Today, we're going to find out which type of investor you are...

We're going to show you two charts – one of Stock A and one of Stock B – and we want you to decide which one you would want to buy.

Here's our first chart, which shows the percentage gain of Stock A since January...

As you can see, Stock A is down quite a bit since January. The stock plunged at the beginning of August and is now down near lows right now.

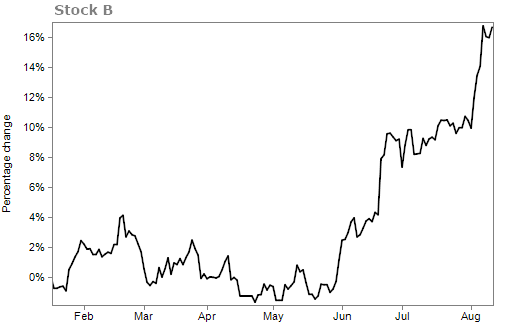

Now let's take a look at Stock B...

Stock B is the exact opposite of Stock A. Stock B has just broken out to new highs. It's in a sharp upward trend.

Without knowing anything about these stocks and just from looking at their charts... which one would you want to buy?

You can make the case for both stocks...

With Stock A down near lows from what looks like a harsh sell-off in a short amount of time, this could mean it's trading at a good value. A downturn that fast is likely an overreaction from investors. All the stock needs to do is recover some of its losses and you'll be sitting on a nice gain.

With Stock B up near highs, you can probably assume there are strong drivers behind this business. And with strong drivers, there's no reason why Stock B can't continue its run up.

Most folks would buy Stock A over Stock B.

It's because most folks love calling bottoms... and because they get scared of investing near a top.

It's easy to look at a chart like Stock A and automatically think that this stock is going to come right back up. You think you're buying on a dip. After all, it's 20% cheaper than it was a few days ago. Most people think it's now a great value. But this type of investing is extremely hard to do successfully...

Typically when you think you're buying on a dip or at a bottom, you don't exactly call the bottom. In fact, calling bottoms is near impossible. Most of the time, the stock can continue to drift lower and lower from where you bought.

Eventually it might bottom out and start recovering some of its losses, but it usually takes a while. And most investors don't have the stomach to hold throughout that whole process. So they sell for a cheaper price and take a loss.

Remember this... It's dangerous to try to catch a falling knife, as the saying goes. And cheap stocks can always get cheaper.

On the other hand, it's tough mentally to buy a stock that looks like Stock B. The first thing people think is, "Well, I missed that one... Guess I'll have to wait for a pullback before I buy".

People are scared to buy stocks that are at highs. They think they missed the good times. But this is typically the wrong thinking...

Buying stocks in an uptrend is much easier than buying stocks in a downtrend.

Trust me... I know from decades in the market.

And look, I'm not a technical trader and I don't base my investment decisions on what a chart looks like... but buying stocks with momentum has its advantages. When buyers are pouring money into a stock, this can send it soaring. Combine that with great fundamentals, and an uptrend can be in place for a long time.

In the charts above, Stock A is the chart of payment-processing company Square (SQ). Stock B is actually a chart of the price of gold.

Square's stock plummeted after forecasting lower-than-expected guidance during its recent earnings report. It's currently down near a two-year low. And before the drop, Square had a premium valuation, with investors pricing it to perfection. Now shares are a little cheaper.

I'll be the first to admit that Square is a great business. It makes it easier for companies and consumers to buy and sell stuff and has grown at an outstanding pace the past few years. But I would want to wait for an uptrend to emerge before placing my hard-earned money in the stock.

Don't ever think a stock can't fall more... because it can.

On the other hand, gold has been soaring. It's in a clear uptrend.

Since there's so much risk in the markets today, investors have fled to safety... And that means parking money in chaos hedges like gold and silver. With more Federal Reserve rate cuts possible in the near future and increasing fears surrounding the economy, there's no reason why gold can't continue its climb higher.

I hope you took my advice and bought gold. If you haven't, it's not too late... Don't think you missed the gains.

Many think gold is in the start of a multiyear bull market. That's why we're staging a massive online event... the 2019 Gold Rush with gold investing legend John Doody. Whether you're a total newbie or a billion-dollar fund manager on Wall Street, you'll get a chance to find out how you can make more money using gold than you've ever thought possible.

What We're Reading...

- Global markets are in panic mode – sparking a wave of investment into gold, bonds, and currencies.

- Square falls 7% after forecasting lower-than-expected guidance.

- Something different: What is momentum?

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

August 14, 2019