My biggest character flaw is a lack of confidence.

It's haunted me throughout my life, but it really came to the forefront recently while talking to my co-editor, Laura Bente. We're similar in age, job security, and lifestyle, yet we have wildly different views on investing risk. I lean moderately conservative while Laura is more aggressive. And her returns are much better for it.

Here's the thing... adding an appropriate amount of risk to your investments greatly improves your portfolio performance. Risk in the market is measured by something called volatility... The more volatile the investment, the more the price swings up and down.

That's why stocks are much riskier than bonds or money market accounts. Their prices are more likely to bounce up and down. But it also means you stand to make a lot more. In many studies, stocks consistently outperform all other investing vehicles over time.

If you're new to investing, you may lack the confidence to take investment risks, too. Maybe it's even kept you from investing at all. But you have to overcome your fears. That's part of why we launched The Sunday Refresh – to help you build the confidence you need to make the best financial and retirement decisions. And investing is the best way to prepare for your retirement.

So today, we want you to assess your own risk tolerance. We've got a guide below to get you started...

What's Your Risk Tolerance?

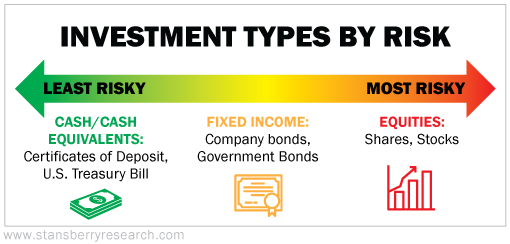

Before we start, let's review the common investment vehicles and where they fall on the risk spectrum:

As you can see, the least risky investments are cash and cash equivalents, like certificates of deposit. These are usually very stable investments, but have low yields.

The riskiest, of course, are stocks. Stocks are the most volatile, but also produce the biggest gains.

So when considering how much to invest in each class, start with a few simple questions. Write down your answers and keep them for reference whenever you make future investing decisions. In fact, it's a good idea to review your plan and risk level each year. Consider the following:

1) How close are you to retirement?

A popular theory is the "100 minus age" rule. Take your age, subtract it from 100, and that's the percentage you should invest in stocks. That means a 35-year-old women should have about 65% of her portfolio in stocks.

The idea is that the younger you are, the more time you have to recover from losses. So you want to take on more risk earlier. However, this is still a general guideline. Everyone needs to determine how comfortable they are with that kind of risk – that's why we have two other questions...

2) What is your primary investing goal?

Are you looking to preserve your wealth, generate income, or grow your investments? These choices represent different levels of risk as well. For example, if you want to generate income, buying dividend-paying stocks will yield more than a typical savings bond, so you'll want to account for that increase in risk.

One solution: Consider multiple accounts. We know a few folks not only have a conservative, "retirement only" account, but also a trading account where they take on more risk. This is a great way to potentially earn big gains without doing damage to your retirement nest egg.

3) How much you are you willing to lose in a one-year period?

Before investing in anything, figure out how much you are comfortable losing and write it down. If you don't want to risk much, opt for less risky investments. Also, be disciplined about selling an investment if it falls by that amount. A great way to do this is with stop losses – a topic we'll cover in a future issue.

Increasing financial literacy can help overcome anxiety about investing. That's why we encourage you to read and share The Sunday Refresh. We want to make sure you have the tools you need to grow and strengthen your financial plans. So help us help you: If there's a topic you'd like us to cover, drop us a note to our address here [email protected].

Here's to a fresh start,

Amanda Cuocci & Laura Bente

January 14, 2018