from the December 2021 issue of Extreme Value), Dan Ferris explains how to find stocks that will keep building your wealth for the long term...

***

Making money in stocks is simple, but it's not easy...

First, find stocks with the potential to become exceptional long-term performers.

Second, buy them.

Third, hold on for the long term, no matter what peaks and valleys surface along the way.

It sounds easy enough on paper... But in practicality, what's the best way to find those exceptional long-term performers – the ones you can trust to endure every valley and surpass every previous peak?

To answer that, let's start with Hendrik "Hank" Bessembinder.

Bessembinder is a professor at Arizona State University. If you've heard Bessembinder's name before, it's likely due to his most famous research paper – a 2018 piece titled, "Do Stocks Outperform Treasury Bills?"

According to him, just 3% of more than 25,000 listed stocks returned $47 trillion more to investors than Treasury bills produced since 1926.

In 2019, Bessembinder conducted similar research on global stocks and found that of more than 26,000 globally listed companies, just 1.3% returned as much to investors as every single Treasury bill combined between 1990 and 2018.

Knowing how to identify the few potential great performers out of thousands is clearly a valuable skill. You need to buy them when their share prices fall and hold them for the long term, which, as we know, is more difficult than it sounds.

Bessembinder found that the average drawdown of the best-performing global companies since 1990 was 32.5% and that it lasted an average of 10 months. Shareholders of some extraordinary stocks had to endure even larger drawdowns for longer periods of time.

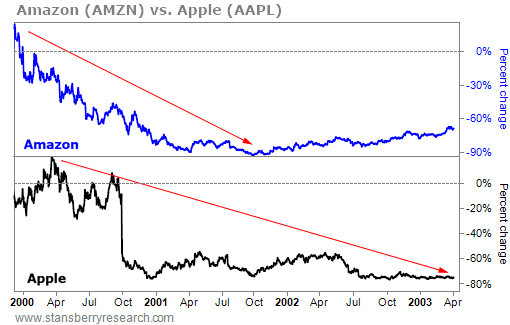

Bessembinder used Apple (AAPL) and Amazon (AMZN), two of the best-performing global stocks, to illustrate this point.

Amazon fell 94% from its dot-com peak in December 1999 to its dot-com trough in September 2001. Apple fell 82% from its March 2000 peak to its April 2003 trough. Take a look...

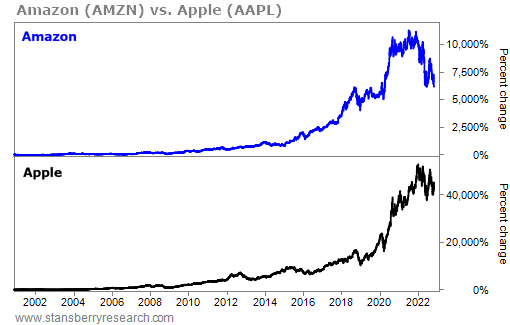

You could have bought either Apple or Amazon at any time and at any price along the way and you'd be holding a huge return today...

Buying Apple at its dot-com era high and holding until today would have made you more than 110 times your money... Buying Amazon at its dot-com high would have made you nearly 20 times your money.

But buying either at its respective low could have made you several hundred times your money, even after the recent fall in these stocks...

Bessembinder wanted to know how to find stocks with best-performer potential. So, he searched for and determined a few key characteristics that can help investors find those stocks.

Investment firm Baillie Gifford summed them up like this...

Investing in research and development while still achieving superior growth in returns, scale and profitability is a key characteristic of winning companies. Firms succeed or fail for myriad reasons, but this appears to be must-have.

Armed with Bessembinder's insights, we can identify future best-performing long-term investment opportunities...

When you get a crown jewel at a discount that ticks all these boxes, you hang on for the long term.

Good investing,

Dan Ferris

Editor's note: According to Dan, making money right now could be much easier than you might think. Last week, Dan detailed a huge market event that most folks aren't aware of. The last time he saw this setup, investors could have made 1,000 times their money. Click here to get the full story.