Doc's note: Stocks have been on another tear this month... The major indexes in the U.S. soared to new all-time highs last week. But despite the good news, some investors are still wondering when the euphoria will end.

In today's issue, from Brett Eversole, editor of True Wealth Systems, he explains why he's not ready to call an end to the bull market. And if you don't have your money in the markets, you could miss out on fantastic returns...

I can't buy now... the economy.

I can't buy now... the election.

I can't buy now... valuations.

Ask any investor for their biggest hang-up, and you might get one of these answers. Worries like these are keeping a lot of folks awake at night – and out of the market.

In reality, though, we're two years into a powerful bull market. Stocks are up 60% since the October 2022 bottom.

All the fear looks a lot less rational when you realize how profitable stocks have been. But one of the most consistent investment truisms is this...

Investors love to hate a bull market.

It feels prudent – even wise – to expect the worst. So poking holes in the rally becomes a habit... even though history tells us that higher prices usually lead to higher prices.

This year has been incredible so far. According to history, that nearly guarantees we'll see strong returns to finish the year. And that means we want to stay long right now...

We are in a bull market. No matter how many fears you might have, there's no getting around that fact.

Stocks have been on a tear in 2024. And this bull market has made the past two years some of the best in recent memory. Take a look...

This boom intensified this year. Stocks jumped 20% in the first 10 months of 2024.

Since 1950, that's the 10th-best return in the first 10 months of the year. And importantly, this strong start makes more gains all but certain.

To see it, I looked at the S&P 500 Index's returns over the past 75 years. Here's what has happened historically after stocks jumped 20%-plus in the first 10 months...

Strength begets strength. When stocks are moving higher, they tend to keep moving higher. And a great first 10 months means we can expect more gains ahead...

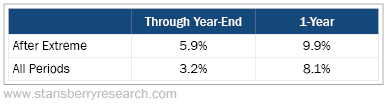

Stocks historically finished those years with a 5.9% gain in the final two months. That's nearly double the typical return in November and December. And the market was higher by year-end 100% of the time.

What's more, these setups tend to last. Stocks were up 9.9% a year later... a solid improvement over the typical one-year gain of 8.1%.

Plenty of investors are scouring the headlines looking for reasons to sell. That's no surprise, given the incredible rally we've seen over the past two years. But history shows that selling – or even finding a reason not to buy – is a big mistake right now.

Instead, stick with the bull market that's underway... and be prepared for a strong rally to end an already fantastic year.

Good investing,

Brett Eversole

Editor's note: Brett believes we're headed for a "secret bull market." This rare market phase, which typically emerges when more than 90% of stocks have peaked, offers significant potential gains even as more popular stocks decline. Historical data suggests that this sector surge can last for decades, making the current moment a crucial time for investors to buy in... And the "smart money" on Wall Street has already begun to pivot over.