In the 1300s, a squirrel caused massive inflation in Europe...

The Tarbagan marmot – a 2-foot-long squirrel – lives in deep burrows near the base of the Himalayan mountains. It's a beautiful place... But fewer folks know it's a breeding ground for the bacteria that causes one of the world's more gruesome diseases.

Bubonic plague.

Back in the 1300s, when the marmot population was much greater, the marmot-to-flea-to-rat-to-flea (again)-to-human chain became extensive at just about the time that global trade was expanding. That created a world-altering situation that went unnoticed as it happened right in front of everyone near a boat...

When ships set sail from Asia for Europe and beyond, infected rats scampered up mooring lines... And when these ships pulled into their next port, they parked just long enough for a few rats to escape to shore.

Then the process repeated at the next city up the coast. The plague spread through trading routes.

The bubonic plague had many outbreaks over the centuries, starting as early as the Plague of Justinian around 540 A.D. But the outbreak in Europe and Asia starting in 1347 earned the name "Black Death" for good reason.

Since doctors at the time did not understand how the disease spread, it was largely unstoppable. Estimates suggest that as many as one-third of all Europeans died from the Black Death between 1347 and 1350. Tens of millions died overall from the plague in the 14th century, and world-population levels didn't rebound to pre-plague numbers for another 200 years.

You can imagine the social upheaval that such a wipeout caused. Many thought the world was ending, especially given the horrific nature of the deadly disease (which we'll spare you the details of).

The world, of course, didn't end... But the Black Death certainly left its mark on human history in many ways.

In the immediate aftermath of the Black Death outbreak, prices of all sorts of items fell. With so many people dying, there was less demand for staples of the European economy, like wheat and barley.

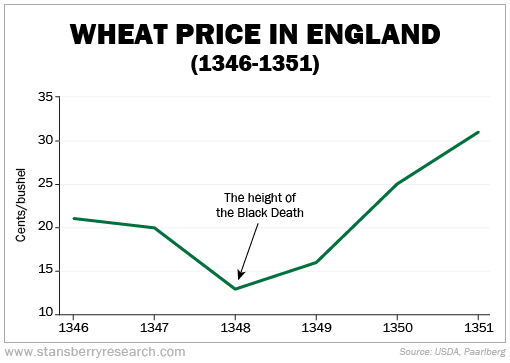

But soon after the height of the Death, prices doubled within a three-year period.

Pardon our love of obscure charts, but here's the price of wheat in England from 1346 through 1351, converted to cents per bushel...

After the initial decline in demand around 1347, the bigger problem for the European economy became the lack of available labor to till fields and tend the mules or whatever other terrible jobs folks had back then.

This led to a decline in available supplies and a rise in wages, both contributing to rapid inflation as the value of the items went up and the value of money went down.

This "Black Death inflation" stands in contrast to many of the other historic episodes of inflation that have generally been studied...

It's often claimed that inflation only comes from the debasement of a currency through money printing or other vast increases in the money supply.

But the truth is that analyzing inflation is difficult. No one – not politicians, economists, central bankers, or hedge-fund wizards – fully understands it. It comes from complex interactions between monetary and fiscal policy, the financial system, and the expectations of everyday people.

Today, the world during the bubonic plague doesn't seem so strange. We've lived through the global COVID-19 pandemic, and we're seeing the cost of everything – from housing to food – increase, alongside shortages of essential products.

In June, we saw the biggest rise in inflation since 1982... 6.8%. To fight back, last week, the Federal Reserve raised interest rates by 0.75% for the second consecutive month.

We've warned of the Fed using a swift and heavy hand to attempt to tamp down inflation. But some folks are worried about the phenomenon known as "hyperinflation." This happens when runaway prices turn a currency worthless.

We don't expect things to get that bad... Our modern monetary system isn't perfect, but policymakers have a simple remedy for inflation: higher interest rates from the Fed.

The problem is that higher interest rates slow the economy and push down stock and bond prices. That makes it tough to find new investments or even protect your existing wealth.

However, in our latest issue of Income Intelligence, we detailed a little-known investment that gives you an opportunity to make money as markets rise while providing you protection in case the bottom falls out of stocks.

If you're not already an Income Intelligence subscriber, click here to learn more. (Current subscribers can read it here.)

What We're Reading...

- How the Fed is trying to beat rising inflation.

- Something different: Stephen King is helping the government fight against a major publisher merger.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

August 3, 2022