If you're worried, take a deep breath...

It has admittedly been a rough couple of weeks for the market.

The S&P 500 Index is down 9% from its all-time high. The tech-heavy Nasdaq Composite Index is down almost 14%, meaning it's officially in correction territory. And popular stocks like Tesla (TSLA) and Nvidia (NVDA) have taken it on the chin lately... fueling further investor panic about Big Tech.

I (Jeff Havenstein) am here to tell you that everything is OK.

Doc Eifrig and I have previously written that the markets were due for a breather. And that's exactly what we've been seeing lately.

But a breather doesn't mean we're in for a brutal bear market.

Rather, I think this is just a healthy market correction, and the bull market we've been enjoying for the past few years still has some life left.

The reason? Everyone is too bearish right now. That means sentiment will likely flip soon.

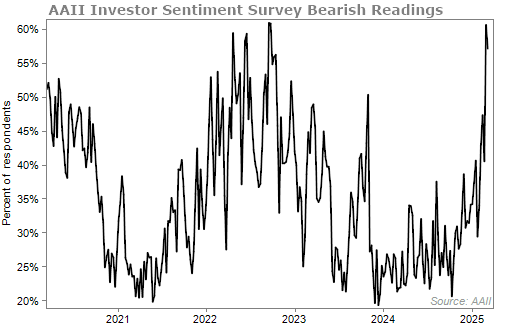

To gauge sentiment, I often check out the American Association of Individual Investors' ("AAII") Investor Sentiment Survey. Since 1987, AAII members have been answering the same simple question each week: "Do you feel the direction of the stock market over the next six months will be up (bullish), no change (neutral), or down (bearish)?"

Historically, 31% of investors answer that they are bearish. But lately, the survey is showing an extreme level of bearishness. Take a look...

The bearish percentage stands at 57% today, but it recently hit a high of 61%. We haven't seen this many investors this scared since late September 2022, when a full-fledged bear market was raging.

Take a guess when the bear market bottomed...

October 12, 2022.

That low came just a few weeks after we reached the same extreme level of bearishness that we're seeing today.

To figure out what the markets will do next, you just need to look at the extremes...

When everyone is giddy and thinks that their favorite crypto is going "to the moon," it's probably time to sell and take profits. By that point, there are few buyers left to keep prices high.

But when everyone is scared and thinks the market is heading for another 2008-like collapse, it's time to buy.

Today we're seeing the latter. Bearishness has reached extreme levels thanks to overvaluations in the tech sector and tariffs imposed by President Donald Trump. But businesses are still enjoying profits, and it doesn't seem like a recession is here just yet.

Sure, markets may continue to fall over the next few days. But I believe this is nothing more than a healthy market correction... something we needed.

Plus, a lot of Big Tech speculators are running for the exits, which is a good thing for a long and healthy bull market.

As Doc always says, corrections are just a normal part of the market cycle. They're nothing to fear... especially if you've been following our advice to stay diversified and not have too much money in overhyped, overvalued tech names.

So don't panic sell.

This bull market isn't over yet.

In the meantime, you can use all the volatility to your advantage. That's because Greg Diamond, editor of Ten Stock Trader, has developed a strategy that thrives in especially volatile markets.

It doesn't matter whether stocks are soaring or falling... You can profit from large swings in either direction with Greg's trading strategy. In fact, the last time Trump was president, Greg used it to help his subscribers book 17 triple-digit winners.

Click here to get all the details.

What We're Reading...

- Something different: Waymo expands its robotaxi service again, this time to parts of Silicon Valley.

Here's to our health, wealth, and a great retirement,

Jeff Havenstein

March 12, 2025