With the S&P 500 Index recently hitting all-time highs, you're likely one of two investors...

You see the run-up in stocks and get nervous. You think to yourself that nothing goes up forever... and you see the risks in the economy and market. So you decide to flee to safer assets like government bonds and cash.

Or you're the investor who sees new highs and decides to buy stocks...

You want to add fuel to the fire. All your friends are talking about stocks, so you don't want to be left behind if there is another major move higher.

In my early days in the market, I (Jeff Havenstein) struggled with which investor to be. I'll never fault anyone for taking some profits at a market high (though, to be clear, you should never sell all your stocks, as Doc Eifrig has often written about).

But today, I'm here to tell you that you should be the second type of investor. The numbers back it up...

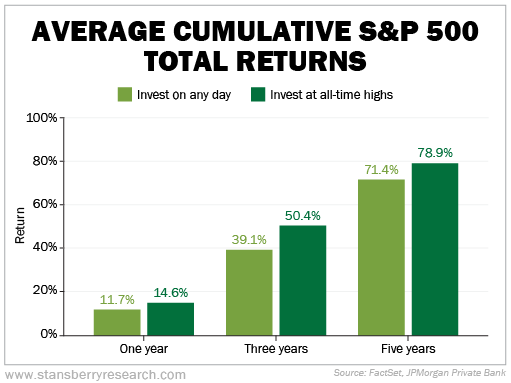

The chart below looks at returns for the S&P 500 from January 1988 to August 2020. Since 1988, if you bought the S&P 500 on any given day, you would have seen an average one-year return of 11.7%.

That's fantastic. There's no doubt that stocks are the best game in town.

But if you bought when the market hit an all-time high, you would have done even better... Specifically, your average one-year return would be 14.6%. On average, buying at all-time highs also outperforms over a three- and five-year holding period.

One of the most valuable things I have learned watching markets is: The most likely thing to follow a new high is another new high.

Folks see stocks hitting records on the news. If they're not already fully invested, their amygdalae start firing... and that motivates them to follow the herd. They buy stocks to catch up and this pushes markets even higher.

Of course, it's true that nothing goes up in a straight line forever. The key to being a savvy investor is to spot when things get a bit too frothy in the market.

I don't believe we're there yet.

Consumer sentiment has bounced higher from its 2022 lows. But it's still below historical averages.

I'm just not seeing people getting too excited about stocks. No one seems to be "all in" just yet. And that's why I think stocks can still run higher from here.

It's easy to be the first type of investor I mentioned earlier, the doom-and-gloom guy. But it's lucrative to be the second investor, buying stocks after a fresh all-time high.

My advice today is to have your money in the stock market... Then just wait for the next, new all-time high. It should be coming shortly.

What We're Reading...

- Something different: People want 'dumbphones.' Will companies make them?

Here's to our health, wealth, and a great retirement,

Jeff Havenstein

May 22, 2024