If you had an "infinite money cheat code," would you use it?

You could deposit $2,000 and turn it into $20,000, $50,000, or even $1 million in moments...

And you could put that money in a single stock – maybe your favorite is beverage giant Coca-Cola (KO) – and watch it grow into thousands of dollars in profits for you with one small move...

The holidays are right around the corner. And I (Jeff Havenstein) am sure some extra cash will come in handy given everything that has happened this year.

The promise of a big pile of money would tempt a lot of folks to use this "cheat code." And while it might seem unrealistic, it did exist...

There's proof.

If you've never heard of the online message board Wall Street Bets, it's worth a visit...

The site, hosted on the popular news aggregator and discussion website Reddit, has become a home for investors who make risky bets and want to share information and opinions about them.

The message board is a collection of investment tips, bragging, quite a few memes, and of course... overconfident young traders.

Let me give you a quick example...

In 2018, a 24-year-old software engineer, Dennis Cao, boasted about a massive wager he'd made... He bet that a few big tech darlings would rise after they released quarterly earnings.

Unfortunately, the trade went against him. He lost about $185,000 in one day. And he posted a screenshot of his losses on Wall Street Bets shortly after.

But instead of getting blasted for his recklessness, other users sent positive notes, congratulating him for sharing the results of his loss. One reader said he behaved, "like a man."

"Mad respect," said another.

Early last year, a few Wall Street Bets members posted about the "infinite money cheat code"...

One user wrote that he was able to deposit $2,000 in his brokerage account and magically turned it into $50,000. He then proceeded to lose it all as he used it to buy Apple (AAPL) put options.

Other people used the same "cheat code" to greater extremes...

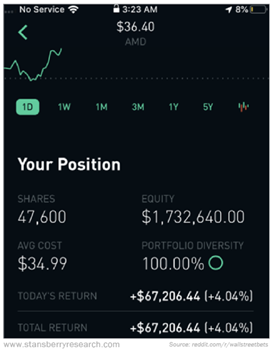

Two users turned their respective cash deposits of $4,000 and $15,000 into more than $1 million worth of stock. One trader used the method to end up over 500 times leveraged and long more than $1.7 million in chip-maker Advanced Micro Devices (AMD).

Here's the screenshot he posted to prove it...

Posts like these were hits on Wall Street Bets. They were cheered.

Now, you might not be the type of person to post about risky single-stock trades on an Internet message board... But wouldn't you like to know what this "cheat" investment was?

Here's how this "cheat code" existed in the first place...

In short, it was a glitch in the free stock-trading app Robinhood. Robinhood was launched to the public in 2015 and allows you to trade stocks on your smartphone or tablet.

Its target audience is millennials, a generation perfect for Wall Street Bets.

The "infinite money cheat code" existed for Robinhood Gold members. These are paid subscribers who are allowed to trade "on margin" if they have at least $2,000 deposited in their accounts.

As regular Health & Wealth Bulletin readers know, margin can be risky if used incorrectly. Margin is a type of debt. Using margin allows you to buy shares of a stock with less upfront cash than you would otherwise need.

When successful, it can magnify your percentage gains. But it can also exacerbate your losses. And like any debt, it costs you interest and you have to pay it off eventually.

But the trade in this case wasn't the issue. It was Robinhood's software. And a small group of astute users of the app noticed a loophole...

Traders used margin to borrow money and buy shares of a single company... Then they sold something called "covered-call options," which paid them cash immediately...

And once the cash from the options sale was added to their account, it tricked Robinhood into thinking they had more cash than they actually did. That led to more "buying power."

It was an "infinite money cheat code"... and they repeated it over and over again. We're talking tens – or even hundreds – of thousands of dollars more in buying power.

Now, this might sound complex if you're unfamiliar with options jargon. So I'll give a quick Options 101 lesson...

A "call option" is a contract that gives the buyer the right, but not the obligation, to buy shares of a stock at a specific price before a certain date. (If you memorize that sentence, you'll sound very smart talking options at your next Zoom cocktail party.)

But basically, options are like a side bet on a stock. (You might get along with more casual people at the cocktail party if you describe options this way.)

A "covered call" means you're selling someone else in the market the right to purchase a stock that you already own.

In options, there are sellers and buyers, each making bets...

When you sell a covered call, the buyer gives you money immediately, known as the "options premium." He'll pay you up front and can decide whether or not he wants to buy your shares.

So when you sell a covered call, you can immediately end up with $300 or $900 or whatever the options premium is. Right away.

And this is where the people posting on Wall Street Bets about a "cheat code" were able to take advantage (at least temporarily)...

The problem was that Robinhood incorrectly added the entire value of the sold options (which could potentially reach into the tens of thousands of dollars) to the original cash that subscribers had on hand.

That allowed these traders to borrow a larger amount of money on margin than they were expecting...

And if you repeatedly sold covered calls and kept getting more cash from the options sale, you could borrow larger and larger amounts with each trade... with no limit.

As you might guess, this didn't end well...

Late last year, Robinhood became aware of the glitch through the posts on Wall Street Bets and quickly fixed it.

And Robinhood's "infinite leverage" was under regulatory scrutiny from the U.S. Securities and Exchange Commission. This wasn't just a problem for Robinhood, however.

Many users of this hack lost a lot of money. One trader who deposited $4,000 and had more than $1.2 million of leverage lost $22,000 – more than five times his initial deposit. Almost all of us go through the lesson (and pain) of having too much leverage at some point. But for these traders, this lesson was excruciating.

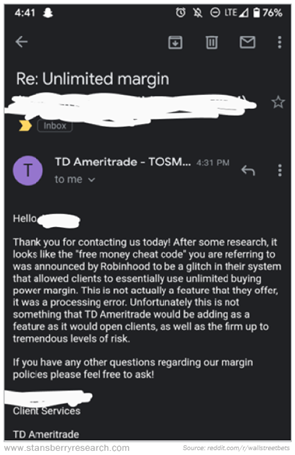

Others had a bit of fun with the hack. One Wall Street Bets member posted this screenshot, trying to get discount broker TD Ameritrade to offer him the same infinite leverage ability...

The accounts that were found to have exploited the error have been suspended.

I'm not going to lie, I had a good laugh when I read about this story last year. But I also shook my head...

This will just scare more people away from options, I thought.

Many investors already consider options to be a complex, risky financial instrument...

But the truth is, options don't deserve their bad reputation.

In fact, selling covered calls will actually give you less risk than a regular shareholder... if done correctly.

I'm an analyst for Doc Eifrig, and he's been telling his subscribers to use this method for nearly a decade.

Some option strategies carry big risk, sure... But selling options is one of the safest things you could do in investing.

It just so happens a few Robinhood members exploited a loophole in Robinhood's software. It had nothing to with the strategy itself.

There's a reason why these exploiters thought to sell covered calls first...

Selling options, when done correctly, has less risk than just buying and holding stocks. Here's an example...

Let's say you buy 100 shares of a stock... in this case, social media company Twitter (TWTR).

You sell a covered call that has a strike price of $47. All that means is that you're agreeing to potentially sell your TWTR shares for $47 each, about 4.4% higher than what TWTR is trading for now (around $45).

And because you agreed to potentially sell your shares, the buyer gives you $325 up front just for the privilege to sell your shares for a higher price than they're trading for now. No other strings attached.

When it works out and TWTR goes higher... you'll sell your shares for 4.4% higher than what they were trading for. Add that to the $325 you received up front, and you'll pocket nearly 12% in just two months.

Now, think about the worst-case scenario... TWTR has a big privacy scandal. Investors are panicked. They sell their shares and the stock crashes to $35 – a drop of 22%. That's a big loss to take as a shareholder. And it's one that we all want to avoid if we can.

But because you own shares and sold the covered call, you're only down 15%. That's because you received $325 up front, which lowers your cost basis.

By selling options, you actually have more downside protection than a regular shareholder.

And sometimes when you sell a covered call, the stock doesn't move too much from where you bought it. The buyer of the call option doesn't make you sell your shares and you get to keep the $325 premium. And that's the end of the trade.

You earn $325 for pretty much doing nothing.

Doesn't sound too bad, right? It might even sound too good to be true...

When used correctly, selling options is one of the safest and most consistent moneymaking strategies out there.

In fact, Doc's all-time record "win streak" from selling options is 136 consecutive winning positions. And he's won 93% of the time for nearly a decade. In his Retirement Trader service, he's recently closed out 20 consecutive winning trades in a row...

When my friends ask for investing tips and ways to get started, I always point them in the direction of selling options. It's perfect for both novice and experienced investors.

Basically, if you like safe income, selling options is for you. Period.

So don't believe everything you hear... or read on sites like Wall Street Bets.

Trading options is only dangerous if you let it be. And today is actually the perfect time to be selling options.

That's because there's so much fear in the market.

Folks are scared of the election... of COVID-19... of high stock market valuations... you name it. And when fear is elevated like it is today, option prices rise. So we can sell options for a small fortune to nervous investors.

You won't find this opportunity very often. That's why Doc recently sat down for to explain how last year, his 93% accurate, crisis-proof strategy handed some Americans the opportunity for over $30,000 in extra cash…

And NEW analysis shows it could blow past that amount before 2020 wraps.

What We're Reading...

- Fears grow of chaotic election.

- Some students returning to on-site classes but fears of COVID-19 resurgence remain.

- Something different: Puzzled scientists seek reasons behind Africa's low fatality rates from pandemic.

Here's to our health, wealth, and a great retirement,

Jeff Havenstein and Dr. David Eifrig

September 30, 2020