People are asking to see my report card...

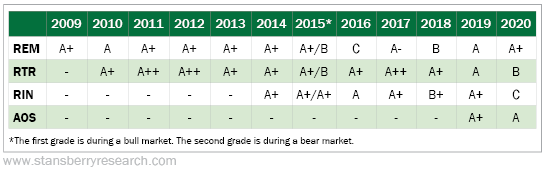

Regular readers know that every year, my publisher Brett Aitken reviews and grades all the investment letters here at Stansberry Research. The annual report card is based on how well a newsletter's stock picks perform over a given period, in terms of win rates and comparisons to benchmark indexes.

Rarely will you see a financial publisher be so transparent or so blunt about its performance. Brett pulls no punches – he'll sing a newsletter's praises when it's doing well, but if anything went wrong... you'll be hearing about it from your boss in front of all Stansberry's subscribers. We've gotten several letters from readers who want to know how I did this year.

Here are my four newsletters that are graded each year:

- Retirement Millionaire (REM) – flagship investment and health advisory

- Income Intelligence (RIN) – income-focused investment advisory

- Retirement Trader (RTR) – option service perfect for beginners or retirees

- Advanced Options (AOS) – more sophisticated and speculative options service

And here's how they've done every year...

Our publisher, Brett Aitken, doles out the grades. The 2020 grades went public over the past few weeks in the Stansberry Digest. I'm extremely proud of how well Retirement Millionaire and Advanced Options have done over the past year.

Here's a small bit of what Brett had to say about the "A+" we earned this year for Retirement Millionaire:

At the end of 2020, Doc held 33 open positions in the portfolio with 29 winners – an 88% win rate. His biggest winner was a whopping 779% gain on software giant Microsoft (MSFT)... which has gone up even more since the end of 2020. (It's at 850% today.) The one active loser was just 3%. And the average gains were an incredible 169%.

That performance earns Doc an "A+" for Retirement Millionaire this year.

And for Advanced Options "A" grade:

Since launching the publication, Doc and his team have closed 40 winning trades from a total of 61 positions... That works out to a 66% win rate. The average gain is 9.7% over an average holding period of about 47 days. That's an average annualized return of 76%.

That's remarkable... It's almost three times better than the 26.5% return of the S&P 500 over similar holding periods. And that earns Doc and his team an "A" for Advanced Options.

As for Retirement Trader's "B":

Doc recommended 257 trades over the past five years. He had 241 winners in this grading period – a 94% win rate. That's an impressive win rate... But to hand out a higher grade, I need to see higher average and annualized gains.

As a result, Retirement Trader earns a "B" in this year's Report Card.

When people tell me that trading options is too risky, I point them toward Doc's Retirement Trader. And the same goes for anyone reading this Report Card right now... If earning steady flows of income with low risk appeals to you, I'd encourage you to give it a try.

And finally, Income Intelligence's "C" grade:

The 61% win rate for Income Intelligence over the five-year grading period for this year's Report Card is better than most investors will achieve over the long run.

However, the publication's average and annualized gains of 10.5% and 8.3%, respectively, both come in just below its benchmark... The Vanguard Wellesley Income Balanced Fund returned 11.0% and 8.7%, respectively, for those metrics during similar holding periods.

So for this year's grading period... Income Intelligence earns a "C" grade.

Now, before I move on, I want to say that I've seen what happens when Doc gets anything below a "B" in our annual Report Card. And I wouldn't bet against him this time, either...

That might sound pretty good to you... But longtime readers might recall why I think a "B" grade is failing. (Lots of you wrote in at the time to disagree with me.)

In school, a "B" or "C" is still a passing grade. But here's the thing – my team and I strive for excellence. We don't even want to just settle for passing.

Income Intelligence had a tough 2020... From February to March, we closed 25 positions as the stock market crashed. But among these positions, we booked several triple-digit winners. They included a 542% gain in software giant Microsoft (MSFT)... a 332% return in global burger franchise McDonald's (MCD)... a 182% gain in energy processing and transportation firm Enterprise Products Partners (EPD)... and a 164% return in beverage maker Coca-Cola (KO).

Stocks have rebounded over the last year, and we've already packed our Income Intelligence portfolio with winners. As I write, out of our 17 current positions, only two are in the negative, with many returning double-digits so far. One is even up by more than 100%.

Right now, we're living in a world that doesn't want to pay income. Interest rates are still near record lows and we're seeing signs of speculative euphoria. Lots of folks don't want to settle for safe and steady income when they see a chance of outrageous returns through riskier investments like bitcoin.

We're aiming for a perfect report card next year, and we're building our strategies for the next phase of the market. So we'll be prepared for what comes next and how to help you build your wealth for a better retirement (and even sooner).

We received a lot of questions about this year's report card. My team and I love reading all of your questions, comments, stories, topic suggestions, and – yes – even your criticisms. So please, keep sending your e-mails our way. They really do make our day... [email protected].

We have space for one more question today...

Q: I'm fortunate enough to be in the top tax bracket. When one of your publications tells us to sell and take profits, I very rarely do. Is this [a] mistake? – K.G.

A: My job as a publisher is to give you the investment advice that I'd give to my own family. Whether or not you follow that advice is up to you.

And by no means am I saying that you're wrong or you're making a mistake if you don't sell when I recommend selling... You're in charge of your own money and you know what's best for you.

The truth is that everyone's investing goals are different.

Sometimes I may recommend selling a stock after a big move up. If I think the risk-to-reward setup is no longer in our favor, taking some chips off the table is usually a good move. After all, is it worse to pay a tax on your gains... or watch those gains evaporate entirely if the stock turns south?

But there is absolutely nothing wrong with buying high-quality businesses and keeping them forever. Holding quality stocks over a long period of time is the best way to grow your wealth.

You also mentioned your tax bracket... and that plays a big role in when you want to sell.

When you sell an asset, like a stock or bond, for more than you paid for it, the result is what's called a capital gain. And there are two types of capital gains... long term and short term. Each is taxed at different rates.

A long-term capital gain is from an asset you've held for more than one year. A short-term capital gain is from an asset you've held for less than one year.

Long-term tax rates are typically much lower than short-term rates. If your holding period was over one year, the tax rate on a capital gain is either 0%, 15%, or 20%, depending on your income. Short-term capital gains are taxed as ordinary income. That means if you're in the highest tax bracket, like you are now, you will be taxed at 37%.

It's completely understandable if you don't want to take profits on a stock if you're holding period was under one year.

Every investor should be aware of their potential tax rate when they're deciding when to sell a stock.

What We're Reading...

- Did you miss it? The similarities of the market today to the late 1990s are unmistakable…

- Something different: The battle between Australia, Facebook, and Google continues…

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

February 26, 2021