At least one good thing came out of the pandemic...

COVID-19 upended the global economy and killed millions around the world. But it also helped Americans pay off their credit cards.

According to the New York Federal Reserve, U.S. household credit-card debt fell for four straight quarters amid the pandemic. With the world locked down, folks were suddenly spending less on things like entertainment and travel, and many Americans received $1,200 or more in stimulus checks.

But the good news didn't last.

Americans are clearly back to spending. In August, the Fed found that credit-card debt had soared by $17 billion from the previous quarter.

For millions of indebted Americans, credit-card debt doesn't just drain your wallet. It can also damage mental health... leading to stress, anxiety, or even depression.

The average American now owes nearly $6,000 in credit-card debt. And most don't have the means to pay it off.

I (Laura Bente) have written before that most Americans have less than $1,000 in savings. So if you're trying to pay off credit-card debt, you have to make every dollar (and every payment) count.

Each time you pay off a dollar, that's a dollar that you're not paying interest on. Who wants to give a big bank their hard-earned cash?

Today, I want to help you take control of your debt, so your health and your wallet don't suffer any longer...

There are two main strategies to pay down credit-card debt: debt snowball and debt avalanche.

Debt Snowball

With a debt-snowball strategy, you pay off the cards with the lowest balances first. Once a card is paid, you then roll that payment into the next card and build momentum – like rolling snow into a snowball. These small debt "victories" will encourage you to keep at it, and make your debt feel more manageable.

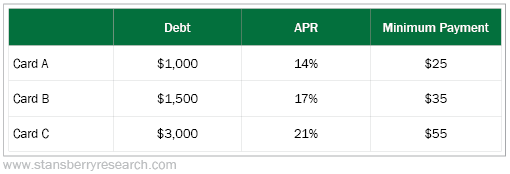

Let's say you have three credit cards: one with a $25 minimum payment, one with a $35 minimum payment, and one with a $55 minimum. They each have a different annual percentage rate (APR), ranging from 14% to 21%.

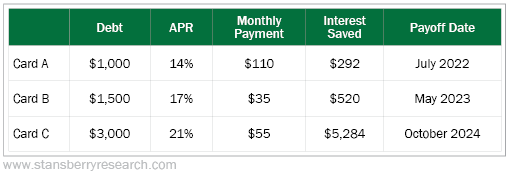

The card with the smallest balance is Card A. So under the snowball strategy, that's the card you'd want to put most of your money toward paying off. We'll assume you have $200 to split among all three cards. Here's how your payments would look for each card...

Assuming your payments stayed the same, you'd have Card A paid off in about 10 months. You'd then roll that $110 payment into Card B's $35, making your payment "snowball" bigger. Once Card B was paid, you'd roll that $145 into Card C's $55.

If you had just made the minimum payments each month, you wouldn't be debt-free until 2036. In this scenario, the snowball method saves you about 12 years – and $6,096 in interest.

Debt Avalanche

This strategy (also called "debt stacking") focuses on interest rates, rather than balances. So your goal is to pay off the cards with the highest interest rates first. Mathematically, this strategy usually saves you the most money on interest and often takes less time than the debt snowball.

The downside is that your psychological debt victories – like paying off your first card – may not be as immediate.

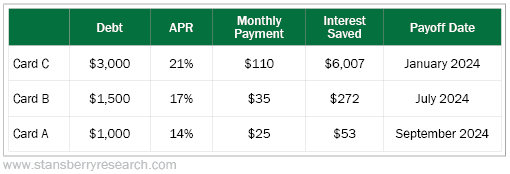

Using the same calculator as above, here's the order you'd pay your cards using the debt avalanche, as well as the interest saved and payoff dates...

Overall, your payment process would be the same. As a card is paid off, you roll that payment into the card with the next-highest interest rate.

How do you know which method is best for you?

That depends.

If paying the least amount of interest is most important to you, mathematically, the debt-avalanche strategy will usually save you the most money. You'd save $236 in interest compared with the snowball strategy. But you wouldn't pay off your first card until 2024.

If you're the kind of person who needs more immediate results to keep you motivated, the snowball method lets you pay off your first card in just a matter of months. As I mentioned, you'll pay more in interest over time, but that might be worth it if it keeps you sticking to your goal of paying off your credit-card debt.

Lastly, keep in mind that whichever strategy you choose, you still need to meet the minimum payments on all your credit cards. If you don't, you'll get hit with fees that add to your debt, making it even harder to pay off.

What We're Reading...

- Americans are racking up credit-card debt again.

- Something different: Researchers begin trials on a vaccine for breast cancer.

Here's to our health, wealth, and a great retirement,

Laura Bente, CFP® with Dr. David Eifrig

October 28, 2021