Nothing is certain but death and taxes.

Benjamin Franklin was famously quoted saying this... And it's true.

We all die at some point. And we all have to pay taxes.

You can, of course, choose to not pay your taxes... but there are serious repercussions. Take actor Wesley Snipes. During the late 1990s, Snipes was at the height of his career. He just starred in the blockbuster superhero movie Blade and would go on to make about $38 million over the next five years.

But Snipes didn't want to pay taxes on all that money he was rolling in. From 1999 to 2001, Snipes used a tax-dodge operation called the Guiding Light of God Ministries to avoid paying $7 million in taxes.

I'm sure you can guess how this turned out... Snipes went to court and was convicted of three misdemeanor counts of failing to file tax returns. He was sentenced to three years in prison.

Not even famous actors can get away with not paying taxes. And I don't recommend you try to get away with not paying yours.

But that doesn't mean you shouldn't try to pay the least amount of taxes possible. Federal judge Learned Hand famously summarized this idea in a 1947 dissenting opinion:

Over and over again courts have said that there is nothing sinister in so arranging one's affairs as to keep taxes as low as possible. Everybody does so, rich or poor; and all do right, for nobody owes any public duty to pay more than the law demands: taxes are enforced exactions, not voluntary contributions. To demand more in the name of morals is mere cant.

The fact is that taxes are very complicated. There are simple ways to save money on taxes, but you still may not be saving every penny you could be. That's why most folks turn to a tax software company to assist them.

Companies like H&R Block (HRB), Intuit (INTU), and TaxAct from Blucora (BCOR) can make filing taxes very easy and efficient. Folks trust these companies.

But Stansberry Research's newest partner, Professor Joel Litman, president and CEO of Valens Research and Chief Investment Strategist of Altimetry, brings up a good question of whether or not you should trust these companies...

What if we told you they can't even get their own accounting right? Should you still trust them with your taxes?

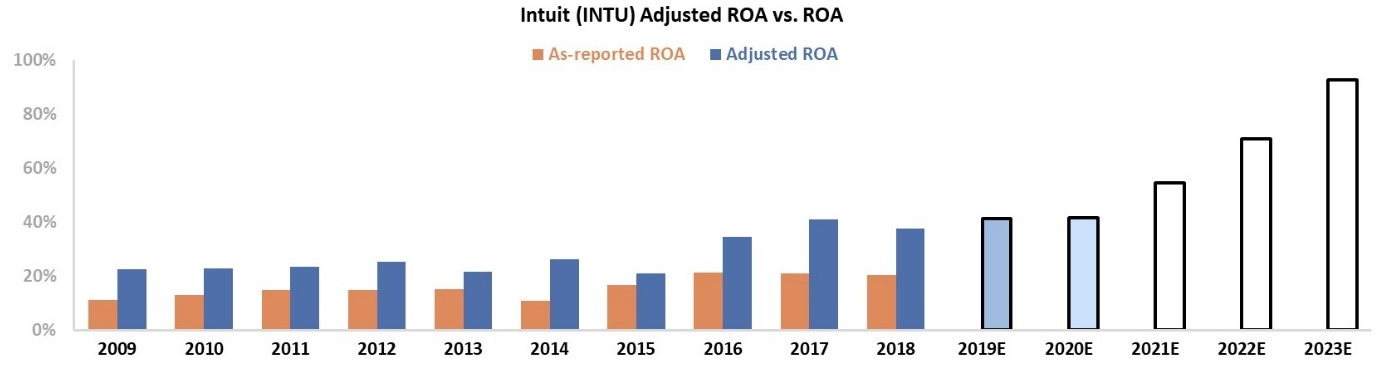

Take a look at the chart below that Joel created. It shows the return on assets ("ROA") – a measure of a company's profitability – of tax software company Intuit.

The orange bars are the traditional accounting metrics that the company reports. The blue bars are the adjusted figures that Joel and his team calculate.

You can see the difference. Intuit is about twice as profitable as the company reports. So even the so-called "tax experts" can't get their accounting right.

And Intuit isn't the only company that doesn't get its numbers right. There are plenty of companies out there that Joel discovered aren't reporting their numbers correctly. They may be selling themselves short by reporting that they are less profitable than they actually are.

These are the stocks Joel looks for. When the rest of the market thinks a company isn't that profitable and Joel discovers that it is actually highly profitable, he's got an edge over the market. He can buy before the rest of the market realizes what he already knows.

And if there's a company that reports fantastic profitability, but Joel discovers the real numbers don't reflect that, it's a sign to stay away.

It's hard to find this kind of edge while investing. That's why Joel Litman is hosting a big exposé tonight.

Beginning at 8 p.m. Eastern time, Joel will walk everyone – including Porter, who will take part in the event – through how to use his "Investment Truth Detector" system.

This remarkable system allows you to see immediately a company's true earnings numbers... and where it's likely going next. Best of all, you can try it out for free leading up to this online event.

Reserve your spot – and find out how to test-drive Joel's system – right here.

What We're Reading...

- Every single tax form in the U.S.

- U.S. household net worth $113.5 trillion in second-quarter 2019.

- Something different: House impeachment vote has suddenly become a real threat for Trump.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

September 25, 2019