These S&P 500 Index companies are back at this "trick" once again, after a down year in 2023...

If you've been reading the Health & Wealth Bulletin for long, you know that Doc has regularly pointed out how share repurchases are a major driver of the market. For the past few years, many large companies, flush with cash, have chosen to buy back their own stock instead of paying higher dividends.

It seems that every earnings season we're seeing headlines about another big company buying back their own stock.

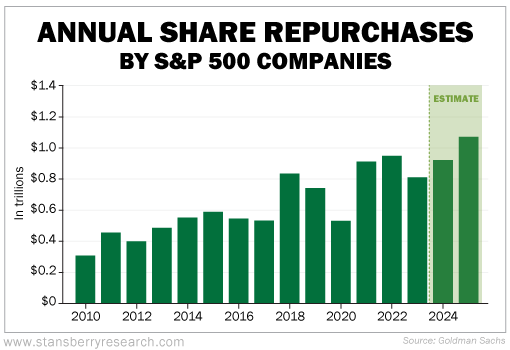

As you can see in the chart below, S&P 500 companies' share buybacks were down in 2023 compared with the two years prior. But because of forecasts for stronger earnings, Goldman Sachs anticipates that buybacks will pick up in 2024 and 2025. Take a look...

Here's Ben Snider, an equity strategist at Goldman Sachs, on why buybacks will pick up this year...

The fact that now we have earnings growth that clearly bottomed in 2023, interest rates that have declined from their peaks and improving economic sentiment all point to an increase in buybacks going forward.

This will be just another tailwind for the market if projections hold true.

Today I (Jeff Havenstein) want to talk about what exactly a stock buyback is and why many companies choose to do it...

To start, a stock buyback occurs when a business purchases its own shares in the market. This is good for investors because it decreases the number of outstanding shares, which means the relative ownership stake for each investor increases. Basically, as a shareholder, your slice of the pie gets bigger.

A company may buy back its stock to reward shareholders or to bet on itself. If a business believes the market has discounted its stock price too greatly, it will buy its shares knowing they should be worth more.

Investors often see a big share-repurchase plan as a bullish sign. It's also a way for a company to improve its financial ratios... making its stock more attractive to investors.

For example, a popular metric that investors look at is earnings per share ("EPS"). This is calculated by taking a company's net income and dividing it by the number of shares outstanding. If net income (the numerator) increases and shares outstanding (the denominator) doesn't change, then EPS increases. That means the company is more profitable and can pay more out to each shareholder.

Let's say a company's net income is $1 billion and there are 100 million shares outstanding. That's an EPS of $10 ($1 billion divided by 100 million). If net income rises to $2 billion but the number of shares outstanding stays at 100 million, that's an EPS of $20.

The problem is that net income doesn't have to increase for EPS to go up. Earnings may be flat, but if the number of shares outstanding (again, the denominator) goes down, then EPS goes up. Going back to our original example, if net income is $1 billion, but the number of shares outstanding falls to 50 million, that means the EPS rises to $20, even though net income hasn't increased.

This may signal that a company is more profitable than it actually is.

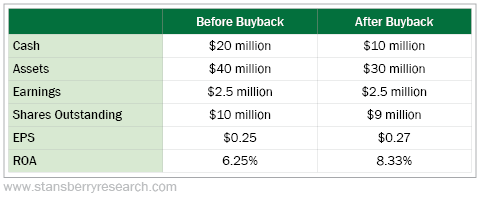

Buying back stock has a similar effect on other popular profitability metrics. Consider return on assets ("ROA"), which takes net income and divides it by total assets. It shows how well a company's management team is at using assets to generate income.

Let's suppose a company buys back 1 million shares of its own stock for $10 a share. You can see that this improves the company's EPS and ROA – even though net income didn't increase...

Many investors use stock screens where they only buy companies that meet certain criteria, like a minimum EPS. So when companies can have these better metrics, they open themselves up to more investment.

Share repurchases also create greater demand in the market. And for companies that do it while their stock prices are on the decline, it can help limit volatility.

As I mentioned earlier, Goldman Sachs is projecting even higher corporate stock buybacks this year and next year... even with a new tax on buybacks.

As part of the Inflation Reduction Act of 2022, Congress enacted a 1% excise tax on all share repurchases. This tax went into effect early last year. It's estimated to raise about $8 billion in revenue in its first year.

Even though companies now owe Uncle Sam a check every time they repurchase their own stock, buybacks don't seem to be slowing down.

Of course, there is talk of the tax rate going from 1% to 4%. But I doubt that will happen anytime soon, especially in an election year.

For now, we can expect share repurchases to ramp up this year... And that's just one reason we could see stocks end the year higher than they are today. At the very least, it will help limit volatility if we see a decline after such a long rally.

What We're Reading...

- Something different: Caitlin Clark's impact on women's sport has been the "coolest part" of her journey as her collegiate basketball career ends.

Here's to our health, wealth, and a great retirement,

Jeff Havenstein

April 10, 2024