One million dollars is worth less and less every day...

In the critically acclaimed movie series Austin Powers, the villain Dr. Evil cryogenically freezes himself in 1967 and wakes up 30 years later. Determined to terrorize the world, he steals a nuclear weapon and demands a payment of $1 million from the United Nations...

To his surprise, leaders from around the world started to laugh at him.

As his right-hand man, No. 2, pointed out in an earlier scene, "$1 million isn't exactly a lot of money these days."

It's true. One million dollars wasn't much in 1997. And it sure isn't much today...

Consider this... Someone in Maryland just won the Powerball for $731 million. Jeff Bezos, the founder of Amazon (AMZN), has a net worth of $190 billion. And Apple (AAPL) now has a market cap of $2.2 trillion.

Numbers keep getting bigger and bigger. And it's also true for your retirement... Living comfortably is more expensive these days.

A nest egg of $1 million, which used to be the dream of many Americans, might not even be enough to live comfortably in your retirement. According to a 2020 survey by Charles Schwab, many folks believe they need $1.9 million to retire.

Fortunately, having more than $1 million saved isn't as daunting a task as it used to be. You just need two things... Time and a good rate of return.

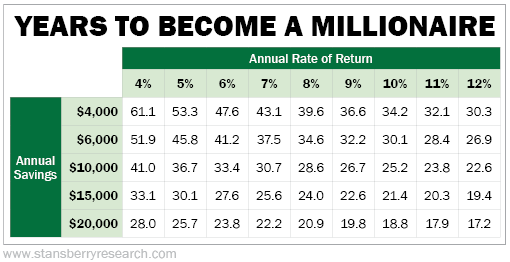

Take a look at the table below. It shows you how many years it will take you to become a millionaire based on how much you save each year and your annual rate of return.

For example, if you save $10,000 every year and earn 8% on your investment, you'd be a millionaire after 28.6 years...

Obviously, becoming a millionaire doesn't happen overnight. Anyone who tells you otherwise is either doing something illegal or highly risky. Avoid these "get rich quick" schemes like the plague.

Time is by far the biggest factor in planning for a successful retirement. The earlier you start saving and investing the better.

I've talked before about the power of compounding returns, which you can read about here. Even if you start saving and investing just a few years earlier than your buddies, it can mean tens of thousands of extra dollars by the time you retire.

Every year of savings counts, even if you're not in your 20's or 30's. Don't put it off any longer.

The truth is that over time, investing in the stock market will make you money. Each year the market's returns may vary. But returns are pretty consistent when looking at the big picture...

Over the past 60 years, the S&P 500 Index has returned 10.4% a year when you factor in dividends. Over the past 40 years, the average annual return is 11.8%. And over the past 20 years, the average annual return is 7.7%.

Stocks are by far the best game in town. Savings accounts earning barely any interest do not cut it.

If you're a serious investor, you need to own stocks. Plus, if you're an active investor and choose the right stocks, you can make more than the market every year (as we've done in my Retirement Millionaire advisory over the past five years.)

Let's say you're a 40-year-old who makes $100,000 a year. And up to this point, you haven't taken retirement seriously. You haven't setup a 401(k) yet. You spend too much on travel and food. And you aren't interested in the stock market.

The good thing though is that time is still on your side – even though you're technically late to the game. All it will take is a small amount of discipline and a simple S&P 500 fund.

If you save 20% of your salary every year – this includes any money you put into your 401(k) plus any employer match – and put that money into a S&P 500 fund, you can be a millionaire by the time you're 59 (assuming a 10% annual rate of return.) If you plan to retire by 67, and bump your savings rate up a little bit in the last eight years of your working life, you can get close to the $1.9 million mark to retire comfortably.

But then again, not everyone will need $1.9 million for their retirement.

A common rule that you've likely heard before is the "70%/80% rule." This means that you should aim to replace about 70% to 80% of your salary in retirement.

So if you made $100,000 annually before you retired, you should ideally have $70,000 to $80,000 a year to maintain your standard of living. This can include portfolio withdrawals, Social Security, pensions, and other sources of income.

The only problem is that many retirees find themselves spending more than 70% to 80% of their pre-retirement income – especially in the first few years after leaving the workforce.

Your costs get eaten up by having more time... You may find yourself traveling more, going out to eat more, and spending more on new hobbies. Plus, the cost of health care adds up quickly as you get older.

There's also something called the "4% rule." Take your desired annual income in retirement and divide it by 0.04. This will give you an estimate of how much you need saved for retirement.

So if you imagine that you will need $60,000 a year in retirement, you'd need a nest egg of $1.5 million ($60,000 divided by 0.04).

Another way to make sure you're on track for your retirement is by following a general outline based on your annual salary and age. The benchmarks below, provided by Fidelity, can help make sure you are saving enough throughout your life...

- At age 30, you should have one times your annual salary saved

- At age 35, two times your annual salary

- At age 40, three times your annual salary

- At age 45, four times your annual salary

- At age 50, six times your annual salary

- At age 55, seven times your annual salary

- At age 60, eight times your annual salary

- At age 67, 10 times your annual salary

Finally, a simple way to think about how much you should save is with the "50/30/20 rule." This is a broad guideline where 50% of your income (at maximum) should go toward your bills and necessities, 30% is your play money, and 20% should go toward savings.

These are all general guidelines to help you think about saving for retirement. But there's really no one answer for what amount of money you need to retire comfortably...

Perhaps the best method, especially if you're getting close to your retirement age, is to write down all of your projected expenses while retired. Think of all your bills and also include things like how many vacations you plan to take per year. You can then work your way back to calculate how big of a nest egg you'll actually need and what your actual replacement rate will be.

Also consider that life will undoubtedly get more expensive in the future, not less... So try to save a little more than you think you'll need.

If you're struggling to know how much of your income to save each year, I like to tell folks to save at minimum 12% to 15% of their salary... and to invest that money.

As always, the earlier the better.

If you've been putting off thinking about your retirement and how you'll fund it, it's time to start now. It's never too late. All it takes is a little bit of discipline.

What We're Interneting...

• How much do I need to retire?

• Charles Schwab's 2020 401(k) Participant Survey

• Something different: Bumble founder Whitney Wolfe Herd becomes youngest self-made woman billionaire after IPO

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

February 17, 2021