The tide appears to be turning for this asset...

For the past couple of years, it has been hated. No one has wanted to own it.

It was once touted as protection against inflation. But while inflation raged in 2022, this asset was flat for the year. Die-hard fans had given up hope, especially as bond yields began to soar and 5% interest rates were guaranteed.

But I'm writing to you today to urge you to own some of it.

Folks are finally buying again.

Regular readers know that I'm far from a gold bug. I see its value, sure...

Gold is a physical asset and has been a store of value for thousands of years. Gold coins were minted for commerce beginning around 550 B.C.

No matter what happens to the economy, even if banks collapse and our economic structure goes down in flames, gold will always have value. Investors like the safety of gold. And that's why I call it a "chaos hedge."

But gold has its drawbacks... It's not a productive asset. It doesn't pay any yield. Your money just sits there, and that turns many folks away from it.

That's especially true when interest rates are at decade highs. So you can see why investors have soured on the precious metal lately.

In the Health & Wealth Bulletin, we've been covering gold and how investors have not been buying it for the past few years.

But things in the economy are starting to get murky. Everyone wants to predict a recession over the next year or so as debt levels have been rising.

With no clear picture of where the economy will head, investors have finally turned to the safety of gold.

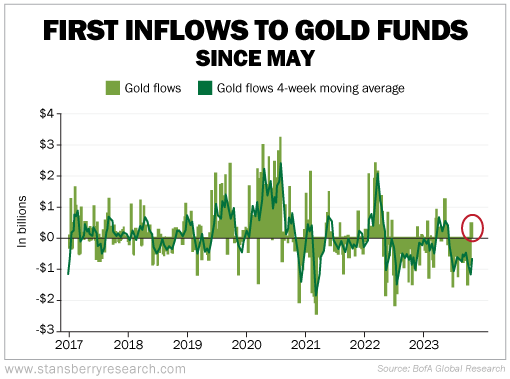

Gold funds saw an inflow of money over the past month, for the first time since May. Take a look at the chart below from Bank of America Global Research...

If we do see bond yields come down in the months to come, then we could see a rush back into gold. The opportunity cost of holding gold, which doesn't pay a yield, wouldn't be so high. And folks would favor the protection that gold provides over other sources of income.

I'm of the strong opinion that every investor should own some gold in their portfolio... especially today.

You could own physical gold or gold funds... It doesn't matter, really.

Buying physical gold isn't as simple as buying gold stocks. You have to find a reputable dealer and figure out where to store it.

The quickest and easiest way to get direct exposure to the price of gold is through SPDR Gold Shares (GLD). Owning this exchange-traded fund is less risky than buying shares of a gold miner, which will be more volatile than the price of gold, but it still only takes a few clicks in your brokerage account.

My advice to any conservative investor is to have around 10% to 12% of your portfolio in gold and other chaos hedges.

If things do get ugly in the economy over the next 12 months, you'll be happy to own these assets.

I'm not the only one seeing warning signs...

The man who predicted the exact week of the 2020 crash, called the 2022 crash a day before it began, and nailed the recent market bottom is now stepping forward with his newest prediction.

If you have any money in the markets, you don't want to miss what he has to say.

What We're Reading...

- Something different: The Federal Reserve's Austan Goolsbee says the "golden path" of a huge drop in inflation without a recession is still possible.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

November 8, 2023