Doc's note: Today, I'm sharing a special guest essay from my friend Matt McCall – senior editor at our corporate affiliate InvestorPlace Media.

You may not have heard of Matt before, but I recently spent a week with him in China and I can tell you... this guy knows his stocks. Over the past 10 years, he has pinpointed no fewer than 16 1,000% winners.

And today, he's explaining why he believes it's time to go "all in" on stocks...

Every week, I sift through hundreds (if not thousands) of charts and data points as part of my investment analysis.

Like many people, I feel most of the information I come across is forgettable. While it might be interesting or notable, it's ultimately not important.

And then you have unforgettable data. You have REALLY important information.

That's the kind of information I have for you today. It's the No. 1 reason I'm "all in" on stocks. It's the No. 1 reason I believe we're in for a major market rally over the next 12 months.

In fact, these data caught my eye so strongly that I sent the information to my CEO, Brian Hunt, in the middle of the night.

The next day at lunch, Brian told me that he moved $368,000 into the stock market right after seeing the chart I sent. Naturally, I laughed and assumed he was joking. But he wasn't.

This is a guy who has lived and breathed the stock market for the last 20 years. This is not some amateur investor who's new to the game. Brian is also a deliberate guy who typically doesn't make major financial decisions at the drop of a hat. But after seeing what I have to show you, that's just what he did.

But then again, I shouldn't be surprised... because I've also been busy buying stocks since that chart popped up on my screen.

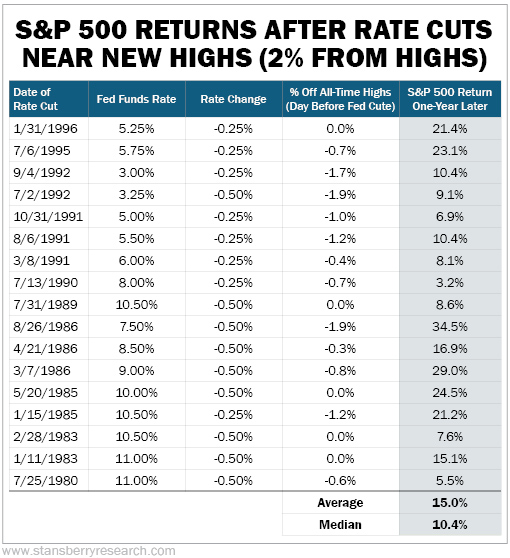

This "super bullish" information comes to us from financial adviser LPL Financial. It's a study that shows what happens after the Federal Reserve cuts interest rates when the stock market is near all-time highs. It has happened 17 times since 1980.

This, by the way, is the situation we're likely to be in soon. Low interest rates stimulate the economy and the stock market. Low interest rates make people happy. President Donald Trump wants people so happy that he wins the 2020 presidential election. Trump knows finance... and he knows low interest rates will boost the economy and stocks. I believe he'll get his rate cuts... and he'll give the economy a shot of adrenaline.

As I mentioned, the Fed has cut interest rates with stocks near all-time highs 17 times since 1980.

In all 17 instances, the S&P 500 was higher one year later.

Even more impressive, stocks gained an average of 15% in the years following the rate cuts.

Here's the breakdown of annual returns:

Much of the time, making an investment decision is difficult and complicated. This isn't one of them. It's very simple. Trump knows lower rates will boost the market. He knows a strong market will help him get re-elected. Trump wants to get re-elected. He'll get low interest rates.

If you are not yet sold after seeing the chart above, here is another...

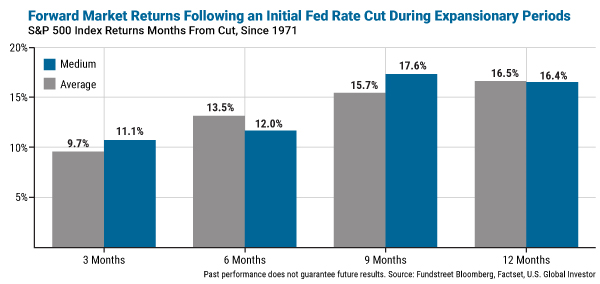

Research firm Fundstrat looked at instances when the Fed cut interest rates during an expansionary period for the U.S. economy, going back to 1971. Every single time, the market was higher three, six, nine, and 12 months later. And the returns were impressive...

One year later, the average gain was 16.5%.

A 16.5% return from today would push the S&P 500 above 3,500.

For context, the average 12-month return for the S&P over the last 50 years is about 8%. So in this particular situation of a rate cut near market highs, we see nearly twice the average returns.

Right now, the S&P 500 is sitting near an all-time high – and the rate cut is highly likely to happen soon. According to the Federal Reserve Bank of Atlanta, the probability of a 25 basis point ("bps") rate cut by mid-September is 95.6%. Both Citigroup and JPMorgan Chase are predicting a 25 bps rate cut in July – and Morgan Stanley and UBS are going even further. They expect a rate cut of 50 bps in July.

Now, while a one-year gain of 16.5% is impressive for the S&P 500, keep in mind that it's a broad index. Broad indexes by nature contain lots of average and weak companies. I believe high-quality growth stocks in the midst of emerging mega-trends will do much better than the broad market.

These emerging mega-trends include the 5G infrastructure buildout, self-driving vehicles, advanced batteries, the Internet of Things, gene therapy, and cannabis.

These hypergrowth mega-trends are set to create stock market winners that gain many times more than the broad market.

But mark my words: Stocks are in a bull market. Low interest rates will act as an accelerant for that bull market.

If you're not yet long stocks, get long soon. If you're already long stocks, get longer.

Regards,

Matt McCall

Editor's note: Matt specializes in finding early stage opportunities that could lead to 1,000% gains. And on Wednesday, July 31, he's planning to give away some of his favorite speculative opportunities, including one stock he believes could soar 10 times or more in the coming months.