Doc's note: Everyone's talking about low gas prices. Here in the U.S., prices at the pump have been plummeting.

But in today's issue, Rob Spivey, director of research at our corporate affiliate Altimetry, explains the critical oil move the U.S. just made that could have major implications for the market...

If you missed it, you're not alone...

In October, President Joe Biden's administration made a critical decision regarding U.S. oil. It could mean big changes for the oil market.

But here's the thing – the announcement flew completely under the radar. Almost nobody talked about it.

We wrote about a possible "Biden bailout" for oil companies back in September. If the government bought oil, it would create a "floor" for the commodity... stopping prices from falling too much due to recessionary concerns.

This would benefit consumers by promoting investment from oil companies, which means lower prices at the pump. Plus, it could help fill the U.S. supply of emergency crude oil, known as the Strategic Petroleum Reserve ("SPR").

At the time, we wrote that the Biden administration was unlikely to make this move yet. Oil prices were still historically high, and the industry didn't need a boost.

But to our surprise, he's now doing just that. On October 18, the White House announced it will buy West Texas Intermediate crude oil (the U.S. benchmark) when prices are at or below $67 to $72 dollars per barrel.

The "sweet spot" will be at $70 per barrel. All purchases will help restock the SPR.

This should go a long way toward easing concerns about our oil reserves...

As oil prices started rising at the beginning of the year, the Biden administration tapped into the SPR at an unprecedented rate.

It was the largest release of oil reserves in U.S. history, and folks are still nervous. The SPR is supposed to be there in case something catastrophic happens to our oil supply.

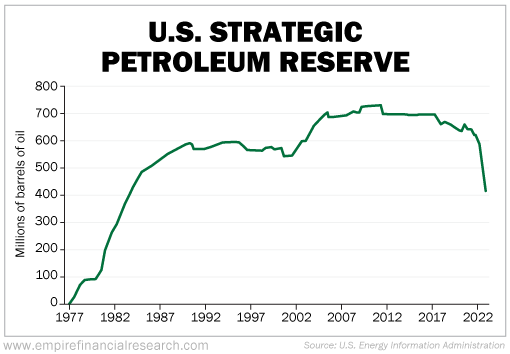

For the past 20 years, the U.S. has carried a steady supply, ranging between roughly 600 million and 700 million barrels.

But as of August (the most recent available data), that supply was down to 445 million barrels. That's the lowest level since November 1984. Clearly, Biden knows we need a restock...

The administration's purchases should help get the SPR back on track. But considering Biden's recent thoughts on the oil industry, you may be wondering why he's setting a floor at $70 per barrel.

Biden has been critical of some oil companies booking record profits in the past few quarters. He has been calling for oil producers to lower prices at gas stations, arguing that many of them are rewarding shareholders instead.

The president hasn't necessarily abandoned his thoughts on Big Oil. He's striking a balance. At $70 per barrel, oil companies won't be booking record profits... but they will be profitable.

That balance is crucial for keeping a steady economy that benefits both consumers and producers.

The goal of this move isn't to give oil companies a handout...

It's to help them get comfortable with investing.

The mid-2010s saw the biggest oil glut in history. And with renewable energy posing a threat, oil companies were scared to invest.

Since prices plunged in 2014, these companies have been stubborn about not investing more. But now, prices are high. Investment is picking back up. Biden's plan could be the next big push the oil market needs.

This would benefit the industry in a number of ways. Exploration and production companies will invest while prices are high. This means they'll generate more cash flow.

But the strongest outperformance will be in an entirely different corner of the oil market. You see, with the U.S. government propping up oil prices above $70 per barrel, companies will be drilling new holes... setting up rigs... and extracting like crazy.

Oil equipment and services (E&S) companies only make money when all of that is happening. When it's happening, though, they make a lot of money.

The iShares U.S. Oil Equipment & Services Fund (IEZ), which tracks a basket of domestic E&S companies, has risen more than 60% so far this year. It's up roughly 20% since Biden's announcement alone.

We've been taking advantage of the trend toward oil investment in our monthly Altimetry's High Alpha service. Our two recent E&S recommendations are up 34% in roughly three months and 18% in less than two months, respectively. And we believe there will be plenty of opportunities to come in this space.

In the end, the White House's move to buy oil solidifies what we already knew – money is pouring into U.S. shale.

A lot of businesses will benefit from this trend... But the biggest winners will be the E&S companies that help producers get oil and gas out of the ground.

Regards,

Rob Spivey

Editor's note: Joel Litman – founder and chief investment strategist of Altimetry – predicted the 2008 crash, the 2020 crash, the runup in the energy sector this year, and the demise of 36 different companies since 2020. And now, he has another major prediction for 2023. If you want to know exactly where to put your money right now, and what to expect for next year, click here.