Everyone's talking about volatility.

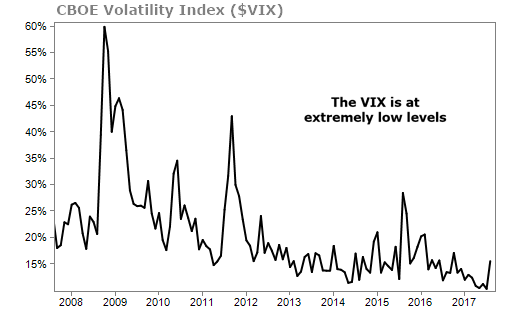

Implied volatility, as measured by the CBOE Volatility Index ("VIX"), is at historic and persistent lows...

Today, the financial press is filled with opinions about what this means for investor sentiment, or where the market is headed next. But I know from my experience with options and statistics that most folks talk gibberish about the meaning of this curve.

No one knows where volatility is headed. Trying to predict volatility is like predicting when the bull market will end... You can't do it.

[optin_form id="73"]

Why do so many people care about volatility? Let me explain...

Longtime readers know the VIX is often called the "fear index." That's because the VIX is calculated by looking at how much people are paying for the S&P 500 options expiring in the next two months. It's a little like deducing how often a city floods by looking at how much the people there pay for flood insurance.

A low VIX means people aren't expecting much action in the markets. They're not fearful, and they're not paying for protection.

A rising VIX signals that people are expecting more volatility in the market and may be getting fearful.

But it seems that today, the low VIX is starting to cause fear on its own. You may have seen some talking heads in the media warn of a coming disaster... According to them, after a period of the VIX sitting at a low level, something bad happens, and the VIX shoots higher.

That's not true.

The VIX can go low and stay low for a long time. Indeed, we're bullish overall for the market over the next year or so.

Now, if you're an option seller – like we are in my options newsletter Retirement Trader – this low volatility means you're making less money. Recall that higher volatility means richer option premiums.

While we prefer higher volatility to increase option premiums, it hasn't stopped us from making trades... and profits.

As option sellers, we can profit in a bull market. As stocks go up, our put options expire worthless and we keep maximum gains. The same goes for our covered-call trades... Our calls get exercised, and we sell our shares for maximum projected returns.

The beauty of our Retirement Trader strategy is that we also profit when stocks remain flat or even fall a bit.

Right now, we're enjoying one of the longest bull markets in history... And we see it extending for the next year or so. We'll continue to use that to our advantage and close out winning positions.

And any time conditions turn the other way... we'll capitalize on a spiking VIX to rake in higher premiums.

Last week in Retirement Trader, I told readers about a strategy that we can use to bend the market to our will and protect ourselves from a correction.

Simply put, here's what this trade does...

- It protects your holdings against a market decline,

- It allows you to profit from the upside of stocks, and

- It prevents you from paying a big tax bill on your profits.

It's not too good to be true. It's real. I call it the "Eifrig Hedge."

The bottom line is that you can dodge the next big decline in the market. You just can't hope to time market tops and bottoms perfectly. And you don't want to sit on the sidelines and miss out on big gains, either. By using the Eifrig Hedge, you can get the best of both worlds.

If you want to learn more about the Eifrig Hedge, click here to get started with Retirement Trader.

What We're Reading...

- Did you miss it? My bear market option strategy.

- Something different: Big Ben is going quiet.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Retirement Millionaire Daily Research Team

August 16, 2017