Toward the end of 2020, I went on record with a group of stocks I absolutely loved...

Unfortunately, my timing was off.

For those who haven't been with me for long, my background is on Wall Street. I was a derivatives trader at Goldman Sachs and at various other firms before giving it all up and deciding to become an eye surgeon.

I launched my Retirement Millionaire newsletter with the idea that folks wanted to hear not only from a guy with an MBA and experience on Wall Street... but also from an M.D.

Given my background, I often cross the two worlds by investing in some of the best health care companies. In fact, some of my biggest winners in the investing world have come from the health care space.

(One of my biggest scores happened when I owned shares of the private gene-therapy company, Mirus, from its founding in 1997... and held them until pharmaceutical giant Roche (RHHBY) paid $125 million in cash to buy us out in 2008.)

At the end of 2020, I was even more bullish about health care than ever before...

In short, technological advances have been making medical science more efficient, and this will have a compounding effect on new discoveries. The biggest scientific breakthroughs are happening in areas like personalized medicine, genomics, and gene therapy. Symmetry and overlap in these scientific disciplines will let them feed on each other and lead to amazing new medical treatments.

I believe the industry will produce incredible winners in the years to come.

Lately, though, we've been slogging through a brutal bear market.

Let's rewind a bit... When the pandemic struck in 2020, governments around the world threw billions of dollars into the development and manufacturing of COVID-19 vaccines and treatments. Specifically, the U.S. government backed pharmaceutical companies with roughly $32 billion.

Since then, though, folks have paid less attention to COVID-19. People are more protected and not as scared. The U.S. Centers for Disease Control and Prevention no longer even recommends isolating for five full days, only for as long as symptoms persist.

With less emphasis on COVID-19, the money stopped flowing in.

Plus, higher interest rates pushed investors away from risky startups and saddled firms with hefty borrowing costs. Decision-makers at major firms had to become conservative with their cash.

But the "COVID hangover" has ended. We're getting back to historical norms as the industry recalibrates.

Spending on research and development (R&D) is projected to rise once again. Take a look...

In 2022, global R&D spending in the pharmaceutical sector reached $244 billion, compared with $185 billion four years prior. And it's only going higher in future years...

This means we're going to see more companies spending on new equipment and materials to develop the next medical breakthrough.

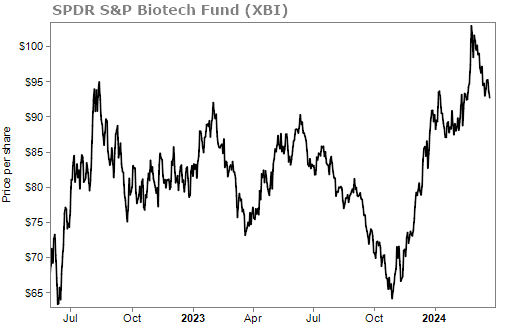

Investors are also starting to show some excitement toward biotech stocks. The biotech sector, as measured by the SPDR S&P Biotech Fund (XBI), has surged off its lows in recent months...

I believe we're on the verge of some very exciting things in health care and more specifically, biotech. Again, I think there will be incredible winners in the years to come.

And I'm not the only one who is betting on health care and biotech...

My good friends Joel Litman and Porter Stansberry have also been pounding the table. You see, Joel and Porter went on camera yesterday and spoke about the amazing opportunity in this sector today...

I don't want to spoil all the details from their presentation, but there is an anomaly in the biotech market today, caused by the bear market and unique circumstances I talked about earlier.

This is a presentation you don't want to miss. Click here to learn more.

What We're Reading...

- Something different: Baltimore Key Bridge collapse live updates: Two rescued, several others believed to still be in water.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

March 27, 2024