It was one of the fastest-growing investments I (Eric Wade) have ever seen...

Launched in 2014, a cryptocurrency called Verge (XVG) billed itself as a "privacy coin" that would allow untraceable transactions.

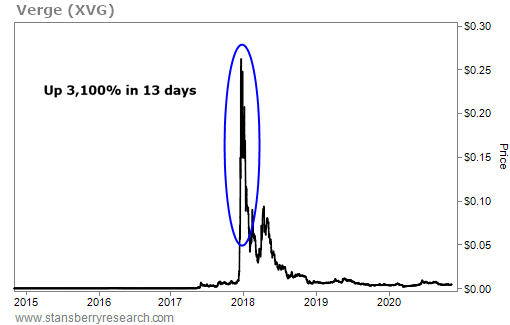

It traded flat for years. But something happened in late 2017.

A big software update called Wraith Protocol was supposedly coming before the end of the year. Finally, XVG would realize its dream of becoming private electronic money. Buyers piled into the coin. The token price doubled every two and a half days for nearly two weeks.

But crypto is unique. It's different from any other kind of technology. And because of that, this situation changed quickly.

This dynamic – and the unique nature of crypto investing – is something you must understand as an investor. So let me share the rest of the story...

Over 13 days, Verge soared around 3,100%. Its market cap shot from around $80 million to almost $4 billion.

But then, Verge's lead developer dropped the ball. The promised software update didn't come out by the end of the year, and Verge prices collapsed nearly as quickly as they'd risen. Take a look...

Its price has never reached those levels again. Today, Verge's homepage doesn't even mention privacy technology.

I'm telling you this because there's an important lesson in the dramatic rise and fall of Verge...

Crypto moves faster than any new technology I've seen in more than three decades of professional investing.

There are two big reasons for this. First, crypto is uniquely monetized – there's an economic incentive baked into the technology. If you're a developer who releases a crypto, the market gives you immediate feedback on its value. Your token's either worth something or it's not. So good ideas thrive... and bad ones disappear almost immediately.

Second, crypto projects are open source. Their source code, or the computer code that makes them work, is given away for free. That means anyone can take existing crypto code and "fork" (or copy) it, change it in some way, and release it. That's why more than 5,000 cryptos exist today.

This ability to build upon existing technology and get immediate feedback on its value has led to something I like to call "idea Darwinism"... where only the fittest survive. Each new idea breeds more new ideas, and the industry's pace of change accelerates.

The pace is now so fast that projects can balloon from ideas to $100 million in market cap in days. Or the reverse can happen just as quickly... where a crypto collapses from millions of dollars to nothing.

In short, this incredible volatility can work to your advantage... but you must understand what you're investing in.

That's why if you're a crypto investor, now is a good time to make sure you only have the cryptos that are set to thrive over the next year.

Cryptos are down across the board in 2022... that's no secret to anyone.

Do I wish that wasn't the case? Of course.

Do I think it's time to bail on cryptos and go to cash? No way.

Cryptos are more mainstream than ever. We've seen everything from Super Bowl commercials to mass adoption by banks, corporations, and even entire nations.

That's led to an increasing number of people refusing to sell their cryptos no matter what the market throws at them.

Including one of my readers...

Late last year, I received a letter from a subscriber that explained how he used just one of my crypto trade recommendations to amass an astounding $54 million fortune in less than two years. And last week, I released a video detailing his incredible story.

Click here to learn how he did it.

Regards,

Eric Wade