According to legendary investor Warren Buffett, "Interest rates are to asset prices like gravity is to the apple. They power everything in the economic universe."

That's no exaggeration.

The value of your stocks, bonds, home, insurance policies, income stream, and more... all depend on the prevailing interest rate of the day.

That's why developing an intuition for how interest rates work is essential to understanding what will happen to your investments...

When it comes to interest rates causing asset prices to move, what you're really assessing is how interest rates change the way buyers and sellers think about that asset.

This happens in two ways: the time value of money and relative yields.

We'll start with the former concept. The time value of money simply means that money today is worth more than in the future.

For example, if I offered you $100 today or $100 a year from now, you'd probably prefer the $100 today. That's just human nature. Why wait for the same amount of money?

But if I kept offering you more in the future, I'd eventually hit a price point where you'd prefer the money a year from now. Perhaps you'd like $100 today, but if I offered you $105 in a year, you'd happily wait to earn that extra cash.

And you know what a good rate is to determine the changing value of money over time? The current interest rate.

If you can earn 5% by parking that $100 in a bank account, I'd better offer you at least $105 in the future to compensate you for the interest you "lost" by waiting for the money.

Let's reset our example. Say you "own" a promise to collect $100 a year from now. If you wanted to sell that promise like an asset, you'd have to discount it since it occurs in the future. Perhaps with interest rates around 5%, you could sell it for $95. (If you earn 5% on $95, you end up with $99.75... essentially $100.)

But if interest rates rose to 10%, the price of your asset would fall in value to about $91. That's because if we put the money to work at 10%, that $91 would be worth around $100 in one year.

So rising interest rates drive the present-day value of future money down, while falling interest rates drive the present-day value of future money up.

And since every financial asset is a claim on future money, interest rates affect the price of every asset.

The second way to think about the prevailing interest rate is by considering your current investment choices.

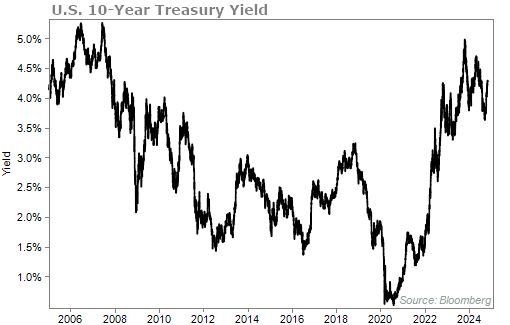

Oftentimes, the 10-year U.S. Treasury rate can be thought of as the interest rate.

It's backed by the U.S. government and is considered the "risk free" rate. Today, you can park your money there and collect 4.4% – not too bad.

If instead you wanted to invest in a corporate bond, you'd be taking on more risk. For that reason, corporate bonds must pay more than whatever the 10-year Treasury rate is.

In 2020, when the Treasury rate paid 0.5%, an AAA-rated corporate bond (the highest-rated bond possible) paid about 2%. But with the Treasury yield at 4.3%, AAA-rated corporates now pay about 5%.

(And remember, since prices and yields move inversely, for the same bond to pay a higher yield, that means its price fell in the meantime.)

The same relationship holds, though less directly, for equity investments. Greater upside potential and downside risk complicate things, but the principle is still in place.

Imagine you're looking at a real estate investment trust ("REIT") that pays, say, 3%. It looks a lot more valuable when interest rates are at 0.5% than when they are at 4%. Why would you take a lower yield with more risk when you could earn more in a completely safe Treasury bond?

So higher interest rates drive up the yield (and, in turn, drive down the share prices) of income-paying stocks. Folks aren't willing to pay as much for these equity investments when they can do so well with risk-free Treasury securities.

For about a decade, no one cared about this lesson...

After the 2008 financial crisis, the Federal Reserve drove interest rates down to zero to help bolster the economy. It started raising rates again in 2015... but not enough to make much of a difference.

Then, the pandemic-driven recession of 2020 sent rates down again. And the subsequent inflation led the Fed to hike rates rapidly, starting in 2022. You can see how the 10-year Treasury yield soared...

Today, interest rates do matter. They once again power everything in the economic universe. And it's all anyone can talk about – well, aside from yesterday's election.

It's very likely that we'll see more interest-rate cuts in the near future as the warning signs in the economy continue to pile up.

And as rates fall, many investors will look to get out of safe U.S. Treasurys and back into higher-yielding equities. This is where my friend Marc Chaikin comes in.

Marc spent 40 years on Wall Street before founding our corporate affiliate Chaikin Analytics to help individual investors. Now, you can gain access to his proprietary indicator that tracks which sectors and specific stocks the "smart money" is flowing into... or fleeing.

This tool gives you an inside look at what the best and brightest investors are doing in the financial markets. With it, you could find tomorrow's big winners while also avoiding the biggest losers. To learn more about Marc's powerful new way of handling your money – and also get two free stock recommendations – click here to learn more.

What We're Reading...

- Fed seen on track to cut rates this week and in December.

- When will interest rates go down?

- Something different: DNA-testing site 23andMe fights for survival.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

November 6, 2024