Forget the twists and turns of tariff policy... Forget what pundits are saying on the news...

Instead, focus on one thing.

This thing will help you gauge the health of the economy and influence how you should think about the markets longer term.

The good news is that it's not hard to find or complicated to understand. You can get a sense of it by talking to your family and friends, by seeing how crowded restaurants are, or by watching how many Amazon packages hit your neighbors' doorsteps.

I'm talking about the behavior of consumers.

The logic is simple. It doesn't matter what part of the economy you're talking about, because every single part reflects trends in consumer spending. For example, the clothing industry thrives when consumers buy more blue jeans... Jet-engine demand rises when consumers buy more plane tickets... And oil consumption surges when consumers drive to their local Target or Walmart more often.

Consumer spending makes up around 70% of our economy. It determines the decisions of virtually every business out there and creates profits for the companies you own.

But today, we're getting a warning sign from consumers.

While consumer spending is at an all-time high of $20.4 trillion in February, consumer confidence has plunged in recent weeks. According to the Conference Board, it's at a 12-year low.

A big reason for the drop has been the Donald Trump's trade war with China and many other countries. But this doesn't tell the whole story... The problem started before "Liberation Day."

You see, although consumers are spending more, they are spending more by taking on debt.

Americans' total credit-card debt is now around $1.1 trillion. And thanks to higher interest rates and higher prices of everyday goods, folks are having a tough time keeping up with their credit-card payments.

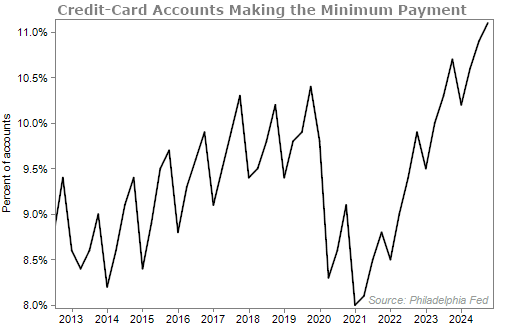

According to the Philadelphia Federal Reserve, 11.1% of active credit-card accounts only made the minimum payment in the fourth quarter of 2024. That's up from 10.9% in the third quarter. And it's the highest level in 12 years of data.

Take a look...

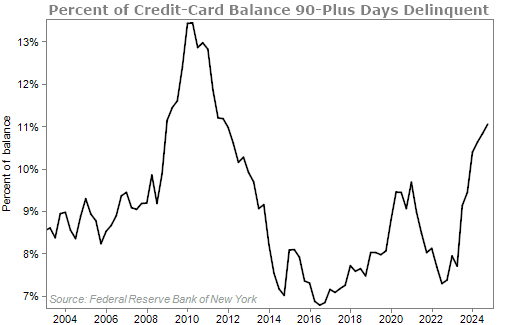

We're also seeing delinquency rates rise...

The balance of credit-card debt that is 90-plus days past due is at a decade high. In fact, the last time we saw a percentage this high was in early 2009, during the great financial crisis.

This is a worrisome trend.

Even if interest rates come down as expected, excessive borrowers will face a day of reckoning.

Now, this doesn't mean markets will plunge into 2008-like territory tomorrow. My senior analyst has made many compelling arguments in recent issues that markets will rise in the short term. And things like this – a debt bubble – can take a while to play out.

But if we continue to see more folks struggle to pay off their credit cards, we'll have to make adjustments to our investing strategy.

The one thing I want to stress today is to have cash as a significant allocation of your portfolio. In my conservative Retirement Millionaire newsletter, my standard advice is to keep around 20% to 25% of your portfolio in cash.

And by cash, I mean all the money you have in savings accounts, checking accounts, certificates of deposit, short-term U.S. Treasury bills (which offer a decent yield, by the way), and any other investment with one year to maturity or less.

Cash can be your dry powder during the next stock crash...

While almost everyone else would be panic selling everything, you'd have the ammunition to step in and buy great businesses on the cheap.

It's easy to overlook cash's usefulness when the economy is chugging along. But please take the time to reexamine your own situation and make sure you have a good portion of your portfolio dedicated to cash so you can take advantage of the next downturn.

According to my colleague Dan Ferris, that chance might be coming soon…

Dan says that strange events are unfolding in the global financial system. A monetary reset dubbed the "Mar-a-Lago Accord" is quietly in motion, and the financial elite are already taking protective action.

If history is any guide, average investors could lose massive amounts of their wealth over the next two years.

Click here to learn all about it.

What We're Reading...

- More Americans are making only minimum payments on credit cards.

- Something different: A 5.2-magnitude earthquake strikes Julian, California, in San Diego County.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

April 16, 2025