You've likely heard the phrase "do more with less"...

That's what we look for as investors – companies that don't have to spend a lot of money to make a lot of money.

Let's say there are two companies that sell homemade ice cream. Company A has a bit more start up cash than company B and spends $60,000 for state-of-the-art ice cream equipment and a store near the beach. Company B is only able to spend $6,000 for its equipment and an old beaten-up ice cream truck.

Both companies have been up and running for 12 months and have great reviews from customers. Over that 12-month time frame, company A was able to generate $3,600 in profits. And company B ended up with $600 in profits.

Clearly company A is more valuable than company B. It has better equipment, a store near the beach (as opposed to a truck), and generates more profits. So as an investor you'd want to buy company A... right?

Not exactly. Company B actually looks like the better investment. And it's because of something called return on assets (ROA).

ROA can tell us how efficient a company is. The formula for ROA is net income divided by total assets. The higher that number, the better a company's management team is at using its assets to generate income.

In our example, company B had fewer assets, but was able to generate a higher return on those assets...

|

Company |

Assets |

Profits |

Return on Assets |

|---|---|---|---|

|

Company A |

$60,000 |

$3,600 |

6% |

|

Company B |

$6,000 |

$600 |

10% |

This tells us that company B is able to do more with less. It's a more efficient operation. And that's what we like to see as investors... squeezing the most out of limited resources.

It's tempting to look at two similar businesses and want to own the one that has more revenue or more profits... But we want to know, as investors, if we put our money into a company that the management team will be able to turn that back into profits – which can be distributed to us as shareholders.

Typically I like to see a company that has a ROA of at least 10%.

My friend, Professor Joel Litman, president and CEO of Valens Research and Chief Investment Strategist of Altimetry, pays close attention to ROA when he looks for investment ideas. The higher the ROA, the better of course.

But, according to Joel, the important elements of as-reported corporate financial statements have become unreliable. Basically, the ROA numbers you'll find on widely available sources like Yahoo Finance can't be trusted.

Regular sources of data may say a company has a ROA of 3% (a sign to stay away), when in fact Joel's numbers say the company has a ROA of 25% (a sign to buy).

Here's an example from Joel...

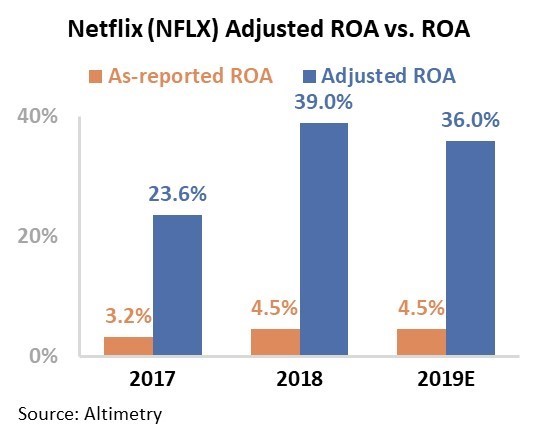

Nowadays, Netflix is as much of a movie studio and a content-production business as it is a subscription-software service. The accounting for a subscription business is already problematic. Add a movie studio on top of it... and Netflix's accounting is impossible to understand without the right tools.

Netflix looks abysmal through a traditional accounting lens, with a weak return on assets ("ROA") of 5%. At a glance, it looks like the firm should have stopped making movies and investing in its business yesterday. It seems like it's generating below-average returns!

But those numbers are wrong.

This is what Joel and his team do... They crunch the numbers and find the errors. If a company doesn't look attractive to other investors because of a low ROA, Joel and his team might find that its ROA is actually much higher than what's reported – making it a potential buying opportunity. That's because the rest of the market doesn't know just how profitable the company really is.

Here's more from Joel on Netflix...

As you know, we specialize in "Uniform Accounting" – a more reliable way of looking at companies than the GAAP and IFRS accounting policies that let issues like Hollywood accounting exist in the first place.

When we apply our Uniform Accounting metrics, the distortions from as-reported accounting statements are removed – including R&D capitalization versus expensing, stock option expense compensation, and acquisition distortions – and we can immediately see that Netflix has significantly stronger ROA than the market realizes, at 36%.

Mark your calendars for next Wednesday, September 25. In a special demonstration of his Lie Detector system, Joel will expose a massive discrepancy in the U.S. accounting system that allows us to see the TRUE earnings of 32,000 stocks.

Click here to reserve your spot.

What We're Reading...

- Return on equity versus return on assets.

- Never trust 'Hollywood Accounting.'

- Something different: Saudi Arabia promises concrete proof Iran behind oil strikes.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

September 20, 2019