I've spent the past few months writing about my favorite "chaos hedge"...

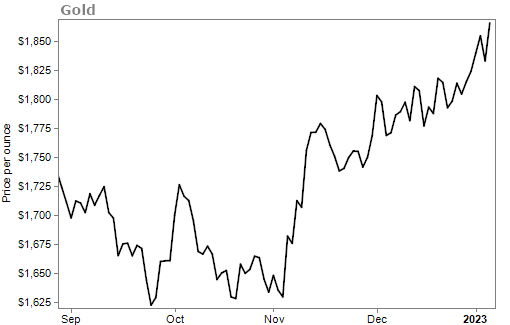

Some of you may have gotten bored, given the repetition. But all this asset has done is shoot up 17% over the past two and a half months.

I'm not going to stop writing about it, either. The gains are far from over. There’s more to come.

Today, I want to share with you why my team and I are bullish on gold... and why it may end up being the best performing asset of 2023...

To recap, I first wrote about gold in the Health & Wealth Bulletin on November 16. I noted that many gold bugs had lost hope in the precious metal because it had failed them as inflation protection.

The price of gold was down 1% in 2022... when stocks were down nearly 20%. It did better than the market, but that's not what gold investors have come to expect. Gold has historically posted big gains when stocks were in bear markets.

Because of this, investors have recently abandoned gold. Here's what we wrote in November...

We know gold is hated because no one is dumping money into the precious metal.

In fact, global gold exchange-traded funds ("ETFs") saw a net outflow of $5 billion in September and another $3 billion in October...

This marks six straight months of outflows.

We saw more of the same in November and December. Global gold outflows were $1.8 billion in November and $534 million in December.

The tally is now up to eight straight months of outflows. No one wants gold.

But that's starting to change...

The price of gold is staging a comeback lately. It's up 17% since November. Take a look...

Fortunately, we've been able to profit from gold's recent rise.

In my Advanced Options trading service, we closed a trade on Royal Gold (RGLD) for a gain of nearly 84% on January 3. And we most recently made a trade on the SPDR Gold Shares (GLD), which is up 30% after little more than a week in the trade.

In December's Retirement Millionaire, we also made the case for gold, claiming that "everyone needs to own gold... especially in bear markets. Buy some today if you haven't already."

And in January's issue of Retirement Millionaire, we gave subscribers the ideal asset allocation for today's market. We increased exposure to gold and other chaos hedges to 15% of the hypothetical portfolio.

Finally, we just sold options on a gold fund in this past Friday's Retirement Trader. We'll stand to make bond-like returns from our ultra-safe trade.

We've been writing about gold for the past few months... and we've been acting on it. Our timing has worked out.

But I don't want you to think you've missed your opportunity. I believe there are more gains to come from the precious metal.

You may have noticed that the pace of outflows for gold funds has decreased every month since September... $5 billion to $3 billion to $1.8 billion to less than $1 billion.

Given the rise in the price of gold, investors are starting to believe in the asset again. It wouldn't surprise me if we saw net inflows in the month of January.

When something is hated and the price is going up, it usually leads to big gains. Folks who were dumping the asset will change their mind and pile back in to chase gains... and the more people who buy, the more prices go up.

Make sure you have exposure to gold today. The best one-click way is through the SPDR Gold Shares.

I'm not the only one seeing opportunities in gold...

My colleague Greg Diamond recently told his subscribers that gold is at an inflection point, and now could be an ideal time to buy.

According to Greg, now is the time to put your cash to work. And during his recent "Get Out of Cash" event, he explained...

- Why you absolutely must get out of cash right now...

- When to expect a rare situation that could leave millions of people behind and define your wealth for the next decade...

- How to potentially double your money multiple times this year without touching a single stock...

- And much more...

If you missed it, you can catch all the details – for a limited time – right here.

What We're Reading...

- Something different: Morgan Stanley CEO Gorman says he's confident deal activity will return once the Federal Reserve stops raising rates.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

January 18, 2023