Most big market moves aren't that hard to figure out...

You don't need an MBA or hedge-fund experience. All you need is a basic understanding of sentiment.

It's as simple as this: When times are good and people are buying stocks, stocks can move much higher. New highs tempt other folks to get in on the action, and their cash floods the market – driving prices higher and causing the cycle to repeat.

This can go on for a long time... But the music eventually stops. And it stops when no new buyers are left. This is when sentiment is at a peak.

With no one to prop up prices, stocks can only go down. Think back to the dot-com bust and you'll know what we're talking about.

The opposite is also true...

When everyone is selling, they move to cash and markets tank. Eventually, there's no one left to sell and fear is widespread.

When this happens, so much cash is sitting on the sidelines, earning nothing, that investors have to use it somewhere. Folks start to buy stocks again, and the market reverses.

We saw this back in 2020 during the COVID-19 crash. Investors panicked as the virus ripped through our country and caused the economy to shut down. They sold their stocks and were left with a big pile of cash.

Soon enough, they started putting that money into stocks again. Once some cash entered the market, prices began to rise. And that tempted new buyers who were sitting on a ton of cash to buy as well. And on it goes...

Anytime you see investors with a good chunk of their portfolios in cash, it's a bullish sign. Eventually, they'll want to get back in on stocks. No one wants to be left behind, parked in cash as markets are soaring.

Today, lots of fearful investors are hiding in cash. They're worried about the Federal Reserve... COVID-19... inflation... Russia... the supply chain... a bear market in tech stocks... you name it.

And right now, we're seeing more cash sitting on the sidelines since April 2020. Don't let your hard-earned money waste away.

My colleague Mike DiBiase is no stranger to helping folks make money in wild markets. Mike knows that fears of pending doom can sometimes create opportunities for savvy investors to make huge returns before these companies go bankrupt.

In fact, since the COVID-19 crash, Mike has helped his subscribers achieve a 91% win rate – and an average return of 14.7%, or 35.5% annualized.

To learn more, and hear how Mike's strategy helped one of his readers retire at age 52, click here.

Keep your questions coming our way at [email protected]. We read every e-mail. Here are some of the things on your minds this week...

Q: What does it mean when there's going to be more shares of stock? Do I need to worry about it? – B.H.

A: It could mean one of two things... but only one of them is cause for concern.

Sometimes, companies do what's called a "stock split." That's when they change a stock's price in line with the number of shares.

A recent example is Alphabet (GOOGL), which announced that a 20-for-1 stock split will occur in July. That would take Alphabet's share price from its current level around $2,100 to $105. So if you hold, say, 10 shares of GOOGL, you'd hold 200 after the split. But the value of your total position doesn't change.

The main benefit of a stock split is reducing the cost of the share price and increases the number of shares available, which allows for smaller investors to buy the stock. And sometimes, companies with extra-low share prices will do a "reverse stock split" in which you end up holding fewer shares at a higher price per share. That can make it easier for some institutional investors to buy in.

The reasons and benefits for splits are debated in the academic literature, but suffice it to say that nothing has changed in the value of the company or any reasons you might have to buy (or not buy) it.

But sometimes companies issue brand-new shares of stock, typically a way of raising money. And that's a problem for existing shareholders. It means that for the same price you paid for your shares, you now own a smaller percentage of the company, called share dilution. Sometimes you'll still do well in the end after share dilution, depending on how the company spends the money it raised from issuing shares. But as an investor, it's something to pay closer attention to.

Q: Is there such a thing as too much sleep? – J.A.

A: Longtime readers are familiar with my spiel on sleep...

Getting a good night's sleep is essential for a healthy lifestyle. Getting plenty of sleep at night helps reduce stress, makes you three times less likely to catch a cold, helps you maintain a healthy weight, and reduces your risk of diseases like cancer and diabetes.

We often focus on the dangers of not getting enough sleep because more than a third of Americans are severely sleep-deprived. Not getting enough sleep has dangerous consequences... Chronic sleep deprivation impairs memory, alertness, and concentration.

But it's true that you can also get too much sleep. Oversleeping leads to grogginess, just like a sleep deficiency. And several studies show sleeping too much increases your risk of heart disease, stroke, and diabetes.

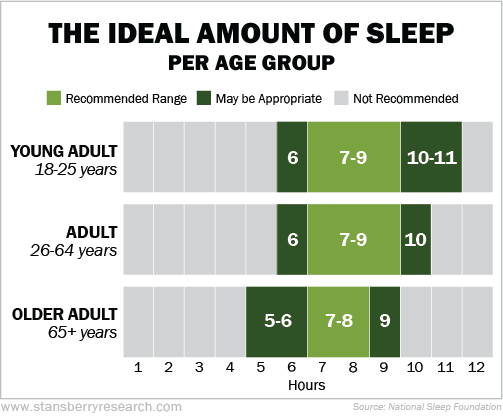

The amount of sleep we need in a 24-hour period largely depends on our age...

Exceeding the acceptable sleep range for your age group is one possible sign of depression. It might also signal you have sleep apnea. If you're oversleeping, check for other symptoms. Are you feeling depressed? Are you waking up during the night? When you wake up in the morning, do you feel well rested? Are you sleepy throughout the day?

Some folks just naturally sleep a little longer than average. But if you're sleeping more than nine or 10 hours a day and you're still sleepy, that could be a sign that something is wrong. Don't ignore it.

What We're Reading...

- Did you miss it? You're not ready for a disaster. Here are five ways to prepare.

- Something different: NASA caught an underwater volcano exploding.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

May 27, 2022

P.S. Our offices are closed for Memorial Day next Monday, May 30. Expect your next Health & Wealth Bulletin issue on Tuesday, May 31.