There's a lot of noise in the market right now...

On one extreme, you hear the bears advocating for the collapse of the market... Debt is too high and valuations are overstretched. On the other, the bulls think the long run-up in stocks is not over yet and we still haven't seen the final explosive phase – the "Melt Up," as my colleague Steve Sjuggerud calls it.

Both sides make strong arguments because there are underlying data that support both. And the doctor in me needs to see data.

Luckily, we're right in the middle of earnings season for public companies... so data are coming out every day. We can see how businesses are performing and the health of the stock market.

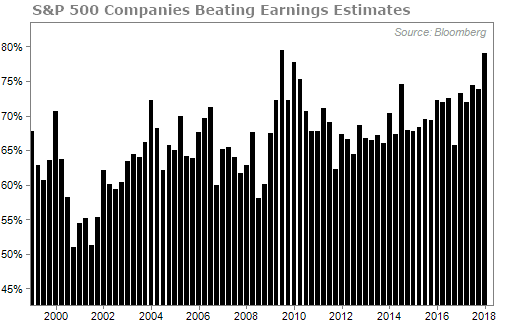

Right now, the bulls should feel good about the last week. More than half of companies have already reported earnings and the results are better than expected. The graph below shows the percentage of S&P 500 Index companies that have posted higher earnings than their estimates...

If the remaining companies that have not reported yet continue to beat expectations like the others, this will be a historic quarter. (Note that the current quarter bar is as of last Friday, April 27.)

Now, it's easy to see this and become optimistic. After all, earnings reports should move the stock up or down. If the financial results show that a business is doing great, then investors should want to buy.

Case in point: Fast-food king McDonald's (MCD).

MCD reported earnings on Monday morning and the company had a blowout quarter. It reported better-than-expected first-quarter earnings, better-than-expected revenue (more than $5 billion), and strong same-store sales growth in the U.S. of 2.9%. Even more impressive, global same-store sales rose by a whopping 5.5%.

As a result, the stock was up nearly 6% for the day. That makes sense.

However, just a few days earlier, construction-equipment maker Caterpillar (CAT) beat earnings expectations by 33%... which is no small feat. But management commented that earnings growth may be "as good as it gets." The market reacted as if this was a bearish warning.

Shares fell 6%.

It's been a weird earnings season so far. We're seeing a lot of profits and healthy cash flows, but investors aren't reacting as positively as we've seen in the past. In fact, since the start of last week, the market is only up less than 1%.

Maybe expectations from investors are too high, or they're scared of a 2008 repeat.

And I must admit, I've become concerned about the market lately.

So, let's go over a concept that will help you in any market condition – even in an abnormal one like we're seeing lately. It's a strategy for how to choose what stocks to invest in, which is one of the biggest challenges for most individual investors...

Find a Company You Want to Own

Legendary investor Warren Buffett said it best... "Buy into a company because you want to own it, not because you want the stock to go up."

I think a lot of investors make a mistake by choosing stocks they think will appreciate rather than stocks of businesses they want to own. Remember, stock ownership means business ownership.

You wouldn't buy a semiconductor stock if you didn't know the difference between a transistor and a microprocessor, right? Well in my experience, many folks get that wrong.

I see it all the time... Folks buy certain stocks even though they don't have a clue what the company does or understand the industry dynamics in which the company competes. And that's where you can get into trouble.

Some of the best investments are stocks that you can easily understand and even check up on frequently every day. For example, on your way to work you notice that the drive-thru line at McDonald's is always jam-packed and there's barely any room to sit down inside.

You look across the street and see the parking for your local town restaurant is empty.

It doesn't take a master's degree to see that McDonald's is doing just fine. Using your everyday experiences to help you decide which businesses you want to own is powerful. I do it all the time when I travel the country.

So, the next time you go to buy a stock, think about what it is you're buying. Ask yourself:

- Is this company going to be around another 20 years?

- How many people in my life use its product or service?

- What advantage does it have over its competitors?

- Are there long lines at its stores every day?

Once you find the right company you want to own, that's where the work begins...

Knowing when to buy and knowing when to sell are the next steps you'll need to take. But often, they're the most difficult.

Next Thursday, May 10, we're hosting a special presentation with my colleague Dr. Steve Sjuggerud, TradeStops founder Dr. Richard Smith, and Stansberry Research founder Porter Stansberry. During this event, you'll discover a simple system for always knowing when to buy and sell stocks.

You'll also learn the one action you should take in 2018 to make more money from the stocks you already own... And to protect yourself from a sudden and gut-wrenching decline like we had in 2008.

[optin_form id="73"]

What We're Reading...

- Folks are eating a lot of Big Macs.

- Something different: Disney crushes box office numbers with Avengers: Infinity War.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

May 2, 2018