Doc's note: Consumers are still feeling the strain on their wallets. Prices on everything from groceries to cars to homes are still much higher than we saw before the COVID-19 pandemic.

Today I'm sharing an essay (originally published in August) from my friend Joel Litman, founder and chief investment strategist at our corporate affiliate Altimetry. Joel explains another major pain consumers are facing and how it could hurt a major industry...

It might be time to revisit your budget...

For most of the pandemic, the U.S. government found ways to keep money in consumers' pockets.

If you kept up with the headlines back then, you can probably recite the list by heart. Stimulus packages kept spending strong, companies happy, employment high, and interest rates low.

It was the opposite of what would happen in a recession. And while it propped up the economy for years, we're now seeing a key sign that the "easy money" era is over...

On October 1, student-loan payments resumed for almost 27 million borrowers. The average borrower owes about $400 per month. So many consumers will have to make some tough budgeting choices.

These folks haven't had to worry about student loans for the past three years, which means this will be a big adjustment. Analysts believe more households could fall behind on credit-card and other loan payments as a result.

The macroeconomic environment is getting worse across the board. Today, we'll dive into why this change is adding stress to the already troubled U.S. consumer... and why the effects could be far-reaching.

Consumer balance sheets were looking great...

And the same was true for corporate credit.

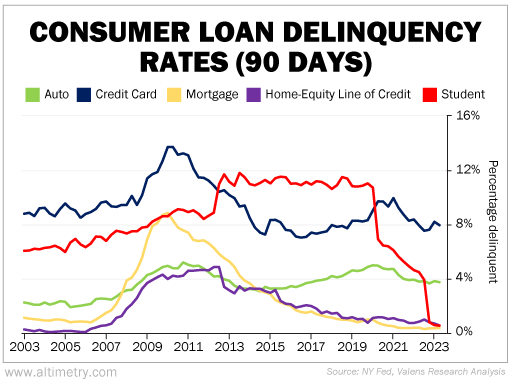

Starting in March 2020, when the government paused student-loan payments, delinquency rates started falling for almost every form of consumer credit. Many rates trended toward record lows.

For instance, credit-card delinquency rates fell from nearly 10% in mid-2020 to as low as 7.5% in September 2022. Auto-loan delinquencies fell from more than 5% to less than 4%.

Student-loan delinquency rates fell the most. They had been above 11% for most of the 2010s. By late 2022, they had dropped below 2%. Take a look...

Unfortunately, that trend couldn't last forever. Times are getting tougher for borrowers, including those with student loans.

Again, before the pandemic, more than 11% of student-loan borrowers were already more than 90 days late on their payments. Economists at Bank of America expect that pattern to pick right back up when the pause ends.

That will almost immediately add $167 billion in delinquent balances back to the U.S. economy.

The kicker is, rising delinquency rates will put pressure on everything else...

When student-loan payments were paused, it drove delinquency rates down. So it makes sense that as those payments pick up, so will delinquency rates.

This is going to put pressure on the entire economy. It will send other types of loan delinquencies higher... And it will hurt retail businesses. As folks spend more on debt repayments, they'll have less money for discretionary spending.

Keep an eye on all kinds of consumer delinquency rates in the coming months. As they start rising, credit issues will worsen. We may even see the retail landscape deteriorate.

These are all signs that we're not out of the woods yet.

Regards,

Joel Litman

Editor's note: For the past couple of weeks, Joel has warned that a big event is coming to the stock market next month that could send stocks crashing... But it could also be a major boon for an investment you might be ignoring. Click here to learn what to do with your portfolio before that happens.