Doc's note: One of the biggest concerns folks have right now is runaway inflation... With prices of just about everything rising and the ongoing war between Ukraine and Russia pushing oil higher, there's a lot eating at your nest egg right now...

So today, I'm sharing an excerpt from the just-released Income Intelligence report, "Your 2022 Inflation Survival Guide: Four Steps to Protect and Grow Your Money When Prices Soar."

As long as we have money, we'll have inflation...

We take special care to study and talk about inflation in Income Intelligence.

For one, it hampers those who live on savings and generate income from wealth. If you have planned to earn a certain amount per year from investments, that same amount is now worth less.

When an indebted government inflates a currency and makes it easier to pay what it owes, the lender suffers by receiving a payment worth less. As an investor, you are a lender when you put money into bonds in exchange for interest or into stocks in exchange for an equity stake.

Another concern is that while inflation has threatened to rise since we started Income Intelligence in 2013... we still haven't seen a true inflation disaster.

Low interest rates and an increasing money supply set up some of the conditions for inflation – but it didn't happen. And that's as we predicted. We bet that inflation wouldn't come when we started in 2013, so we spent more time worrying about deflation until around 2015. Inflation has remained low ever since the financial crisis of 2008 to 2009.

In 2019, we did predict that inflation would start to creep in... We were right again, as expected-inflation levels almost broke 2%. But when the COVID-19 pandemic struck, the economic calamity pushed expectations almost toward deflation.

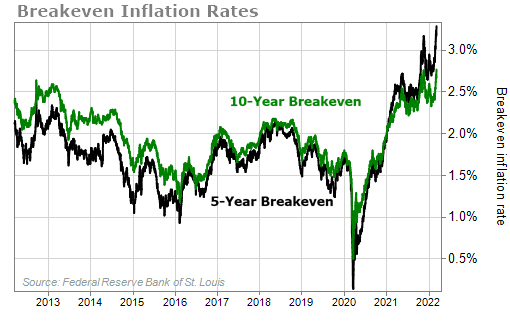

A set of measures known as "breakevens" evaluates how much inflation the market expects. In the depths of the crisis, markets saw five-year inflation at just 0.16%. But rather quickly, expectations have risen to crack 2.5%.

These breakevens tell us that right now, the market expects average inflation of 2.7% per year over the next 10 years and 3.2% over the next five.

That's where we are now. And though expectations are high (by recent historical standards), the actual rate of inflation is outpacing that. The January 2022 reading on the Consumer Price Index showed prices rose 7.5% over the previous year.

Now, let's clarify... At this point, we're not fearing hyperinflation – the phenomenon by which runaway prices turn a currency worthless. Our modern monetary system isn't perfect, but policymakers have a simple remedy for inflation: higher interest rates.

Even so, the difference between 1% inflation and 4% inflation is significant. Due to the power of compounding, a $100 weekly grocery bill turns into $110 over 10 years at 1% inflation... or $148 at 4%. If you spread that across all of your daily costs, retirement gets a lot more expensive.

What's more, the expectations for inflation will drive investment returns. When you expect inflation, you position yourself differently than you would if you expect deflation. And other investors doing the same thing will drive some investments to lead and others to lag.

We've covered inflation in Income Intelligence before. And one important takeaway is that inflation remains mysterious, poorly understood, and difficult to predict.

But in the most basic terms, the combination of a hot economy and an abundance of money leads to inflation. The relationships may not be as direct as Economics 101 tells you, but that's where it comes from. And it also doesn't help that there's a war between Russia and Ukraine, which has been driving up the price of oil.

In my new report, I offer a practical walk-through of the current inflation statistics, show where they are, and demonstrate that the threat of inflation sustaining at 4% or higher is very real... and already underway. And I share four ways you should prepare your portfolio for it.

If you're not already an Income Intelligence subscriber, click here to learn more about the dangers of inflation and get access to my report.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

March 14, 2022